DEF 14A: Definitive proxy statements

Published on April 28, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

| VOLITIONRX LIMITED |

| (Name of Registrant as Specified In Its Charter) |

|

|

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

|||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

|

|

|

|

||

| (2) | Aggregate number of securities to which transaction applies: |

|||

|

|

|

|

||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

|

|

|

|

||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

|

|

|

|

||

| ☐ | Fee paid previously with preliminary materials. |

|||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

| (1) | Amount Previously Paid: |

|||

|

|

|

|

||

| (2) | Form, Schedule or Registration Statement No.: |

|||

|

|

|

|

||

| (3) | Filing Party: |

|||

|

|

|

|

||

| (4) | Date Filed: |

|||

VOLITIONRX LIMITED

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Friday, June 23, 2023

To Our Stockholders:

Notice is hereby given that the 2023 Annual Meeting of Stockholders, or the Annual Meeting, of VolitionRx Limited, which we refer to as VolitionRx, the Company, we or us, will be held at 93-95 Gloucester Place, London, W1U 6JQ, United Kingdom, at 1:00 p.m. British Summer Time on Friday, June 23, 2023, for the following purposes:

|

| 1. | Election of Directors. To elect eight directors to serve until the next annual meeting of stockholders, and until such director’s successor is duly elected and qualified, or until his or her earlier death, resignation or removal; |

|

| 2. | Ratification of Selection of Independent Registered Public Accounting Firm. To ratify the selection of Sadler, Gibb & Associates, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2023; |

|

| 3. | Non-Binding Advisory Vote to Approve Named Executive Officer Compensation. To approve, by a non-binding advisory vote, the compensation of the Company’s named executive officers, as disclosed in the Compensation of Named Executive Officers section of this Proxy Statement; |

|

| 4. | Approval of Amendment to 2015 Stock Incentive Plan. To approve an amendment to the Company’s 2015 Stock Incentive Plan, as amended, or the 2015 Plan, to increase the number of shares of common stock that the Company has authority to grant under the 2015 Plan from 7,750,000 to 9,700,000; and |

|

| 5. | Other Business. To consider and act upon such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The Company’s board of directors unanimously recommends that you vote “FOR” the election of each of the director nominees named in Proposal 1, and “FOR” Proposals 2, 3, and 4.

The Company’s board of directors has fixed the close of business on April 24, 2023, as the Record Date for the determination of stockholders that are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. Only stockholders of record, and holders of shares in street name as represented by a bank or broker statement certifying the number of shares in their possession, as of the close of business on the Record Date are entitled to notice of and to vote at this Annual Meeting and any postponements or adjournments.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the Proxy Statement and submit your proxy and voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section entitled How to Vote in the Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

|

| By order of the Board of Directors |

|

|

|

|

|

|

|

|

| /s/ Cameron Reynolds |

|

|

|

| Cameron Reynolds President, Chief Executive Officer and Director |

|

Approximate Date of Mailing of Notice of

Internet Availability of Proxy Materials:

May 12, 2023

| 1 |

|

||

| 1 |

|

||

| 2 |

|

||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 5 |

|

|

| 7 |

|

||

| 11 |

|

||

| 11 |

|

||

| 11 |

|

||

|

| 11 |

|

|

| 13 |

|

||

| 13 |

|

||

| 13 |

|

||

| 13 |

|

||

| 13 |

|

||

| 13 |

|

||

| 15 |

|

||

| 15 |

|

||

| 16 |

|

||

| 16 |

|

||

| 17 |

|

||

| 17 |

|

||

| 18 |

|

||

| Policy on the Review, Approval or Ratification of Transactions with Related Persons | 18 |

|

|

| 19 |

|

||

| 20 |

|

||

| 20 |

|

||

| 22 |

|

||

| 23 |

|

||

| 23 |

|

||

| 23 |

|

||

| 25 |

|

||

| 25 |

|

||

|

| 26 |

|

|

| 28 |

|

||

| PROPOSAL 2 — RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 34 |

|

|

| PROPOSAL 3 — NON-BINDING ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | 36 |

|

|

| PROPOSAL 4 — APPROVAL OF AMENDMENT TO 2015 STOCK INCENTIVE PLAN | 37 |

|

|

| 43 |

|

||

| 43 |

|

||

| DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS FOR THE NEXT ANNUAL MEETING | 43 |

|

|

| 43 |

|

||

|

| 43 |

|

|

| 44 |

|

VOLITIONRX LIMITED

1489 West Warm Springs Road, Suite 110

Henderson, Nevada 89014

Telephone: +1 (646) 650-1351

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Friday, June 23, 2023

VolitionRx Limited has made this Proxy Statement, as well as the Notice of Annual Meeting of Stockholders and our Annual Report on Form 10-K for the year ended December 31, 2022, or collectively, the Proxy Materials, available to you on the Internet or, upon your request, in paper or e-mail form, in connection with the solicitation of proxies by the board of directors of VolitionRx Limited for the 2023 Annual Meeting of Stockholders, or the Annual Meeting, to be held on Friday, June 23, 2023, and any adjournment or postponements of the Annual Meeting. In addition to the Proxy Materials, proxies may be solicited personally or by telephone, mail, facsimile or other electronic means. Directors, officers and employees will not be paid any additional compensation for soliciting proxies, but Broadridge Financial Solutions, Inc. will be paid its customary fee of approximately $9,000, exclusive of printing and mailing fees, and Georgeson, LLC, a proxy solicitation firm, will be paid a fee of $10,000, plus disbursements. We will, upon request, also reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock. The cost of solicitation will be borne by the Company.

The Company is taking advantage of the rules of the Securities and Exchange Commission, or the SEC, that allow us to furnish our Proxy Materials over the Internet to our stockholders rather than in paper form. We believe that this delivery process will expedite our stockholders’ receipt of our Proxy Materials, reduce the environmental impact of the Annual Meeting and lower the costs of printing and distributing our Proxy Materials. Accordingly, you will receive a Notice of Internet Availability of Proxy Materials, or the Notice, which we expect to mail on or about May 12, 2023. You may request receipt of our Proxy Materials in paper or e-mail form by following the instructions on the Notice.

