PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on April 1, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

VOLITIONRX LIMITED

(Name of Registrant as Specified In Its Charter)

_________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

[X] |

No fee required. |

|

|

[ ] |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

[ ] |

Fee paid previously with preliminary materials. |

|

|

|

|

|

|

[ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

VOLITIONRX LIMITED

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 19, 2020

To Our Stockholders:

Notice is hereby given that the 2020 Annual Meeting, or the Annual Meeting, of VolitionRx Limited, which we refer to as VolitionRx, the Company, we or us, will be held at 42-44 avenue de la Gare, L – 1610 Luxembourg, at 12:00 p.m. local time on June 19, 2020, for the following purposes:

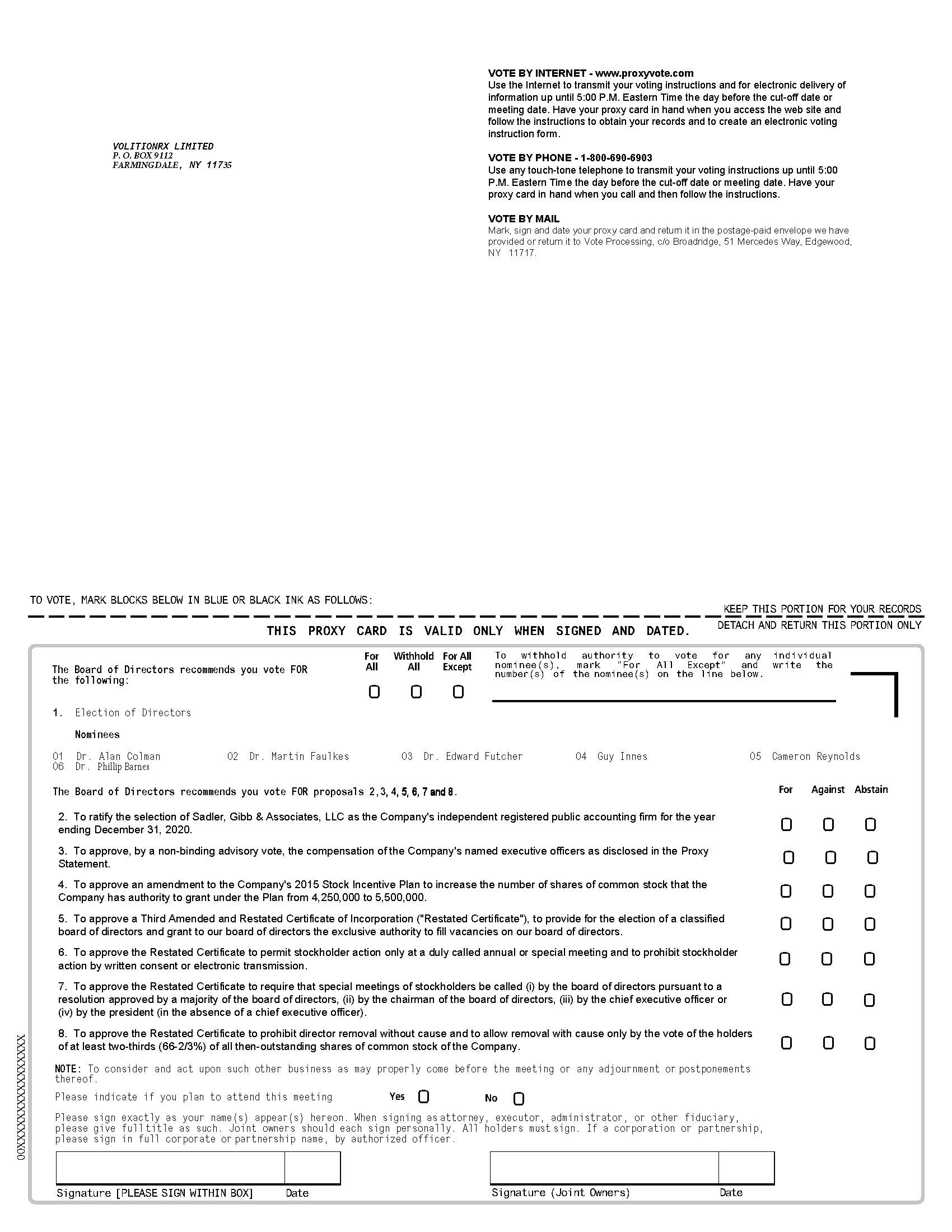

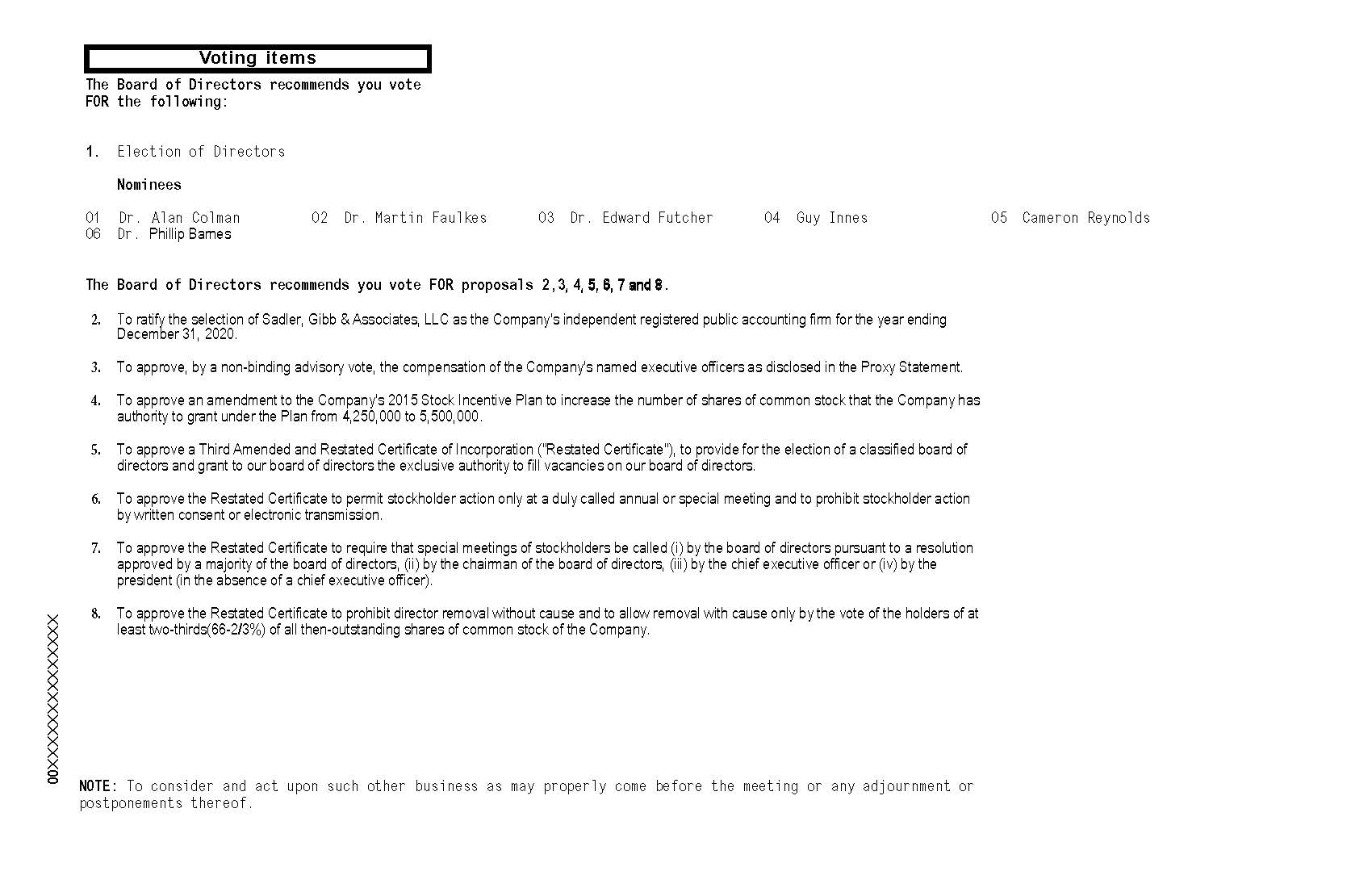

1.Election of Directors. To elect six (6) directors to serve until the next annual meeting of stockholders or, if Proposal 5 is approved, to hold office until the annual meeting of stockholders applicable to the class of director to which the applicable director will be assigned, and until such director’s successor is duly elected and qualified, or until his or her earlier death, resignation or removal;

2.Ratification of Selection of Independent Registered Public Accounting Firm. To ratify the selection of Sadler, Gibb & Associates, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2020;