In this Proxy Statement, except as otherwise indicated by the context, references to “Company,” “VolitionRx,” “Volition,” “we,” “us,” and “our” are references to VolitionRx Limited and its wholly owned subsidiaries, Singapore Volition Pte. Limited, a Singapore-registered company, or Singapore Volition, Belgian Volition SRL, a Belgium-registered company, or Belgian Volition, Volition Diagnostics UK Limited, a company registered in the United Kingdom, or Volition Diagnostics, Volition Germany GmbH (formerly Octamer GmbH), a company with limited liability organized under the laws of Germany, or Volition Germany, Volition Global Services SRL, a Belgium-registered company, or Volition Global Services, and Volition America, Inc., a Delaware corporation, or Volition America, as well as majority-owned subsidiary Volition Veterinary Diagnostics Development LLC, a Texas limited liability company, or Volition Vet. Additionally, in this Proxy Statement we use the term “Share Exchange Agreement” to refer to the share exchange agreement with Singapore Volition and the former shareholders of Singapore Volition dated September 26, 2011, pursuant to which we acquired Singapore Volition through an exchange of shares with the former Singapore Volition shareholders effective October 6, 2011.

We are holding our Annual Meeting at 93-95 Gloucester Place, London, W1U 6JQ, United Kingdom, on Friday, June 23, 2023, at 1:00 p.m. British Summer Time. At our Annual Meeting, our stockholders will act upon the matters outlined herein. In addition, our management will report on our performance during the 2022 fiscal year and respond to questions from stockholders.

While the Company plans to take precautionary measures, including certain of those recommended by governmental authorities, such as “social distancing,” at this year’s Annual Meeting to protect the health and safety of attendees and prevent the spread of the COVID-19 virus, the Company will not be able to provide attendees, including stockholders, with personal protective equipment, such as face masks or gloves, and we encourage you to bring your own.

Attendance at the Annual Meeting will be limited to stockholders of the Company. Stockholders will be required to furnish valid identification and proof of ownership of the Company’s common stock before being admitted to the Annual Meeting. Stockholders holding shares in street name are requested to bring a statement from the bank, broker or other holder of record confirming their ownership in the Company’s common stock. For directions to the Annual Meeting, you may contact the Company’s Corporate Secretary, Rodney Rootsaert, by writing to VolitionRx’s principal executive offices at 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014, by email to investorrelations@volition.com, or by telephone at +1 (646) 650-1351.

| 1 |

| Table of Contents |

All shares represented by properly executed proxies received by the board of directors of VolitionRx Limited pursuant to this solicitation will be voted in accordance with the holder’s directions specified on the proxy. If no directions have been specified using the Internet voting site, toll-free number or by marking the appropriate places on a Proxy Card, the shares will be voted in accordance with the board of directors’ recommendations, which are:

|

| 1. | “FOR” the election of each of the following eight director nominees: Dr. Phillip Barnes, Dr. Alan Colman, Dr. Martin Faulkes, Dr. Edward Futcher, Mickie Henshall, Guy Innes, Kim Nguyen and Cameron Reynolds to serve until the next annual meeting of stockholders, and until such director’s successor is duly elected and qualified, or until his or her earlier death, resignation or removal; |

|

| 2. | “FOR” the ratification of the selection of Sadler, Gibb & Associates, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2023; |

|

| 3. | “FOR” the approval, by a non-binding advisory vote, of the compensation of our named executive officers, as disclosed in the Compensation of Named Executive Officers section of this Proxy Statement; and |

|

| 4. | “FOR” the approval of an amendment to the Company’s 2015 Stock Incentive Plan, as amended, or the 2015 Plan, to increase the number of shares of common stock that the Company has authority to grant under the 2015 Plan from 7,750,000 to 9,700,000. |

You may either vote “FOR” or “WITHHOLD” authority to vote for each director nominee. You can vote “FOR” or “AGAINST” (or “ABSTAIN” from voting on) any of the other Proposals. Your vote on any one of these Proposals will not affect your vote on any of the other Proposals.

When using Internet or telephone voting, the voting systems will verify that you are a stockholder through the use of a company number for VolitionRx and a 16-digit control number or QR code unique to you. If you vote by Internet or telephone, please do not also mail a Proxy Card.

If you plan to vote in person at the Annual Meeting, please bring valid identification. Even if you currently plan to attend the Annual Meeting, we recommend that you also submit your proxy so that your vote will be counted if you later decide not to attend the Annual Meeting.

Record Date

You may vote all shares that you owned as of April 24, 2023, which is the Record Date for the Annual Meeting. As of April 24, 2023, we had 63,144,130 shares of common stock issued and outstanding held of record by approximately 151 stockholders. Each share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting.

A complete list of the stockholders entitled to vote at the Annual Meeting will be open to examination by any stockholder for purposes germane to the meeting, during normal business hours for ten days prior to the date of the Annual Meeting at the Company’s offices at 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014. Please be aware that due to continuing health and safety concerns from the COVID-19 pandemic, at this point, we do not know if our offices will be open in advance of or during the Annual Meeting. If you wish to inspect the stockholder list, please contact the Company’s Corporate Secretary, Rodney Rootsaert, by writing to Corporate Secretary c/o VolitionRx Limited, 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014, or by telephone at +1 (646) 650-1351.

Ownership of Shares

If your shares are registered directly in your name, you are the holder of record of these shares, and we are sending the Notice or, if requested, paper or e-mail copies of the Proxy Materials directly to you. As the holder of record, you have the right to give your proxy directly to us or to vote in person at the Annual Meeting.

If you hold your shares in a brokerage account or through a bank or other holder of record, you hold the shares in “street name,” and your broker, bank or other holder of record is sending the Notice or Proxy Materials to you. As a holder in street name, you have the right to direct your broker, bank or other holder of record how to vote by filling out a voting instruction form that accompanies your Proxy Materials. Regardless of how you hold your shares, we invite you to attend the Annual Meeting.

If you receive more than one Notice or set of Proxy Materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions to ensure that all of your shares are voted.

| 2 |

| Table of Contents |

How to Vote

Your Vote Is Important. We encourage you to vote promptly. You may vote in any of the following ways:

By Internet – www.proxyvote.com: Use the Internet to submit your proxy by going to www.proxyvote.com and following the instructions on how to complete an electronic proxy card up until 11:59 p.m. Eastern Time on Thursday, June 22, 2023, the day before the Annual Meeting. You will need the 16-digit control number or QR code included on your Notice or your Proxy Card in order to vote by Internet.