3.Advisory Vote to Approve Named Executive Officer Compensation. To approve, by a non-binding advisory vote, the compensation of our named executive officers, as disclosed in the Compensation of Named Executive Officers section of this Proxy Statement;

4.Approval of Amendment to 2015 Stock Incentive Plan. To approve an amendment to the Company’s 2015 Stock Incentive Plan, as amended, to increase the number of shares of common stock that the Company has authority to grant under the Plan from 4,250,000 to 5,500,000;

5.Approval of Restated Certificate to Provide for a Classified Board of Directors. To approve a Third Amended and Restated Certificate of Incorporation, or the Restated Certificate, to provide for the election of a classified board of directors and grant to our board of directors the exclusive authority to fill vacancies on our board of directors;

6.Approval of Restated Certificate to Limit Stockholder Actions to Duly Called Annual or Special Meetings. To approve the Restated Certificate to permit stockholder action only at a duly called annual or special meeting and to prohibit stockholder action by written consent or electronic transmission (our Amended and Restated Bylaws, or our Bylaws, already contain a similar provision);

7.Approval of Restated Certificate to Specify Persons Who May Call Special Meetings of Stockholders. To approve the Restated Certificate to require that special meetings of stockholders be called (i) by the board of directors pursuant to a resolution approved by a majority of the board of directors, (ii) by the chairman of the board of directors, (iii) by the chief executive officer or (iv) by the president (in the absence of a chief executive officer) (our Bylaws already contain a similar provision);

8.Approval of Restated Certificate to Limit Removal of Directors. Contingent upon approval of Proposal 5, to approve the Restated Certificate to prohibit director removal without cause and to allow removal with cause only by the vote of the holders of at least two-thirds (66-2/3%) of all then-outstanding shares of common stock of the Company; and

9.Other Business. To consider and act upon such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The Company’s board of directors recommends that you vote “FOR” each of the director nominees named in Proposal 1, and “FOR” Proposals 2 through 8.

The Company’s board of directors has fixed the close of business on April 27, 2020, as the Record Date for the determination of stockholders that are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. Only stockholders of record, and holders of shares in street name as represented by a bank or broker statement certifying the number of shares in their possession, as of the close of business on the Record Date are entitled to notice and to vote at this Annual Meeting or any postponements or adjournments.

The Company recommends that you monitor its press releases and website for important changes that might be made to the Annual Meeting as a result of the COVID-19 outbreak.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the Proxy Statement and submit your proxy and voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section entitled How to Vote in the Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

|

|

By order of the Board of Directors |

|

|

|

|

|

/s/ Cameron Reynolds |

|

|

Cameron Reynolds President, Chief Executive Officer and Director |

Approximate Date of Mailing of Notice of

Internet Availability of Proxy Materials:

May 4, 2020

|

GENERAL INFORMATION |

1 |

|

|

ABOUT THE MEETING |

1 |

|

|

VOTING INFORMATION |

2 |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

6 |

|

|

DELINQUENT SECTION 16(a) REPORTS |

8 |

|

|

DIRECTORS AND EXECUTIVE OFFICERS |

9 |

|

|

CORPORATE GOVERNANCE OF THE COMPANY |

12 |

|

|

Corporate Governance Practices and Policies |

12 |

|

|

Director Independence |

12 |

|

|

Term of Office for Directors and Officers |

12 |

|

|

Family Relationships |

12 |

|

|

Certain Arrangements and Understandings |

12 |

|

|

Involvement in Certain Legal Proceedings |

12 |

|

|

Board and Committee Meetings; Annual Meeting Attendance |

13 |

|

|

Committees of the Board of Directors |

14 |

|

|

Nominating Procedures |

16 |

|

|

Board Leadership Structure and Role in Risk Oversight |

16 |

|

|

Stockholder Communications |

16 |

|

|

Code of Ethics |

17 |

|

|

Employee, Director and Officer Hedging |

17 |

|

|

Transactions with Related Persons |

17 |

|

|

Policy on the Review, Approval or Ratification of Transactions with Related Persons |

18 |

|

|

REPORT OF THE AUDIT COMMITTEE |

19 |

|

|

COMPENSATION OF NAMED EXECUTIVE OFFICERS |

20 |

|

|

Summary Compensation Table |

20 |

|

|

Employment and Consulting Agreements |

21 |

|

|

Role of Executive Officers with Compensation Decisions |

23 |

|

|

Compensation Consultant |

23 |

|

|

Outstanding Equity Awards Table |

24 |

|

|

Long-Term Incentive Plans |

26 |

|

|

Severance and Change of Control Benefits |

26 |

|

|

PROPOSAL 1 — |

ELECTION OF DIRECTORS |

27 |

|

PROPOSAL 2 — |

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

32 |

|

PROPOSAL 3 — |

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

34 |

|

PROPOSAL 4 — |

APPROVAL OF AMENDMENT TO 2015 STOCK INCENTIVE PLAN |

36 |

|

PROPOSAL 5 — |

APPROVAL OF RESTATED CERTIFICATE TO PROVIDE FOR CLASSIFIED BOARD OF DIRECTORS |

42 |

|

PROPOSAL 6 — |

APPROVAL OF RESTATED CERTIFICATE TO PERMIT STOCKHOLDER ACTION ONLY AT A DULY CALLED ANNUAL OR SPECIAL MEETING AND TO PROHIBIT STOCKHOLDER ACTION BY WRITTEN CONSENT OR ELECTRONIC TRANSMISSION |

44 |

|

PROPOSAL 7 — |

APPROVAL OF RESTATED CERTIFICATE TO REQUIRE THAT SPECIAL MEETINGS OF STOCKHOLDERS BE CALLED (I) BY THE BOARD OF DIRECTORS PURSUANT TO A RESOLUTION APPROVED BY A MAJORITY OF THE BOARD OF DIRECTORS, (II) BY THE CHAIRMAN OF THE BOARD OF DIRECTORS, (III) BY THE CHIEF EXECUTIVE OFFICER OR (IV) BY THE PRESIDENT (IN THE ABSENCE OF A CHIEF EXECUTIVE OFFICER) |

46 |

|

PROPOSAL 8 — |

APPROVAL OF RESTATED CERTIFICATE TO PROHIBIT DIRECTOR REMOVAL WITHOUT CAUSE AND TO ALLOW REMOVAL WITH CAUSE BY THE VOTE OF THE STOCKHOLDERS OF AT LEAST 66-2/3% OF ALL THEN OUTSTANDING SHARES OF COMMON STOCK OF THE COMPANY |

48 |

|

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON |

50 |

|

|

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS |

50 |

|

|

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS FOR THE NEXT ANNUAL MEETING |

50 |

|

|

WHERE YOU CAN GET ADDITIONAL INFORMATION |

50 |

|

|

OTHER MATTERS |

51 |

|

VOLITIONRX LIMITED

13215 Bee Cave Parkway

Suite 125, Galleria Oaks B

Austin, Texas 78738

Telephone: +1 (646) 650-1351

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 19, 2020

VolitionRx Limited has made this Proxy Statement, as well as the Notice of Annual Meeting of Stockholders and our Annual Report on Form 10-K for the year ended December 31, 2019, or collectively, the Proxy Materials, available to you on the Internet or, upon your request, in paper or e-mail form, in connection with the solicitation of proxies by the board of directors of VolitionRx Limited for the 2020 Annual Meeting, or Annual Meeting, of our stockholders to be held on June 19, 2020, and any adjournment or postponement of the Annual Meeting. In addition to the Proxy Materials, proxies may be solicited personally or by telephone, mail, facsimile or other electronic means. Directors, officers and employees will not be paid any additional compensation for soliciting proxies, but Broadridge Financial Solutions, Inc. will be paid its customary fee of approximately $6,000, exclusive of printing and mailing fees. We will, upon request, also reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock. The cost of solicitation will be borne by the Company.

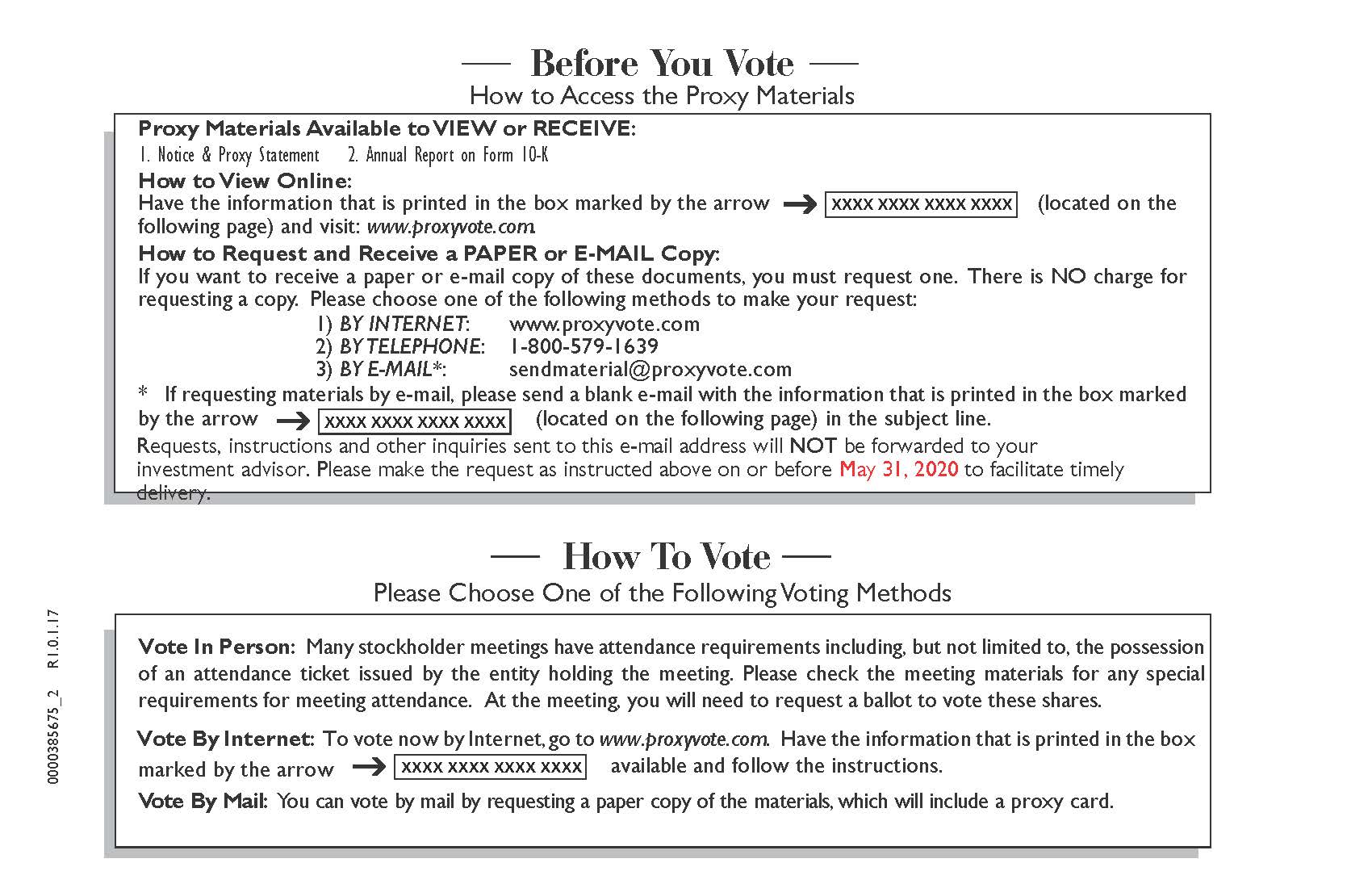

The Company is taking advantage of the Securities and Exchange Commission, or the SEC, rules that allow us to furnish our Proxy Materials over the Internet to our stockholders rather than in paper form. We believe that this delivery process will expedite our stockholders’ receipt of our Proxy Materials, reduce the environmental impact of our Annual Meeting of Stockholders and lower the costs of printing and distributing our Proxy Materials. Accordingly, you will receive a Notice of Internet Availability of Proxy Materials, or the Notice, which we expect to mail on or about May 4, 2020. You may request receipt of our Proxy Materials in paper or e-mail form by following the instructions on the Notice.

In this Proxy Statement, we refer to VolitionRx Limited as VolitionRx, the Company, we or us. VolitionRx has one wholly-owned operating subsidiary, Singapore Volition Pte. Limited, a Singapore registered company, or Singapore Volition. Singapore Volition has one wholly-owned subsidiary, Belgian Volition SPRL, a Belgium registered company, or Belgian Volition. Belgian Volition has three wholly-owned subsidiaries, Volition Diagnostics UK Limited, a company registered in the United Kingdom, or Volition Diagnostics, Volition America, Inc., a Delaware corporation, or Volition America, and Volition Germany GmbH (formerly Octamer GmbH), a company with limited liability organized under the laws of Germany, or Volition Germany, as well as one majority-owned subsidiary, Volition Veterinary Diagnostics Development LLC, a Texas limited liability company, or Volition Vet. Additionally, in this Proxy Statement we use the term “Share Exchange Agreement” to refer to the share exchange agreement with Singapore Volition and the former shareholders of Singapore Volition dated September 26, 2011, pursuant to which we acquired Singapore Volition through an exchange of shares with the former Singapore Volition shareholders effective October 6, 2011.

We are holding our Annual Meeting at 42-44 avenue de la Gare, L – 1610 Luxembourg, on June 19, 2020, at 12:00 p.m. local time. At our Annual Meeting, our stockholders will act upon the matters outlined herein. In addition, our management will report on our performance during the 2019 year and respond to questions from stockholders.

Attendance at the Annual Meeting will be limited to stockholders of the Company. Stockholders will be required to furnish valid identification and proof of ownership of the Company’s common stock before being admitted to the meeting. Stockholders holding shares in street name are requested to bring a statement from the bank, broker or other holder of record confirming their ownership in the Company’s common stock. For directions to the Annual Meeting, you may contact the Company’s Corporate Secretary, Rodney Rootsaert, by writing to VolitionRx’s principal executive offices at 13215 Bee Cave Parkway, Suite 125, Galleria Oaks B, Austin, Texas 78738, or by telephone at +1 (646) 650-1351.

1

All shares represented by properly executed proxies received by the board of directors pursuant to this solicitation will be voted in accordance with the holder’s directions specified on the proxy. If no directions have been specified using the Internet voting site, toll-free number or by marking the appropriate places on a Proxy Card, the shares will be voted in accordance with the board of directors’ recommendations which are:

1.FOR the election of Dr. Alan Colman, Dr. Martin Faulkes, Dr. Edward Futcher, Guy Innes, Cameron Reynolds and Dr. Phillip Barnes as directors of the Company to serve for a term of one (1) year until the next annual meeting of stockholders or, if Proposal 5 is approved, to hold office until the annual meeting of stockholders applicable to the class of director to which the applicable director will be assigned, and until such director’s successor is duly elected and qualified, or until his earlier death, resignation or removal.

2.FOR ratification of the selection of Sadler, Gibb & Associates, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2020.

3.FOR the approval, by a non-binding advisory vote, of the compensation of our named executive officers, as disclosed in the Compensation of Named Executive Officers section of this Proxy Statement.

4.FOR the approval of an amendment to the Company’s 2015 Stock Incentive Plan, as amended, or the 2015 Plan, to increase the number of shares of common stock that the Company has authority to grant under the 2015 Plan from 4,250,000 to 5,500,000.

5.FOR the approval of a Third Amended and Restated Certificate of Incorporation, or the Restated Certificate, to provide for the election of a classified board of directors and grant to our board of directors the exclusive authority to fill vacancies on our board of directors.

6.FOR the approval of the Restated Certificate to permit stockholder action only at a duly called annual or special meeting and to prohibit stockholder action by written consent or electronic transmission (our Amended and Restated Bylaws, or our Bylaws, already contain a similar provision).

7.FOR the approval of the Restated Certificate to require that special meetings of stockholders be called (i) by the board of directors pursuant to a resolution approved by a majority of the board of directors, (ii) by the chairman of the board of directors, (iii) by the chief executive officer or (iv) by the president (in the absence of a chief executive officer) (our Bylaws already contain a similar provision).

8.FOR the approval of the Restated Certificate to prohibit director removal without cause and to allow removal with cause only by the vote of the holders of at least two-thirds (66-2/3%) of all then-outstanding shares of common stock of the Company.

We are asking you to vote on four separate Proposals relating to our Restated Certificate, instead of only one, in order to comply with applicable rules of the Securities Exchange Act of 1934, or the Exchange Act, governing how separate matters should be submitted for stockholder approval and guidance issued by the SEC thereunder. You can vote “FOR” or “AGAINST” (or “ABSTAIN” from voting on) any of these Proposals. Your vote on any one of these Proposals will not affect your vote on any of the other Proposals, except that approval of Proposal 8 (the approval of the Restated Certificate to prohibit director removal without cause and to allow removal with cause only by the vote of the holders of at least two-thirds (66-2/3%) of all then-outstanding shares of common stock of the Company) is contingent on approval of Proposal 5 (approval of the Restated Certificate to provide for the election of a classified board of directors and grant to our board of directors the exclusive authority to fill vacancies on our board of directors). Accordingly, if Proposal 5 is not approved, we will not implement the amendment contemplated in Proposal 8, even if approved by our stockholders. We intend to file the Restated Certificate with the Secretary of State of the State of Delaware reflecting those of Proposals 5 through 8 that are approved by our stockholders promptly after stockholder approval is obtained. However, our board of directors may abandon the amendments reflected in the Restated Certificate, or any of them, before or after adoption and approval by our stockholders at any time prior to the effectiveness of the Restated Certificate.