By Telephone – 1-800-690-6903: Use any touch-tone telephone to submit your proxy by dialing 1-800-690-6903 up until 11:59 p.m. Eastern Time on Thursday, June 22, 2023, the day before the Annual Meeting. You will need the 16-digit control number included on your Notice or your Proxy Card in order to vote by telephone.

By Mail: You may request a paper copy of the Proxy Materials from us by following the instructions on your Notice. When you receive the Proxy Card, mark your selections on the Proxy Card, date and sign your name exactly as it appears on your Proxy Card and mail it in the postage-paid envelope that will be provided to you. Return your Proxy Card by 11:59 p.m. Eastern Time on Thursday, June 22, 2023.

At the Annual Meeting: If you vote your shares now it will not limit your right to change your vote at the Annual Meeting if you attend in person. If you hold your shares in street name, you must obtain a proxy, executed in your favor, from your bank, broker or other holder of record, if you wish to vote your shares at the Annual Meeting.

All shares that have been properly voted and not revoked will be voted at the meeting. If you vote using the Internet voting site or the toll-free number, or by signing and returning a Proxy Card in each case without any voting instructions, your shares will be voted as the board of directors recommends.

Revocation of Proxies

You can revoke your proxy (or voting instructions if you hold your shares in street name) at any time before your shares are voted at the Annual Meeting if you: (1) send a written notice by mail to our Corporate Secretary indicating that you want to revoke your proxy by writing to VolitionRx Limited, 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014, Attention: Rodney Rootsaert, Corporate Secretary, which notice is received prior to the Annual Meeting; (2) vote after delivery of your proxy and before the Annual Meeting by using the Internet voting site or toll-free number or deliver to our Corporate Secretary a duly executed Proxy Card bearing a later date, which revokes all previous proxies; or (3) attend the Annual Meeting in person and, at the meeting, give written notice of revocation of your proxy to the Corporate Secretary of the Annual Meeting prior to the voting of your proxy and vote your shares in person, although your attendance at the meeting will not by itself revoke your proxy.

Quorum and Required Vote

Quorum

We will have a quorum and will be able to conduct the business of the Annual Meeting if the holders of a majority of the outstanding shares of the Company’s common stock entitled to vote are present at the meeting, either in person or by proxy. In determining whether we have a quorum, we count abstentions and broker non-votes as present and entitled to vote.

Vote Required for Proposals

|

| 1. | Election of Directors (Proposal 1). Directors are elected by a plurality of the voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter, meaning the eight nominees receiving the highest number of affirmative “FOR” votes will be elected to the board of directors. A properly executed proxy marked “WITHHOLD ALL” or “FOR ALL EXCEPT” with respect to the election of directors will not be voted with respect to the director or directors indicated. The election of directors is a non-routine matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the election of directors, your broker is not permitted to vote your uninstructed shares on this Proposal and your votes will be counted as broker non-votes. Withheld votes, abstentions and broker non-votes, if any, will have no effect in determining which directors are elected at the Annual Meeting. |

|

| 2. | Ratification of Selection of Independent Registered Public Accounting Firm (Proposal 2). The ratification of the selection of Sadler, Gibb & Associates, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2023 requires the affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. A properly executed proxy marked “ABSTAIN” with respect to such matter will not be voted. Accordingly, an abstention will have the same effect as a vote “AGAINST” this Proposal. The ratification of the selection of Sadler, Gibb & Associates, LLC is a routine matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the ratification of the selection of Sadler, Gibb & Associates, LLC, your broker may use its discretion to vote your uninstructed shares on this Proposal. Accordingly, broker non-votes are not expected for this Proposal. |

| 3 |

| Table of Contents |

|

| 3. | Non-Binding Advisory Vote, to Approve Named Executive Officer Compensation (Proposal 3). The approval, by a non-binding advisory vote, of the compensation of our named executive officers, as disclosed in the Compensation of Named Executive Officers section of this Proxy Statement, requires the affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. A properly executed proxy marked “ABSTAIN” with respect to such matter will not be voted. Accordingly, an abstention will have the same effect as a vote “AGAINST” this Proposal. The advisory vote on compensation is a non-routine matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the advisory vote on compensation, your broker is not permitted to vote your uninstructed shares on this Proposal and your votes will be counted as broker non-votes. Broker non-votes, if any, will have no effect on the outcome of this Proposal. |

|

| 4. | Approval of Amendment to 2015 Stock Incentive Plan (Proposal 4). The approval of the amendment to the 2015 Plan requires the affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. A properly executed proxy marked “ABSTAIN” with respect to such matter will not be voted. Accordingly, an abstention will have the same effect as a vote “AGAINST” this Proposal. The approval of the amendment to the 2015 Plan is a non-routine matter under applicable stock exchange rules, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the approval of the amendment to the 2015 Plan, your broker is not permitted to vote your uninstructed shares on this Proposal and your votes will be counted as broker non-votes. Broker non-votes, if any, will have no effect on the outcome of this Proposal. |

Dissenters’ Rights

Under Delaware law, stockholders are not entitled to dissenters’ rights of appraisal on any Proposal referred to herein.

Cumulative Voting

Stockholders shall not be entitled to cumulate votes with respect to voting on the election of directors or any other Proposal referred to herein.

Voting Results

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a current report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

| 4 |

| Table of Contents |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of April 24, 2023, by: (i) each of our directors; (ii) each of our named executive officers; (iii) all of our directors and executive officers as a group; and (iv) each person or group known by us to beneficially own more than 5% of our outstanding shares of common stock.

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under the rules of the SEC, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which the person has a right to acquire beneficial ownership within 60 days. Under these rules more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

Unless otherwise indicated below, to the best of our knowledge (i) each beneficial owner named in the table has the sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable, and (ii) the address of such beneficial owner is 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014.

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Ownership (#) |

|

| Percent of Class(1) (%) |

|

||

| Directors and Named Executive Officers: |

|

|

|

|

|

|

||

| Dr. Phillip Barnes(2) |

|

| 21,661 |

|

| * |

|

|

| Richard Brudnick(3) |

|

| 21,661 |

|

| * |

|

|

| Dr. Alan Colman(4) |

|

| 301,242 |

|

| * |

|

|

| Dr. Martin Faulkes(5) |

|

| 2,321,410 |

|

|

| 3.7 | % |

| Dr. Edward Futcher(6) |

|

| 455,911 |

|

| * |

|

|

| Mickie Henshall(7) |

| -0- |

|

| * |

|

||

| Terig Hughes(8) |

|

| 228,694 |

|

| * |

|

|

| Guy Innes(9) |

|

| 2,673,150 |

|

|

| 4.2 | % |

| Dr. Gaetan Michel(10) |

|

| 52,773 |

|

| * |

|

|

| Kim Nguyen(11) |

|

| 54,717 |

|

| * |

|

|

| Cameron Reynolds(12) |

|

| 2,748,233 |

|

|

| 4.3 | % |

| All Executive Officers and Directors as a Group (18 Persons)(13) |

|

| 10,213,856 |

|

|

| 15.4 | % |

|

|

|

|

|

|

|

|

|

|

| More Than 5% Stockholders: |

|

|

|

|

|

|

|

|

| Eight Corporation Limited(14) c/o Crowe Morgan 8 St. George’s Street Douglas, Isle of Man IM1 1AH |

|

| 11,976,263 |

|

|

| 19.0 | % |

| Lagoda Investment Management, L.P. (15) 3 Columbus Circle New York, New York |

|

| 3,755,045 |

|

|

| 5.9 | % |

| * | Represents ownership of less than 1.0% |

| 5 |

| Table of Contents |

| (1) | For purposes of the table, the percent of class is based upon 63,144,130 shares of our common stock issued and outstanding as of April 24, 2023. Shares of common stock subject to stock options or warrants currently exercisable, or exercisable within 60 days of April 24, 2023, and restricted stock units which may be settled within 60 days of April 24, 2023, are deemed beneficially owned and outstanding for computing the percentage ownership of the person or entity holding such securities, but are not considered outstanding for computing the percentage ownership of any other person or entity. |

| (2) | Dr. Barnes’ beneficial ownership includes direct ownership of (i) 2,343 shares of common stock and (ii) options to purchase 19,318 shares of common stock that are exercisable within 60 days. |

|

|

|

| (3) | Mr. Brudnick’s beneficial ownership includes direct ownership of (i) 17,343 shares of common stock and (ii) options to purchase 4,318 shares of common stock that are exercisable within 60 days. Mr. Brudnick will not be standing for re-election to our board of directors at the Annual Meeting. |

| (4) | Dr. Colman’s beneficial ownership includes direct ownership of (i) 159,765 shares of common stock and (ii) options to purchase 141,477 shares of common stock that are exercisable within 60 days. |

| (5) | Dr. Faulkes’ beneficial ownership includes direct ownership of (i) 1,568,181 shares of common stock and (ii) options to purchase 397,229 shares of common stock that are exercisable within 60 days. Dr. Faulkes’ beneficial ownership also includes indirect ownership of 356,000 shares of common stock held directly by The Dill Faulkes Educational Trust Limited, or DFET. Dr. Faulkes serves as the chairman, director and trustee of DFET and shares voting and dispositive control over such shares. On December 8, 2015, Dr. Faulkes pledged 12,500 shares to secure a loan. |

| (6) | Dr. Futcher’s beneficial ownership includes direct ownership of (i) 40,593 shares of common stock and (ii) options to purchase 59,318 shares of common stock that are exercisable within 60 days. Dr. Futcher’s beneficial ownership also includes indirect ownership of 356,000 shares of common stock held directly by DFET. Dr. Futcher serves as a director and a trustee of DFET and shares voting and dispositive control over such shares. |

| (7) | Ms. Henshall does not beneficially own any shares of common stock or any options, warrants or restricted stock units that may be exercised or settled within 60 days. |

| (8) | Mr. Hughes’ beneficial ownership includes direct ownership of (i) 15,370 shares of common stock and (ii) options to purchase 28,324 shares of common stock that are exercisable within 60 days and (iii) warrants to purchase 185,000 shares of common stock that are exercisable within 60 days. |

| (9) | Mr. Innes’ beneficial ownership includes direct ownership of (i) 1,559,818 shares of common stock and (ii) options to purchase 139,318 shares of common stock that are exercisable within 60 days. Mr. Innes’ beneficial ownership also includes indirect ownership of (x) 618,014 shares of common stock held directly by Mr. Innes’ children, and (y) 356,000 shares of common stock held directly by DFET. Mr. Innes serves as a director and a trustee of DFET and shares voting and dispositive control over such shares. |

|

|

|

| (10) | Dr. Michel’s beneficial ownership includes direct ownership of (i) 14,093 shares of common stock and (ii) options to purchase 38,680 shares of common stock that are exercisable within 60 days. |

| (11) | Ms. Nguyen’s beneficial ownership includes direct ownership of (i) 19,843 shares of common stock and (ii) options to purchase 4,318 shares of common stock that are exercisable within 60 days. Ms. Nguyen’s beneficial ownership also includes indirect ownership of 30,556 shares of common stock held directly by Ms. Nguyen’s spouse. |

| (12) | Mr. Reynolds’ beneficial ownership includes direct ownership of (i) 1,170,696 shares of common stock and (ii) options to purchase 535,743 shares of common stock that are exercisable within 60 days. Mr. Reynolds’ beneficial ownership also includes indirect ownership of (x) 34,076 shares of common stock held directly by Mr. Reynolds’ spouse and (y) 1,007,718 shares of common stock held directly by Concord International, Inc., of which Mr. Reynolds is the majority stockholder and shares voting and dispositive control over such shares. |

| (13) | The number of executive officers and directors as a group includes 2 executive officers of the Company’s subsidiaries. The amount beneficially owned by the executive officers and directors as a group consists of an aggregate of (i) 7,142,482 shares of common stock, (ii) options to purchase 2,711,374 shares of common stock that are exercisable within 60 days, (iii) restricted stock units for 50,000 shares of common stock that may be settled within 60 days, and (iii) warrants to purchase 310,000 shares of common stock that are exercisable within 60 days. |

| (14) | Based on the information contained in Amendment No. 5 to the Schedule 13D filed with the SEC on July 9, 2020 Eight Corporation Limited, or Eight, which is a director of Cotterford Company Limited, or Cotterford, beneficially owns 11,976,263 shares of common stock, including those held by Cotterford. Each of Amy Slee, James Bartholomew McCarney and David John Morgan are directors of Eight and hold dispositive and voting control over the shares of common stock beneficially owned by Cotterford. |

| (15) | Based on the information contained in Amendment No. 2 to the Schedule 13G filed with the SEC on February 14, 2023, Lagoda Investment Management, L.P. serves as the investment manager to certain managed accounts, and Fatima Dickey, as the sole member of Lagoda Investment Management, LLC, the General Partner of Lagoda Investment Management, L.P., possesses sole voting and dispositive power over such shares. |