When using Internet or telephone voting, the voting systems will verify that you are a stockholder through the use of a company number for VolitionRx and a control number unique to you. If you vote by Internet or telephone, please do not also mail a Proxy Card.

If you plan to vote in person at the Annual Meeting, please bring valid identification. Even if you currently plan to attend the Annual Meeting, we recommend that you also submit your proxy so that your vote will be counted if you later decide not to attend the Annual Meeting.

2

Record Date

You may vote all shares that you owned as of April 27, 2020, which is the Record Date for the Annual Meeting. As of April 27, 2020, we had [l] shares of common stock issued and outstanding held of record by approximately [l] stockholders. Each share of common stock is entitled to one vote on each matter properly brought before the meeting.

A complete list of the stockholders entitled to vote at the meeting will be open to examination by any stockholder for purposes germane to the meeting, during normal business hours for ten (10) days prior to the date of the Annual Meeting at the Company’s offices at 13215 Bee Cave Parkway, Suite 125, Galleria Oaks B, Austin, Texas 78738.

Ownership of Shares

If your shares are registered directly in your name, you are the holder of record of these shares, and we are sending the Notice or, if requested, paper or e-mail copies of the Proxy Materials directly to you. As the holder of record, you have the right to give your proxy directly to us or to vote in person at the Annual Meeting. If you hold your shares in a brokerage account or through a bank or other holder of record, you hold the shares in “street name,” and your broker, bank or other holder of record is sending the Notice or Proxy Materials to you. As a holder in street name, you have the right to direct your broker, bank or other holder of record how to vote by filling out a voting instruction form that accompanies your Proxy Materials. Regardless of how you hold your shares, we invite you to attend the Annual Meeting.

If you receive more than one Notice or set of Proxy Materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions to ensure that all of your shares are voted.

How to Vote

Your Vote Is Important. We encourage you to vote promptly. You may vote in any of the following ways:

By Internet – www.proxyvote.com: Use the Internet to submit your proxy by going to www.proxyvote.com and following the instructions on how to complete an electronic proxy card up until 5:00 p.m. Eastern Time on June 18, 2020, the day before the Annual Meeting date. You will need the 12-digit control number included on your Notice or your Proxy Card in order to vote by Internet.

By Telephone – 1-800-690-6903: Use any touch-tone telephone to submit your proxy by dialing 1-800-690-6903 up until 5:00 p.m. Eastern Time on June 18, 2020, the day before the Annual Meeting date. You will need the 12-digit control number included on your Notice or your Proxy Card in order to vote by telephone.

By Mail: You may request a paper copy of the Proxy Materials from us by following the instructions on your Notice. When you receive the Proxy Card, mark your selection on the Proxy Card, date and sign your name exactly as it appears on your Proxy Card. Mail the Proxy Card in the postage-paid envelope that will be provided to you.

At the Annual Meeting: If you vote your shares now it will not limit your right to change your vote at the Annual Meeting if you attend in person. If you hold your shares in street name, you must obtain a proxy, executed in your favor, from your bank, broker or other holder of record, if you wish to vote your shares at the Annual Meeting.

All shares that have been properly voted and not revoked will be voted at the meeting. If you vote using the Internet voting site or the toll-free number, or by signing and returning a Proxy Card without any voting instructions, your shares will be voted as the board of directors recommends.

Revocation of Proxies

You can revoke your proxy (or voting instructions if you hold your shares in street name) at any time before your shares are voted at the Annual Meeting if you: (1) send a written notice to our Corporate Secretary indicating that you want to revoke your proxy; or (2) vote after delivery of your proxy and before the Annual Meeting by using the Internet voting site or toll-free number or deliver to our Corporate Secretary a duly executed Proxy Card bearing a later date, which revokes all previous proxies; or (3) attend the Annual Meeting in person, give written notice of revocation to the Corporate Secretary of the Annual Meeting prior to the voting of your proxy and vote your shares in person, although your attendance at the meeting will not by itself revoke your proxy.

3

Quorum and Required Vote

Quorum

We will have a quorum and will be able to conduct the business of the Annual Meeting if the holders of a majority of the outstanding shares of the Company’s common stock entitled to vote are present at the meeting, either in person or by proxy. In determining whether we have a quorum, we count abstentions and broker non-votes as present and entitled to vote.

Vote Required for Proposals

1. Election of Directors (Proposal 1). Directors are elected by a plurality of the shares of common stock that are present in person or represented by proxy and entitled to vote on the matter, meaning the nominees receiving the highest number of votes will be elected to the board of directors. A properly executed proxy marked “WITHHOLD” or “FOR ALL EXCEPT” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. The election of directors is a non-discretionary matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the election of directors, your broker is not permitted to vote on this Proposal and your votes will be counted as broker non-votes. Broker non-votes will have no effect in determining which directors are elected at the Annual Meeting.

2. Ratification of Selection of Independent Registered Public Accounting Firm (Proposal 2). The ratification of Sadler, Gibb & Associates, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2020 requires the approval of a majority of the shares present in person or represented by proxy and entitled to vote on the matter. A properly executed proxy marked “ABSTAIN” with respect to such matter will not be voted. Accordingly, an abstention will have the same effect as a vote “AGAINST” this Proposal. The ratification of Sadler, Gibb & Associates, LLC is a discretionary matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the ratification of Sadler, Gibb & Associates, LLC, your broker may use its discretion to vote your uninstructed shares on this Proposal. Accordingly, broker non-votes are not expected for this Proposal. Broker non-votes, if any, will have no effect in determining the outcome of this Proposal.

3. Advisory Vote on the Compensation of the Named Executive Officers (Proposal 3). The approval, on a non-binding advisory basis, of the compensation of our named executive officers, as disclosed in the Compensation of Named Executive Officers section of this Proxy Statement, requires the approval of a majority of the shares present in person or represented by proxy and entitled to vote on the matter. A properly executed proxy marked “ABSTAIN” with respect to such matter will not be voted. Accordingly, an abstention will have the same effect as a vote “AGAINST” this Proposal. The advisory vote on compensation is a non-discretionary matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the advisory vote on compensation, your broker is not permitted to vote on this Proposal and your votes will be counted as broker non-votes. Broker non-votes, if any, will have no effect on the outcome of the Proposal.

4. Approval of Amendment to 2015 Stock Incentive Plan (Proposal 4). The approval of the amendment to the 2015 Plan requires the approval of a majority of the shares present in person or represented by proxy and entitled to vote on the matter. A properly executed proxy marked “ABSTAIN” with respect to such matter will not be voted. Accordingly, an abstention will have the same effect as a vote “AGAINST” this Proposal. The approval of the amendment to the 2015 Plan is a non-discretionary matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the approval of the amendment to the 2015 Plan, your broker is not permitted to vote on this Proposal and your votes will be counted as broker non-votes. Broker non-votes, if any, will have no effect on the outcome of the Proposal.

4

5. Approval of Restated Certificate (Proposals 5 through 8). The approval of each Proposal related to the Restated Certificate requires the approval of the holders of a majority of the shares outstanding and entitled to vote on the matter. A properly executed proxy marked ‘‘ABSTAIN’’ with respect to any such Proposal will not be voted. Accordingly, an abstention will have the same effect as a vote “AGAINST” the particular Proposal. The approval of the Restated Certificate with respect to each Proposal is a non-discretionary matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the approval of the Restated Certificate with respect to a particular Proposal, your broker is not permitted to vote on Proposals 5 through 8 and your votes will be counted as broker non-votes with respect to such Proposals. Broker non-votes, if any, will have the same effect as a vote “AGAINST” Proposals 5 through 8.

Dissenter's Rights

Under Delaware law, stockholders are not entitled to dissenter’s rights of appraisal on any Proposal referred to herein.

Cumulative Voting

Stockholders shall not be entitled to cumulate votes with respect to voting on the election of directors or any other Proposal referred to herein.

Voting Results

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of March 25, 2020, by: (i) each of our directors and director nominees; (ii) each of our named executive officers; (iii) all of our directors, director nominees and executive officers as a group; and (iv) each person or group known by us to beneficially own more than 5% of our outstanding shares of common stock.

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under the rules of the SEC, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which the person has a right to acquire beneficial ownership within sixty (60) days. Under these rules more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

Unless otherwise indicated below, to the best of our knowledge (i) each beneficial owner named in the table has the sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable, and (ii) the address of such beneficial owner is 13215 Bee Cave Parkway, Suite 125, Galleria Oaks B, Austin, Texas 78738.

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership (#) |

Percent of Class (1) (%) |

|

|

|

Directors and Named Executive Officers: |

|

|

|

|

|

Dr. Martin Faulkes(2) |

2,282,284 |

5.5% |

|

|

|

Cameron Reynolds(3) |

2,669,067 |

6.4% |

|

|

|

Dr. Alan Colman(4) |

261,250 |

* |

|

|

|

Dr. Edward Futcher(5) |

438,000 |

1.1% |

|

|

|

Guy Innes(6) |

1,900,701 |

4.6% |

|

|

|

Dr. Jacob Micallef(7) |

651,279 |

1.6% |

|

|

|

Dr. Phillip Barnes |

-0- |

* |

|

|

|

David Vanston(8) |

212,750 |

* |

|

|

|

Dr. Jason Terrell(9) |

400,000 |

1.0% |

|

|

|

All Executive Officers and Directors as a Group (12 Persons)(10) |

8,590,159 |

19.6% |

|

|

|

|

|

|

|

|

|

5% Stockholders: |

|

|

|

|

|

Cotterford Company Limited(11) Eight Corporation Limited c/o Crowe Morgan 8 St. George’s Street Douglas, Isle of Man IM1 1AH |

12,045,332 |

29.2% |

|

|

|

|

|

|

|

*Represents ownership of less than 1%

(1)For purposes of the table, the percent of class is based upon 41,206,632 shares of our common stock issued and outstanding as of March 25, 2020. Shares of common stock subject to stock options or warrants currently exercisable, or exercisable within sixty (60) days of March 25, 2020, are deemed beneficially owned and outstanding for computing the percentage ownership of the person or entity holding such securities, but are not considered outstanding for computing the percentage ownership of any other person or entity.

(2)Dr. Faulkes’ beneficial ownership includes direct ownership of (i) 1,561,284 shares of common stock and (ii) options to purchase 365,000 shares of common stock that are exercisable within 60 days. Dr. Faulkes’ beneficial ownership also includes indirect ownership of 356,000 shares of common stock held directly by The Dill Faulkes Educational Trust Limited, or DFET. Dr. Faulkes serves as the chairman, director and trustee of the DFET and shares voting and dispositive control over such shares. On December 8, 2015, Dr. Faulkes pledged 12,500 shares to secure a loan.

6

(3)Mr. Reynolds’ beneficial ownership includes direct ownership of (i) 1,122,273 shares of common stock and (ii) options to purchase 505,000 shares of common stock that are exercisable within 60 days. Mr. Reynolds’ beneficial ownership also includes indirect ownership of (x) 34,076 shares of common stock held directly by Mr. Reynolds’ spouse and (y) 1,007,718 shares of common stock held directly by Concord International, Inc., or Concord, of which Mr. Reynolds is the majority stockholder and shares voting and dispositive control over such shares.

(4)Dr. Colman’s beneficial ownership includes direct ownership of (i) 156,250 shares of common stock and (ii) options to purchase 105,000 shares of common stock that are exercisable within 60 days.

(5)Dr. Futcher’s beneficial ownership includes direct ownership of (i) 27,000 shares of common stock and (ii) options to purchase 55,000 shares of common stock that are exercisable within 60 days. Dr. Futcher’s beneficial ownership also includes indirect ownership of 356,000 shares of common stock held directly by DFET. Dr. Futcher serves as a director and a trustee of DFET and shares voting and dispositive control over such shares.

(6)Mr. Innes’ beneficial ownership includes direct ownership of (i) 1,354,975 shares of common stock and (ii) options to purchase 140,000 shares of common stock that are exercisable within 60 days. Mr. Innes’ beneficial ownership also includes indirect ownership of (x) 49,726 shares of common stock, held in a bare trust, which is not a separate legal entity, of which Mr. Innes is the trustee, for the benefit of certain minors, and (y) 356,000 shares of common stock held directly by DFET. Mr. Innes serves as a director and a trustee of DFET and shares voting and dispositive control over such shares.

(7)Dr. Micallef’s beneficial ownership includes direct ownership of (i) 86,166 shares of common stock and (ii) options to purchase 195,000 shares of common stock that are exercisable within 60 days. Dr. Micallef’s beneficial ownership also includes indirect ownership of (x) 22,000 shares of common stock held directly by Dr. Micallef’s wife, (y) 38,113 shares of common stock held directly by Borlaug Limited, or Borlaug, for which Dr. Micallef serves as a controlling director, and over which Dr. Micallef shares voting and dispositive control, and (z) options held directly by Borlaug to purchase 310,000 shares of common stock that are exercisable within 60 days.

(8)Mr. Vanston’s beneficial ownership includes direct ownership of (i) 2,750 shares of common stock and (ii) options to purchase 210,000 shares of common stock that are exercisable within 60 days.

(9)Dr. Terrell’s beneficial includes direct ownership of (i) 50,000 shares of common stock, (ii) options to purchase 200,000 shares of common stock that are exercisable within 60 days, and (iii) warrants to purchase 150,000 shares of common stock that are exercisable within 60 days.

(10)The number of executive officers, directors and director nominees as a group includes two executive officers of the Company’s subsidiaries. The amount beneficially owned by the executive officers, directors and director nominees as a group consists of an aggregate of (i) 5,878,159 shares of common stock, (ii) options to purchase 2,562,000 shares of common stock that are exercisable within 60 days and (iii) warrants to purchase 150,000 shares of common stock that are exercisable within 60 days.

(11)Based on the information contained in a Schedule 13D filed with the SEC on August 1, 2019 and Form 4 filed with the SEC on October 18, 2019, Cotterford Company Limited, or Cotterford, beneficially owns 11,706,913 shares of common stock, and Eight Corporation Limited, or Eight, which is a director of Cotterford, beneficially owns 12,045,332 shares of common stock, including those held by Cotterford. Each of Amy Slee, James Bartholomew McCarney and David John Morgan are directors of Eight and hold dispositive and voting control over the shares of common stock beneficially owned by Cotterford.

Changes in Control

We are not aware of any arrangements that have resulted, or may at a subsequent date result, in a change of control of the Company.

7

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, requires our directors and executive officers and persons who beneficially own more than ten percent of a registered class of our equity securities to file with the SEC initial reports of ownership and reports of change in ownership of our common stock and other equity securities. To our knowledge, based solely upon a review of Forms 3, 4 and 5 and amendments thereto filed electronically with the SEC during the year ended December 31, 2019, and the representations made by our directors and executive officers to us, we believe that during the year ended December 31, 2019, our executive officers and directors and all persons who own more than ten percent of a registered class of our equity securities have complied with all Section 16(a) filing requirements with the exception of Cotterford Company Limited and Eight Corporation Limited who jointly filed a late Form 4 to report a purchase of shares of our common stock in October 2019.

8

DIRECTORS AND EXECUTIVE OFFICERS

Identification of Directors and Executive Officers

The following table sets forth the names and ages of the Company’s directors and executive officers as of December 31, 2019.

|

Name |

|

Age |

|

Position with the Company |

|

Officer/Director Since |

|

Cameron Reynolds |

|

48 |

|

President |

|

October 6, 2011 |

|

|

|

|

|

Chief Executive Officer |

|

October 6, 2011 |

|

|

|

|

|

Director |

|

October 6, 2011 |

|

David Vanston |

|

52 |

|

Chief Financial Officer |

|

April 10, 2017 |

|

|

|

|

|

Treasurer |

|

April 10, 2017 |

|

Rodney Rootsaert |

|

48 |

|

Corporate Secretary |

|

October 6, 2011 |

|

Dr. Jason Terrell |

|

39 |

|

Chief Medical Officer |

|

March 20, 2013 |

|

|

|

|

|

Head of U.S. Operations |

|

March 20, 2013 |

|

Dr. Jacob Micallef |

|

63 |

|

Chief Scientific Officer |

|

January 1, 2015 |

|

Dr. Jasmine Kway |

|

48 |

|

Chief Executive Officer, |

|

June 1, 2018 |

|

|

|

|

|

Singapore Volition |

|

|

|

Dr. Gaetan Michel |

|

47 |

|

Chief Executive Officer, |

|

July 1, 2015 |

|

|

|

|

|

Belgian Volition |

|

|

|

Dr. Martin Faulkes |

|

75 |

|

Executive Chairman |

|

October 6, 2011 |

|

|

|

|

|

Director |

|

October 6, 2011 |

|

Guy Innes(1) (2) (3) |

|

63 |

|

Director |

|

October 6, 2011 |

|

Dr. Alan Colman(1) |

|

71 |

|

Director |

|

October 6, 2011 |

|

Dr. Phillip Barnes(1) (2) (3) |

|

58 |

|

Director |

|

October 9, 2019 |

|

Dr. Edward Futcher(1) (2) (3) |

|

65 |

|

Director |

|

June 23, 2016 |

|

|

|

|

|

|

|

|

|

(1) Member of the Audit Committee |

|

|

|

|

||

|

(2) Member of the Compensation Committee |

|

|

|

|

||

|

(3) Member of the Nominations and Governance Committee |

|

|

||||

The background and business experience during the past five years of the persons listed above are as follows:

CAMERON REYNOLDS serves as our President and Chief Executive Officer and is a director of the Company. Information regarding Mr. Reynolds is provided under Proposal 1 – Election of Directors of this Proxy Statement.