Changes in Control

We are not aware of any arrangements that have resulted, or may at a subsequent date result, in a change in control of the Company.

| 6 |

| Table of Contents |

DIRECTORS AND EXECUTIVE OFFICERS

Identification of Directors and Executive Officers

The following table sets forth the names and ages of the Company’s directors and executive officers as of the Record Date, except as otherwise noted:

| Name | Age | Position(s) with the Company | Officer/Director Since |

|||

| Cameron Reynolds | 52 | President Chief Executive Officer Director | October 6, 2011 October 6, 2011 October 6, 2011 |

|||

| Terig Hughes | 53 | Chief Financial Officer Treasurer | February 1, 2021 February 1, 2021 |

|||

| Dr. Gaetan Michel | 50 | Chief Operating Officer | February 1, 2021 |

|||

| Dr. Jacob Micallef | 66 | Chief Scientific Officer | January 1, 2015 |

|||

| Gael Forterre | 42 | Chief Commercial Officer | February 1, 2021 |

|||

| Nicholas Plummer | 52 | Group General Counsel | November 1, 2021 |

|||

| Louise Batchelor |

| 52 |

| Group Chief Marketing & Communications Officer |

| September 12, 2022 |

| Rodney Rootsaert |

| 51 |

| Corporate Secretary |

| October 6, 2011 |

| Dr. Salvatore Thomas Butera | 72 | Chief Executive Officer, Volition Vet | May 1, 2021 |

|||

| Dr. Jasmine Kway | 51 | Chief Executive Officer, Singapore Volition | June 1, 2018 |

|||

| Dr. Martin Faulkes | 79 | Executive Chairman Director | October 6, 2011 October 6, 2011 |

|||

| Dr. Phillip Barnes(1)(2) | 61 | Director | October 9, 2019 |

|||

| Richard Brudnick(1)(2)(4) | 66 | Director | March 25, 2021 |

|||

| Dr. Alan Colman(1) | 74 | Director | October 6, 2011 |

|||

| Dr. Edward Futcher(1)(3) | 68 | Director | June 23, 2016 |

|||

| Mickie Henshall(2)(3) | 51 | Director | August 15, 2022 |

|||

| Guy Innes(1)(3) | 66 | Director | October 6, 2011 |

|||

| Kim Nguyen(2)(3) | 46 | Director | March 25, 2021 |

|

| (1) | Member of the Audit Committee |

|

|

|

|

|

| (2) | Member of the Compensation Committee |

|

|

|

|

|

| (3) | Member of the Nominations and Governance Committee |

|

|

|

|

|

| (4) | Mr. Brudnick, a director who currently serves as a member of our Audit and Compensation Committees, is not standing for re-election at our Annual Meeting. |

| 7 |

| Table of Contents |

The background and business experience during the past five years of the persons listed above, other than Mr. Brudnick who is not standing for re-election, are as follows:

CAMERON REYNOLDS serves as our President and Chief Executive Officer and is a director of the Company. Information regarding Mr. Reynolds is provided under Proposal 1 – Election of Directors of this Proxy Statement.

TERIG HUGHES serves as our Chief Financial Officer and Treasurer. He has also served as Chief Financial Officer and Treasurer of both Volition America since December 1, 2022, and of Volition Vet since March 17, 2023, as well as a Director of Volition Global Services since September 2, 2021. Between September 1, 2021 and August 8, 2022, Mr. Hughes served as a Director of Singapore Volition. Mr. Hughes joined the Company from AUM Biosciences Pte. Ltd., a fast-growing biotechnology company focused on developing novel drugs for cancer treatment, where he was the Chief Financial Officer based in Singapore, and oversaw all aspects of business and finance, from initial start-up in 2018 through to first revenue in 2020. Prior to 2018, Mr. Hughes held a number of senior finance and business leadership positions at Elsevier, a division of RELX Group plc (formerly Reed Elsevier), an FTSE 100 company. From 2014 to 2017, Mr. Hughes was the regional Managing Director of RELX Group plc for India and Southeast Asia, overseeing all aspects of the business including sales, marketing, and product development. From 2006 to 2014, he served as the company’s Finance Director for Asia Pacific, during which he managed and oversaw accounting and finance functions, including financial planning and analysis. During this period, he also oversaw a successful finance transformation project, which included systems implementation, transition to a shared-services model, and outsourcing of various work streams, as well as a number of mergers and acquisitions projects in China. From 2003 to 2006, Mr. Hughes was the Vice President Finance of Elsevier’s US Journals and Pharma Communications Division where he provided commercial support to senior management, oversaw implementation of internal control standards as required by the Sarbanes-Oxley Act of 2002, and managed the annual pricing process. Mr. Hughes has over 25 years of accounting, finance and business management experience gained through an international career spanning the United States, Europe and Asia. Mr. Hughes received a B.A. in Accounting and Law from De Montfort University, Leicester in the United Kingdom.