DAVID VANSTON serves as our Chief Financial Officer and Treasurer. Mr. Vanston has over twenty years of financial management experience with a strong background as an international finance executive and a senior controller, including extensive experience in Sarbanes-Oxley compliance and implementation of successful change programs. Mr. Vanston was previously employed at Octo Telematics from 2016 to 2017, a high-growth technology company based in Boston, where he was the Senior Controller for the U.S. business. Prior to joining Octo Telematics, he held the position of Vice President of Excorp Medical, Inc., an early-stage company, from 2015 to 2016, and prior to that served as European Chief Financial Officer for Monster Worldwide, Inc. and Chief Financial Officer for GrowHow Ltd. Mr. Vanston managed and oversaw accounting, finance, tax, treasury, financial planning and analysis of GrowHow Ltd.’s business. Mr. Vanston is a certified chartered accountant and holds an MBA from Warwick Business School. The board of directors believes that Mr. Vanston’s financial and accounting knowledge is a valuable asset to the Company.

RODNEY ROOTSAERT serves as our Corporate Secretary. Prior to the completion of the transactions under the Share Exchange Agreement, he was the Administration and Legal Officer of Singapore Volition, a position he held since August 6, 2010. Mr. Rootsaert became a Director of Singapore Volition on December 15, 2015. He has been a Manager and Secretary of Belgian Volition since October 4, 2010, was appointed Director of Volition Diagnostics on November 13, 2015, and was additionally appointed Secretary and Treasurer of Volition Vet on August 7, 2019. Mr. Rootsaert served as director and corporate secretary of Mining House Ltd. between 2007 and 2018. His responsibilities included ensuring compliance with all relevant statutory and regulatory requirements. From 2007 until 2011, Mr. Rootsaert served as corporate secretary for Magellan Copper and Gold Plc., where his duties included maintaining and preparing company documents, accounts and contracts. With over ten years of experience in providing corporate, legal and administrative services and prior roles as corporate secretary for several mining companies in the United Kingdom, the board of directors believes that Mr. Rootsaert is a valuable addition to our team.

9

DR. JASON TERRELL serves as our Chief Medical Officer and Head of U.S. Operations. Effective January 1, 2016, Dr. Terrell was appointed to the position of Chief Medical Officer and Head of U.S. Operations on a full-time basis, having previously served in a part-time capacity as the Company’s Chief Medical Officer and Head of U.S. Operations since March 2013. On February 3, 2017, Dr. Terrell was appointed Director and Chief Executive Officer of Volition America, and was additionally appointed a Manager and Vice President of Volition Vet on May 28, 2019 and August 7, 2019, respectively. Since February 2017, Dr. Terrell has also concurrently served as both a director and Chief Medical Diagnostics Officer of Generex Biotechnology Corporation (OTCMKTS: GNBT), a publicly-held biopharmaceutical company focused on developing or acquiring technologies that help pharmaceutical companies discover and develop medicines, and additionally as the non-executive chairman of the board of directors of Kiromic BioPharma, Inc. (a private company). Between January 2013 and October 2015, Dr. Terrell served on the board of directors of CDEX Inc., a publicly-held company developing drug validation technology, and between January 2012 and October 2015, as Medical Director of CDEX Inc. In addition, over the last six years, Dr. Terrell has built and sold multiple private diagnostic laboratories and currently serves as a National Franchise Corporate Medical Director for Any Lab Test Now, giving him oversight of over 70 franchises in 14 states. Dr. Terrell is a Texas-based doctor and earned a B.S. in Biochemistry from Hardin-Simmons University, where he graduated Summa Cum Laude, receiving the Holland Medal of Honor as the top graduate in the School of Science and Mathematics. He then attended the University of Texas at Houston Medical School and affiliate MD Anderson Cancer Center to become Doctor of Medicine. He undertook his General Medicine Internship, and Anatomic and Clinical Pathology Residency at Texas Tech University Health Sciences Center. In February 2014, Dr. Terrell was recipient of the Outstanding Young Alumni Award from Hardin-Simmons University. Dr. Terrell holds medical licenses in 14 states across the United States and has expertise in both clinical medicine and the laboratory diagnostics business. He has a strong grounding in diagnostics and product commercialization and has both executive and board directorship experience with publicly traded companies in the biotechnology and pharmaceutical industries. Our board of directors has concluded that Dr. Terrell brings value to the Company with his strong grounding in both medicine and more specifically in diagnostics.

DR. JACOB MICALLEF serves as our Chief Scientific Officer. Dr. Micallef also served as a Director of Belgian Volition between August 10, 2011 and March 31, 2016. Prior to the Share Exchange Agreement, he served as Chief Scientific Officer of Belgian Volition from October 11, 2010 to December 31, 2014, but was not otherwise involved with Singapore Volition. Dr. Micallef joined Cronos Therapeutics Limited, or Cronos, in 2004 and, in 2006, Cronos was listed in the U.K. on the AIM, becoming Valirx plc, or Valirx. Dr. Micallef continued to work as Technical Officer for Valirx, where he in-licensed the NucleosomicsTM technology and co-founded ValiBio SA, which is now Belgian Volition. From 2004 to 2007, he taught “science and enterprise” to science research workers from four universities at CASS Business School before joining Cronos. In 2001, Dr. Micallef co-founded Gene Expression Technologies, after getting his MBA in 1999, where he successfully led the development of the chemistry of the GeneICE technology and implemented the manufacture of GeneICE molecules. He also played a major role in business development and procured a GeneICE contract with Bayer AG. Over a 15-year period, starting in 1985, Dr. Micallef worked for the World Health Organization, or WHO. While working for WHO, Dr. Micallef developed new diagnostic products in the areas of reproductive health and cancer. In 1990, he commenced development of a new diagnostic technology platform for WHO which was launched in 1992 and supported 13 tests. Dr. Micallef also initiated and implemented in-house manufacture (previously outsourced to Abbott Diagnostics Inc.) and world-wide distribution of these products for WHO. Also in 1990, he started a “not-for-profit” WHO company, Immunometrics Ltd., which marketed and distributed those diagnostic products worldwide. Dr. Micallef has over 20 years of experience in research and development and in the management of early stage biotechnical companies, including the manufacture of biotechnology products and the establishment of manufacturing operations. Our board of directors believes that Dr. Micallef’s prior work with Belgian Volition in the development of diagnostic products would continue to be an asset to us in his role as Chief Scientific Officer of the Company and its subsidiaries.

DR. JASMINE KWAY serves as the Chief Executive Officer of Singapore Volition. Dr. Kway previously served as Singapore Volition’s Vice President of Asia from January 2017 until June 2018. Prior to joining Singapore Volition, during 2016 Dr. Kway served as Chief Executive Officer of intellectual property practice at RHT i-Assets Advisory, one of the leading companies of the RHT Group of Companies and RHT Holdings (RHT), a Singapore headquartered integrated leading professional services company providing professional services in Asia. While at RHT i-Assets Advisory, Dr. Kway was focused on managing buy-side and sell-side clients globally in technology/intellectual property transactions, business development, and fund raising. Prior to RHT i-Assets Advisory, Dr. Kway worked in both the private and public sectors, including as Executive Vice President, Business Development at Transpacific IP Group Limited from 2010 to 2015, and as Director of Industry Liaison of the National University of Singapore from 2005 to 2010. In these positions, Dr. Kway formulated and implemented national intellectual property policies, corporate intellectual property strategies and management, intellectual property and technology development, commercialization, fundraising, and investment. Our board of directors believes that Dr. Kway’s extensive prior management experience, including with respect to intellectual property matters, is an asset to us in her role as Chief Executive Officer of Singapore Volition.

10

DR. GAETAN MICHEL serves as the Chief Executive Officer of Belgian Volition and was appointed a Manager of Belgian Volition on June 24, 2015. Dr. Michel previously served as Belgian Volition’s Chief Operations Officer from July 2014 to June 2018. On January 10, 2020, Dr. Michel was also appointed the Managing Director of Volition Germany. Dr. Michel has over 10 years’ experience in production management. Prior to joining Belgian Volition, from 2010 to 2014 Dr. Michel worked as production director for Bone Therapeutics SA (Euronext Brussels and Paris: BOTHE), a bone cell therapy-based pharmaceutical company, where his responsibilities included establishing two new production plants to commence manufacturing for two phase III clinical trials, developing quality systems for new products in negotiation with the Belgian health authorities, and establishing a product plant for an injectable medical device. From 2007 to 2010, Dr. Michel worked for KitoZyme, a global manufacturer of biopolymers of fungal origin with its core business in weight management, digestive and cardiovascular health. During this period, Dr. Michel established both the production and process development departments and oversaw the commencement of the company’s industrial phase culminating in the roll out of first products. Prior to joining KitoZyme, following the completion of his PhD in 2002, Dr. Michel joined ATT (Advanced Array Technology), a University of Namur spin-off company as project manager in proteomics. ATT later became EAT (Eppendorf Array Technology), part of the German Eppendorf Biotech company, where Dr. Michel became production manager and was involved in establishing production processes and equipment. In light of Dr. Michel’s extensive experience in the area of production management, Dr. Michel was appointed as Chief Executive Officer of Belgian Volition.

DR. MARTIN FAULKES serves as our Executive Chairman of the board of directors. Information regarding Dr. Faulkes is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

GUY INNES serves as a director. Information regarding Mr. Innes is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

DR. ALAN COLMAN serves as a director. Information regarding Dr. Colman is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

DR. PHILLIP BARNES serves as a director. Information regarding Dr. Barnes is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

DR. EDWARD FUTCHER serves as a director. Information regarding Dr. Futcher is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

11

CORPORATE GOVERNANCE OF THE COMPANY

Our business is managed by the Company’s board of directors. Our board members are informed of our business through discussions with management, materials provided to them, visits to the Company’s offices and facilities, and their participation in meetings of the board of directors.

Corporate Governance Practices and Policies

Our board of directors has been carefully following the corporate governance developments that have been taking place as a result of the adoption of the Sarbanes-Oxley Act of 2002, the rules promulgated thereunder by the SEC, and other corporate governance recommendations. Our board of directors addresses, among other things, the board of directors’ composition, qualifications and responsibilities, director education and stockholder communication with directors.

For purposes of determining director independence, the board of directors reviews a summary of the relationships of each director, including any of his or her family members or related parties, with the Company or management and other facts relevant to the analysis of whether the directors qualify as “independent directors” under the NYSE American Company Guide §803(A)(2). No director qualifies as independent unless the board of directors affirmatively determines that the director does not have a relationship that would interfere with the exercise of his or her independent judgment in carrying out his or her responsibilities as a director. In addition, the NYSE American Company Guide provides a non-exclusive list of persons who may not be considered independent.

The board of directors has affirmatively determined that each of Drs. Colman, Futcher and Barnes, as well as Mr. Innes, is an independent director under the rules of the NYSE American. In addition, the members of the Audit Committee are independent directors pursuant to the heightened independence criteria for members of Audit Committees set forth in the applicable SEC rules.

Our independent directors meet as often as is necessary to fulfill their responsibilities but at least annually in executive session without management or non-independent directors in accordance with the requirements of NYSE American Company Guide §802(c).

Term of Office for Directors and Officers

Each director serves for a term of one year until the next annual meeting of stockholders or, if Proposal 5 is approved, to hold office until the annual meeting of stockholders applicable to the class of director to which the applicable director will be assigned, and until such director’s successor is duly elected and qualified, or until his or her earlier death, resignation or removal. Each officer serves for such term as determined by the board of directors or, in the case of officers with employment agreements, for such term set forth in their employment agreement as approved by the board of directors or Compensation Committee. Information regarding employment agreements is provided under the Employment and Consulting Agreements section of this Proxy Statement.

None of the executive officers or directors of our Company, or any nominees therefor, are related to each other.

Certain Arrangements and Understandings

Except as disclosed in the notes to the Compensation of Directors Table and the section entitled Employment and Consulting Agreements in this Proxy Statement, there are no arrangements or understandings between any director, executive officer or director nominee and any other person pursuant to which any person was nominated as a director or selected as an executive officer.

Involvement in Certain Legal Proceedings

During the past ten years no director, executive officer or director nominee of VolitionRx has been involved in any legal proceedings required to be disclosed pursuant to Item 401(f) of Regulation S-K. Additionally, no director, executive officer or director nominee of VolitionRx is party to, or has any material interests in, any material legal proceedings that are adverse to the Company or its subsidiaries.

12

Board and Committee Meetings; Annual Meeting Attendance

During the fiscal year ended December 31, 2019: the board of directors held 4 regularly scheduled meetings and acted by written consent 7 times; the Audit Committee held 5 regularly scheduled meetings and acted by written consent 6 times; the Compensation Committee held 1 regularly scheduled meeting and acted by written consent 5 times; and the Nominations and Governance Committee held 1 regularly scheduled meeting and acted by written consent 2 times. During the fiscal year ended December 31, 2019, all directors attended, in person or by telephone, at least 75% of the total number of meetings of both our board of directors and the committees of our board of directors on which such director served, during such period.

The Company does not have a policy with regard to the attendance of the members of the board of directors at annual meetings of stockholders, however, directors are strongly encouraged to attend the annual meetings of stockholders whether in person or by telephone. All directors attended the 2019 Annual Meeting of Stockholders, either in person or by telephone, with the exception of Dr. Barnes who was not serving as a director at the time.

13

Committees of the Board of Directors

Our board of directors has established an Audit Committee, a Compensation Committee and a Nominations and Governance Committee. The Committees operate pursuant to written charters adopted by the board of directors, copies of which are available on our website at https://ir.volition.com/committee-charters. However, the reference to our website in this Proxy Statement does not constitute incorporation by reference of the information contained on or available through our website, and you should not consider it to be a part of this Proxy Statement. In addition, from time to time, the board of directors may establish special committees when necessary to address specific issues. The composition and functions of each of our Audit, Compensation and Nominations and Governance Committees are described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our Audit Committee consists of four members, Mr. Innes (Chair), and Drs. Barnes, Colman and Futcher, each of whom has been determined to be an independent director under applicable SEC rules and the applicable rules of the NYSE American. The Audit Committee shall at all times be composed exclusively of directors who are, in the opinion of our board of directors, free from any relationship which would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

The Audit Committee is responsible for, among other things:

appointing, terminating, compensating and overseeing the work of any independent auditor engaged to prepare or issue an audit report or other audit, review or attest services;

reviewing all audit and non-audit services to be performed by the independent auditor, taking into consideration whether the independent auditor’s provision of non-audit services to us is compatible with maintaining the independent auditor’s independence;

reviewing and discussing the adequacy and effectiveness of our accounting and financial reporting processes and internal controls and the audits of our financial statements;

establishing and overseeing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, including procedures for the confidential, anonymous submission by our employees regarding questionable accounting or auditing matters;

investigating any matter brought to its attention within the scope of its duties and engaging independent counsel and other advisors as the Audit Committee deems necessary;

determining compensation of the independent auditors and of advisors hired by the Audit Committee and ordinary administrative expenses;

reviewing and discussing with management and the independent auditor the annual and quarterly financial statements prior to their release;

monitoring and evaluating the independent auditor’s qualifications, performance and independence on an ongoing basis;

reviewing reports to management prepared by the internal audit function, as well as management’s response;

reviewing and assessing the adequacy of the Audit Committee’s formal written charter on an annual basis;

reviewing and approving transactions with related persons for potential conflict of interest situations on an ongoing basis; and

overseeing such other matters that are specifically delegated to the Audit Committee by our board of directors from time to time.

The board of directors has affirmatively determined that Mr. Innes is designated as an “Audit Committee financial expert.”

14

Compensation Committee

Our Compensation Committee consists of three members, Mr. Innes (Chair) and Drs. Barnes and Futcher, each of whom has been determined to be an independent director under the applicable rules of the NYSE American.