DR. GAETAN MICHEL serves as our Chief Operating Officer. In addition, Dr. Michel has served as Director and Chief Executive Officer of Volition America since November 16, 2021, as Chief Executive Officer and Manager of Volition Global Services since September 15, 2021 and September 1, 2021, respectively, as Manager and President of Volition Veterinary since August 7, 2019, and May 1, 2021, respectively, and as Chief Executive Officer and Manager of Belgian Volition since November 15, 2022. In addition, from June 22, 2015 to November 4, 2021, Dr. Michel served as Manager of Belgian Volition, from July 1, 2015 to September 14, 2021 as Chief Executive Officer of Belgian Volition, from August 14, 2020 to May 1, 2021 as Chief Executive Officer of Volition Veterinary, and from January 10, 2020 to October 23, 2020, as a Managing Director of Volition Germany. Dr. Michel also previously served as Belgian Volition’s Chief Operations Officer from July 2014 to June 2018. Dr. Michel has over ten years’ experience in production management. Prior to joining Belgian Volition, from 2010 to 2014 Dr. Michel worked as production director for Bone Therapeutics SA (Euronext Brussels and Paris: BOTHE), a bone cell therapy-based pharmaceutical company, where his responsibilities included establishing two new production plants to commence manufacturing for two phase III clinical trials, developing quality systems for new products in negotiation with the Belgian health authorities, and establishing a product plant for an injectable medical device. From 2007 to 2010, Dr. Michel worked for KitoZyme, a global manufacturer of biopolymers of fungal origin with its core business in weight management, digestive and cardiovascular health. During this period, Dr. Michel established both the production and process development departments and oversaw the commencement of the company’s industrial phase culminating in the roll out of first products. Prior to joining KitoZyme, following the completion of his Ph.D. in 2002, Dr. Michel joined Advanced Array Technologies, or AAT, a University of Namur spin-off company as project manager in proteomics. AAT later became Eppendorf Array Technologies, part of the German Eppendorf biotech company, where Dr. Michel became production manager and was involved in establishing production processes and equipment. Dr. Michel received a Ph.D. in Biochemistry from the University of Namur, Belgium.

DR. JACOB MICALLEF serves as our Chief Scientific Officer. Dr. Micallef previously served as a Director of Belgian Volition between August 10, 2011 and March 31, 2016. Prior to the Share Exchange Agreement, he served as Chief Scientific Officer of Belgian Volition from October 11, 2010 to December 31, 2014, but was not otherwise involved with Singapore Volition. Dr. Micallef joined Cronos Therapeutics Limited, or Cronos, a company developing oncology drugs, in 2004 and, in 2006, Cronos was listed in the United Kingdom on the Alternative Investment Market, or AIM, becoming Valirx plc, or Valirx (AIM:VAL). Dr. Micallef continued to work as Technical Officer for Valirx, where he in-licensed the NucleosomicsTM technology and co-founded ValiBio SA, which is now Belgian Volition. From 2004 to 2007, he taught “science and enterprise” to science research workers from four universities at CASS Business School before joining Cronos. In 2001, Dr. Micallef co-founded Gene Expression Technologies, a company developing oncology drugs, where he successfully led the development of the chemistry of the GeneICE technology and implemented the manufacture of GeneICE molecules. He also played a major role in business development and procured a GeneICE contract with Bayer AG. Over a 15-year period, starting in 1985, Dr. Micallef worked for the World Health Organization, or WHO. While working for WHO, Dr. Micallef developed new diagnostic products in the areas of reproductive health and cancer. In 1990, he commenced development of a new diagnostic technology platform for WHO which was launched in 1992 and supported 13 tests. Dr. Micallef also initiated and implemented in-house manufacture, previously outsourced to Abbott Diagnostics Inc., and world-wide distribution of these products for WHO. Also, in 1990, he started a “not-for-profit” WHO company, Immunometrics Ltd., which marketed and distributed those diagnostic products worldwide. Dr. Micallef has over 20 years of experience in research and development and in the management of early-stage biotechnical companies, including the manufacture of biotechnology products and the establishment of manufacturing operations. Dr. Micallef received his M.B.A. from Imperial College, University of London and his Ph.D. from King’s College, University of London.

| 8 |

| Table of Contents |

GAEL FORTERRE serves as our Chief Commercial Officer. He has almost twenty years of experience investing in and scaling fast growing companies. Since October 2013, Mr. Forterre has served as the Managing Partner of Armori Capital Management, LLC, or Armori, as investment advisory firm. Mr. Forterre launched Armori in October 2013, for which he conducted a series of investments on behalf of family offices and institutional investors, and actively supported the growth of its portfolio companies. Since December 2021, Mr. Forterre has also served as a non-executive director for Integrated Wellness Acquisition Corp., a special purpose acquisition company. Mr. Forterre served as the Chief Executive Officer of Ucroo Incorporated, or Ucroo (now Pathify Holdings, Inc.), a SaaS EdTech company, between January 2019 and December 2020, during which period he supervised the launch of its product suite and tripled sales two years in a row; he also served as its Chief Financial Officer between January 2018 and December 2018 and acted as its consultant from August 2017 to December 2017. Mr. Forterre also served as a board member of Ucroo between August 2019 and March 2021, and as a board member of ARTICLE22, a designed-focused social enterprise that he co-founded in 2013, from July 2013 to June 2021. Between 2005 and 2012, Mr. Forterre worked in various positions including as a structurer, an analyst and a trader for BNP Paribas in the corporate and investment banking division, in both New York and Paris, where he was selected to join the top talent program. Mr. Forterre received an M.S. in finance from Sorbonne Paris I and a double M.B.A. from both Columbia Business School and the London Business School.

NICHOLAS PLUMMER serves as our Group General Counsel. Mr. Plummer is a solicitor qualified in England. From 1995 to 2004, Mr. Plummer worked at the United Kingdom and international law firm Ashurst as a corporate lawyer, before moving into his first in-house role as General Counsel and Company Secretary of Ark Therapeutics Group PLC, a UK-listed biotech company, from 2004 to 2008. From 2013 to 2021, Mr. Plummer served as the EU Managing Counsel at Patheon, subsequently Pharma Services Group of Thermo Fisher Scientific, a contract drug developer and manufacturer. Mr. Plummer has over twenty-five years of legal experience in private practice and in-house roles, primarily in the healthcare sector. Mr. Plummer holds a LL.B. law degree (Hons) from Reading University and was admitted as a Solicitor to the Supreme Court of England and Wales in 1997.