The Compensation Committee is responsible for, among other things:

developing, reviewing, and approving our overall compensation programs, and regularly reporting to the full board of directors regarding the adoption of such programs;

developing, reviewing and approving our cash and equity incentive plans, including approving individual grants or awards thereunder;

reviewing and approving individual and company performance goals and objectives that may be relevant to the compensation of executive officers and other key employees;

reviewing and discussing with management the tables and narrative discussion regarding executive officer and director compensation to be included in the annual proxy statement;

reviewing and assessing, on an annual basis, the adequacy of the Compensation Committee’s formal written charter; and

overseeing such other matters that are specifically delegated to the Compensation Committee by our board of directors from time to time.

In fulfilling its responsibilities, the Compensation Committee has the authority to delegate any or all of its responsibilities to a subcommittee of the Compensation Committee.

Nominations and Governance Committee

Our Nominations and Governance Committee consists of three members, Mr. Innes (Chair) and Drs. Barnes and Futcher, each of whom has been determined to be an independent director under the applicable rules of the NYSE American.

The Nominations and Governance Committee is responsible for, among other things:

identifying and screening candidates for our board of directors, and recommending nominees for election as directors;

assessing, on an annual basis, the performance of the board of directors and any committee thereof;

reviewing the structure of the board of directors’ committees and recommending to the board of directors for its approval directors to serve as members of each committee, including each committee’s respective chair, if applicable;

reviewing and assessing, on an annual basis, the adequacy of the Nominations and Governance Committee’s formal written charter; and

generally advising our board of directors on corporate governance and related matters including, without limitation, with respect to the Company’s Certificate of Incorporation, Bylaws and charters of other committees.

15

Nominating Procedures

The Nominations and Governance Committee considers candidates for the board of directors from any reasonable source, including stockholder recommendations. The Committee will not evaluate candidates differently based on who has made the proposal. The Committee has the authority under its charter to hire and pay a fee to consultants or search firms to assist in the process of identifying and evaluating candidates. No such consultants or search firms have been used to date and, accordingly, no fees have been paid to consultants or search firms in the past fiscal year. The Nominations and Governance Committee, and our board of directors, believe that directors should possess the highest personal and professional ethics, integrity and values, and to be committed to representing the long-term interests of the Company’s stockholders. Each director must also be able to dedicate the time and resources sufficient to ensure the diligent performance of his or her duties. Further, our board of directors is intended to encompass a range of talents, experience, skills, backgrounds, and expertise sufficient to provide sound and prudent guidance with respect to the operations and interests of the Company and its stockholders. The Company values diversity and seeks to achieve a diversity of professional experiences and personal backgrounds on our board of directors, but no specific policy regarding board diversity has been adopted.

Stockholders who wish to suggest qualified candidates should write to the Chair of the Nominations and Governance Committee c/o VolitionRx Limited, 13215 Bee Cave Parkway, Suite 125, Galleria Oaks B, Austin, Texas 78738, in accordance with the time periods and information requirements set forth in the Bylaws, specifying the name of the candidates and stating in detail the qualifications of such persons for consideration by the Committee. A written statement from the candidate consenting to be named as a candidate and, if nominated and elected, to serve as a director should accompany any such recommendation. See the section of this Proxy Statement entitled Deadline for Receipt of Stockholder Proposals for the Next Annual Meeting. No director nominations by stockholders have been received as of the filing of this Proxy Statement.

Board Leadership Structure and Role in Risk Oversight

Our board of directors does not have a formal policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board. Our board of directors believes that it is in the best interests of our organization to make that determination from time to time based on the position and the direction of our organization and the membership of our board of directors.

Dr. Martin Faulkes currently serves as the Executive Chairman of our board of directors. Guy Innes is the lead independent director on the board of directors. As the lead independent director, Mr. Innes regularly consults with the Executive Chairman of the board of directors and management on the key issues concerning the Company. Cameron Reynolds, our Chief Executive Officer and principal executive officer, also serves as a director of the Company. Due to Mr. Reynolds’ executive officer position, he is not an independent director. Our board of directors views this arrangement as providing an efficient connection between our management and board of directors, enabling our board to obtain information pertaining to operational matters expeditiously and enabling our Executive Chairman and our Chief Executive Officer to bring areas of concern before the board in a timely manner.

One of our board of directors’ key functions is informed oversight of our risk management process. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through the board as a whole, as well as through various board standing committees that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for us. Each committee of our board of directors meets in executive session with key management personnel and representatives of outside advisors as necessary to oversee risks associated with their respective principal areas of focus. Our Audit Committee oversees management of financial risks. Our Compensation Committee oversees the management of risks related to our executive compensation plans and arrangements. Our Nominations and Governance Committee manages risks associated with the independence of our board and potential conflicts of interest. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through committee reports about such risks. While our board of directors, through its committees, oversees our risk management, our management team is responsible for day-to-day risk-management processes to ensure that such risks are being adequately managed.

The board of directors encourages stockholders to send communications to the board of directors or to individual members of the board of directors. Such communications, whether by letter, e-mail or telephone, should be directed to the Executive Chairman of the board of directors who will forward them to the intended recipients. However, unsolicited advertisements or invitations to conferences or promotional material, in the discretion of the Executive Chairman or his designee, may not be forwarded to the directors.

16

If a stockholder wishes to communicate to the board of directors about a concern relating to the Company’s financial statements, accounting practices or internal controls, the concern should be submitted in writing to the board of directors in care of the Executive Chairman at the Company’s headquarters. If the concern relates to the Company’s governance practices, business ethics or corporate conduct, the concern likewise should be submitted in writing to the Executive Chairman at the Company’s headquarters address. If the stockholder is unsure as to which category his or her concern relates, he or she may communicate it to any one of the directors in care of the Company’s Corporate Secretary.

Stockholders who wish to contact members of the board of directors either individually or as a group may do so by writing to Corporate Secretary c/o VolitionRx Limited, 13215 Bee Cave Parkway, Suite 125, Galleria Oaks B, Austin, Texas 78738, or by telephone at +1 (646) 650-1351, specifying whether the communication is directed to the entire board of directors or to a particular director. Stockholder letters are screened by Company personnel to filter out improper or irrelevant topics, such as solicitations, and to confirm that such communications relate to matters that are within the scope of responsibilities of the board of directors.

We have adopted a Code of Ethics that applies to our directors, officers and employees, including our Chief Executive Officer and Chief Financial Officer. A copy of our Code of Ethics is available on our Company website at https://ir.volition.com/governance-documents. Amendments to our Code of Ethics that apply to our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions, if any, will be posted on our website at https://ir.volition.com/governance-documents. We will disclose any waivers of provisions of our Code of Ethics that apply to such persons by disclosing such information on a Current Report on Form 8-K.

Employee, Director and Officer Hedging

We have not adopted any practice or policy regarding the ability of our employees (including officers) or directors, or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities.

Transactions with Related Persons

For disclosures relating to certain transactions with related persons, see the sections entitled Summary Compensation Table, Employment and Consulting Agreements and the Compensation of Directors Table in this Proxy Statement.

On August 10, 2018, we issued to a beneficial owner of more than 5% of our outstanding shares (Cotterford Company Limited) in a private placement offering 5 million shares of common stock at a price of $1.80 per share, for aggregate gross proceeds of $9 million. Additionally, we issued to Cotterford a warrant to purchase up to an additional 5 million shares of common stock at an exercise price of $3.00 per share payable in cash. The warrant had an expiration date of August 10, 2019 and was exercisable for a period of 6 months commencing on February 10, 2019. The shares of common stock (including the shares underlying the warrant) were subsequently registered for resale on Form S-3 (declared effective by the SEC on October 15, 2018, File No. 333-227731). Following approval of the board of directors and the Audit Committee, effective March 5, 2019 we entered into an amendment to the warrant that temporarily reduced the exercise price of such warrant from $3.00 per share to $2.90 per share through the close of business on March 8, 2019. On March 8, 2019, Cotterford partially exercised the warrant for 1,724,138 shares of our common stock at $2.90 per share resulting in the issuance of 1,724,138 shares of common stock for gross proceeds of $5 million. On May 3, 2019, Cotterford partially exercised the warrant for 1,666,667 shares of our common stock at $3.00 per share resulting in the issuance of 1,666,667 shares of common stock for gross proceeds of $5 million. On July 24, 2019, Cotterford exercised the remainder of its warrant and purchased 1,609,195 shares of our common stock at $3.00 per share resulting in the issuance of 1,609,195 shares of common stock for gross proceeds to the Company of approximately $4.8 million.

On July 1, 2019, we entered into a second amendment of a warrant agreement dated March 20, 2013, with Dr. Jason Terrell, our Chief Medical Officer, as previously amended February 14, 2017, pursuant to which the third and fourth vesting milestones of the original warrant were combined into one vesting milestone with respect to 125,000 shares of common stock that would be deemed achieved upon the execution of a third U.S. clinical trial agreement by the Company. The amended vesting milestone was achieved in February 2020.

17