LOUISE BATCHELOR serves as our Group Chief Marketing and Communications Officer. Ms. Batchelor joined the Company in April 2016 from ACULD Limited, a strategic marketing consultancy specializing in healthcare where she served as director and owner since August 2011. From April 2006 to January 2009, Ms. Batchelor was the global brand marketing manager for Reckitt Benckiser Plc, a British, multinational consumer goods company, where she led the development of the global brand for the Lysol® germ protection range. From 2001 to 2009, Ms. Batchelor also served as the European business unit director for Reckitt Benckiser, based in Paris, France, where she was responsible for general management of the European business and led the European regulatory strategy and launch of multiple products. Prior to joining Reckitt Benckiser, Ms. Batchelor was a product manager, marketing executive, primary care field sales manager and a senior market research executive at Zeneca Pharmaceuticals Ltd in the United Kingdom, from August 1993 to October 2000. Ms. Batchelor has thirty years of global marketing, sales and leadership experience gained through an international career spanning the United States, Europe and the United Kingdom. Ms. Batchelor received a B.A. in business studies from Sheffield Hallam University.

RODNEY ROOTSAERT serves as our Corporate Secretary. Prior to the completion of the transactions under the Share Exchange Agreement, he was the Administration and Legal Officer of Singapore Volition, a position he held since August 6, 2010. Mr. Rootsaert became a Director of Singapore Volition on December 15, 2015. He has been a Director and Secretary of Belgian Volition since October 4, 2010, a Director of Volition Diagnostics since November 13, 2015, Secretary of Volition Vet since August 7, 2019, and Secretary of Volition America since November 16, 2021. Between August 7, 2019 and March 17, 2023, Mr. Rootsaert served as Treasurer of Volition Vet. Mr. Rootsaert served as director and corporate secretary of Mining House Ltd., a company providing consultancy and office support services, between 2007 and 2018. His responsibilities included ensuring compliance with all relevant statutory and regulatory requirements. From 2007 until 2011, Mr. Rootsaert served as corporate secretary for Magellan Copper and Gold Plc., a mineral exploration company, where his duties included maintaining and preparing company documents, accounts and contracts. Mr. Rootsaert has over 15 years of experience in providing corporate, legal and administrative services. Mr. Rootsaert holds an LL.B. degree from the University of Western Australia.

| 9 |

| Table of Contents |

DR. SALVATORE THOMAS BUTERA serves as the Chief Executive Officer of Volition Veterinary. Dr. Butera previously served as a Director of the Company between December 1, 2020 and March 25, 2021, before resigning in order to prepare to assume the role of Chief Executive Officer of Volition Veterinary, effective May 1, 2021. Between 2016 and April 2021, Dr. Butera served as Business Development Director at Veterinary Centers of America, or VCA, which is in the practice and business of veterinary medicine, part of Mars Veterinary Health, or Mars, and was actively involved in business development roles with Mars, leading divisions such as Pet Partners, LLC, or PPL, Banfield Pet Hospitals and VCA, and serving as Co-Founder, Board Member and Chief Medical Officer of PPL prior to its acquisition by Mars. Dr. Butera received his B.A. from Fairfield University and his D.V.M. from the University of Missouri Veterinary School.

DR. JASMINE KWAY serves as the Chief Executive Officer of Singapore Volition. Dr. Kway previously served as Singapore Volition’s Vice President of Asia from January 2017 until June 2018. Prior to joining Singapore Volition, during 2016 Dr. Kway served as Chief Executive Officer of intellectual property practice at RHT i-Assets Advisory, or RHTiAA, one of the leading companies of the RHT Group of Companies and RHT Holdings, a Singapore-headquartered integrated leading professional services company providing professional services in Asia. While at RHTiAA, Dr. Kway was focused on managing buy-side and sell-side clients globally in technology and intellectual property transactions, business development, and fund raising. Prior to RHTiAA, Dr. Kway worked in both the private and public sectors, including as Executive Vice President, Business Development at Transpacific IP Group Limited, a full-service intellectual property company, from 2010 to 2015, and as Director of Industry Liaison of the National University of Singapore from 2005 to 2010. In these positions, Dr. Kway formulated and implemented national intellectual property policies, corporate intellectual property strategies and management, intellectual property and technology development, commercialization, fundraising, and investment. Dr. Kway received her Bachelor of Engineering (Honors) and Doctorate degrees from the National University of Singapore.

DR. MARTIN FAULKES serves as our Executive Chairman of the board of directors. Information regarding Dr. Faulkes is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

DR. PHILLIP BARNES serves as a director. Information regarding Dr. Barnes is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

DR. ALAN COLMAN serves as a director. Information regarding Dr. Colman is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

DR. EDWARD FUTCHER serves as a director. Information regarding Dr. Futcher is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

MICKIE HENSHALL serves as a director. Information regarding Ms. Henshall is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

GUY INNES serves as a director. Information regarding Mr. Innes is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

KIM NGUYEN serves as a director. Information regarding Ms. Nguyen is provided under the Proposal 1 – Election of Directors section of this Proxy Statement.

| 10 |

| Table of Contents |

CORPORATE GOVERNANCE OF THE COMPANY

Our business is managed by the Company’s board of directors. Our board members are informed of our business through discussions with management, materials provided to them, visits to the Company’s offices and facilities, and their participation in meetings of the board of directors.

Corporate Governance Practices and Policies

Our board of directors has been carefully following the corporate governance developments that have been taking place as a result of the adoption of the Sarbanes-Oxley Act of 2002, the rules promulgated thereunder by the SEC, and other corporate governance recommendations. Our board of directors addresses, among other things, the board of directors’ composition, qualifications and responsibilities, director education and stockholder communication with directors.

For purposes of determining director independence, the board of directors reviews a summary of the relationships of each director, including any of his or her family members or related parties, with the Company or management and other facts relevant to the analysis of whether the directors qualify as “independent directors” under the NYSE American Company Guide §803(A)(2). No director qualifies as independent unless the board of directors affirmatively determines that the director does not have a relationship that would interfere with the exercise of his or her independent judgment in carrying out his or her responsibilities as a director. In addition, the NYSE American Company Guide provides a non-exclusive list of persons who may not be considered independent.

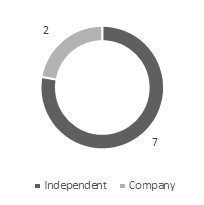

The board of directors has affirmatively determined that each of Drs. Barnes, Colman and Futcher, Mss. Henshall and Nguyen, and Messrs. Brudnick and Innes, is an independent director under the NYSE American Company Guide. In addition, the members of the Audit Committee are independent directors pursuant to the heightened independence criteria for members of Audit Committees set forth in the applicable SEC rules.

Our independent directors meet as often as is necessary to fulfill their responsibilities but at least annually in executive session without management or non-independent directors in accordance with the requirements of NYSE American Company Guide §802(c).

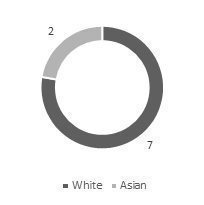

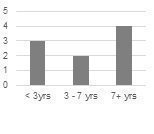

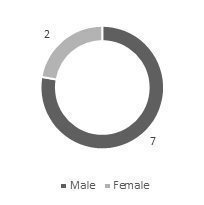

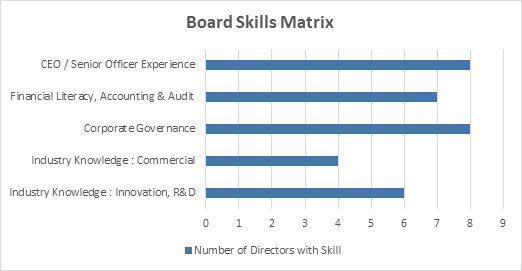

Board Composition and Attributes

Our Nominations and Governance Committee continually assesses the board of directors and the skill sets, experiences and characteristics represented by the directors to ensure alignment with the Company’s strategic objectives and evolving needs and expectations. The board of directors believes that its membership should reflect a diversity of industries, experience, gender, race, ethnicity and age to help ensure that it serves the long-term interests of stockholders and promotes the best interests of the Company. Additionally, the Nominations and Governance Committee is committed to considering the candidacy of women and racially and ethnically diverse candidates for future vacancies on the Board. The below skills matrix and diversity matrix represents the current members of the board of directors. These matrices are re-assessed regularly and evolves with the needs of the organization.

| 11 |

| Table of Contents |

| Board Diversity Matrix |

| Ethnic Diversity |

| Well-Balanced Mix of Tenures |

| Independence |

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

| Gender Diversity |

| Director’s Age – Average |

| Active Board Refreshment |

||

|

|

|

|

|

|

Over the last 5 years, 4 new directors have joined the board. |

|

|

| 40-54 | 55-70 | 71+ |

|

||

|

| 3 directors | 4 directors | 2 directors |

|

||

|

| 33.3% | 44.5% | 22.2% |

|

||

| 12 |

| Table of Contents |

Term of Office for Directors and Officers

Each director serves until the next annual meeting of stockholders and until such director’s successor is duly elected and qualified, or until his or her earlier death, resignation or removal. Each officer serves for such term as determined by the board of directors.

None of the executive officers or directors of our Company, or any nominees therefor, are related to each other.

Certain Arrangements and Understandings

There are no arrangements or understandings between any director, executive officer or director nominee and any other person pursuant to which any person was nominated as a director or selected as an executive officer.

Involvement in Certain Legal Proceedings

During the past ten years no director, executive officer or director nominee of VolitionRx has been involved in any legal proceedings required to be disclosed pursuant to Item 401(f) of Regulation S-K. Additionally, no director, executive officer or director nominee of VolitionRx is party to, or has any material interests in, any material legal proceedings that are adverse to the Company or its subsidiaries.

Board and Committee Meetings; Annual Meeting Attendance

During the fiscal year ended December 31, 2022: the board of directors held four regularly scheduled meetings and acted by written consent six times; the Audit Committee held four regularly scheduled meetings and acted by written consent six times; the Compensation Committee held two regularly scheduled meeting and acted by written consent 14 times; and the Nominations and Governance Committee held one regularly scheduled meeting and acted by written consent three times. During the fiscal year ended December 31, 2022, all directors attended, in person or by telephone, at least 75% of the total number of meetings of both our board of directors and the committees of our board of directors on which such director served, during their respective periods of service.

The Company does not have a policy with regard to the attendance of the members of the board of directors at annual meetings of stockholders, however, directors are strongly encouraged to attend the annual meetings of stockholders whether in person or by telephone. Five of the eight directors then serving on the board of directors attended the 2022 Annual Meeting of Stockholders, either in person or by telephone.

Committees of the Board of Directors

Our board of directors has established an Audit Committee, a Compensation Committee and a Nominations and Governance Committee. The Committees operate pursuant to written charters adopted by the board of directors, copies of which are available on our website at https://ir.volition.com/committee-charters. However, the reference to our website in this Proxy Statement does not constitute incorporation by reference of the information contained on or available through our website, and you should not consider it to be a part of this Proxy Statement. In addition, from time to time, our board of directors may establish special committees when necessary to address specific issues. The composition and functions of each of our Audit, Compensation and Nominations and Governance Committees are described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our Audit Committee currently consists of five members, Messrs. Innes (Chair) and Brudnick, and Drs. Barnes, Colman and Futcher, each of whom has been determined to be an independent director under applicable SEC rules and the NYSE American Company Guide. Following the Annual Meeting, assuming the election of the director nominees set forth in Proposal 1 – Election of Directors of this Proxy Statement, our Audit Committee shall consist of four members, Mr. Innes (Chair), and Drs. Barnes, Colman and Futcher. The Audit Committee shall at all times be composed exclusively of directors who are, in the opinion of our board of directors, free from any relationship which would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

| 13 |

| Table of Contents |

The Audit Committee is responsible for, among other things:

|

| · | appointing, terminating, compensating and overseeing the work of any independent auditor engaged to prepare or issue an audit report or other audit, review or attest services; |

|

|

|

|

|

| · | reviewing all audit and non-audit services to be performed by the independent auditor, taking into consideration whether the independent auditor’s provision of non-audit services to us is compatible with maintaining the independent auditor’s independence; |

|

|

|

|

|

| · | reviewing and discussing the adequacy and effectiveness of our accounting and financial reporting processes and internal controls and the audits of our financial statements; |

|

|

|

|

|

| · | establishing and overseeing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, including procedures for the confidential, anonymous submission by our employees regarding questionable accounting or auditing matters; |

|

|

|

|

|

| · | investigating any matter brought to its attention within the scope of its duties and engaging independent counsel and other advisors as the Audit Committee deems necessary; |

|

|

|

|

|

| · | determining compensation of the independent auditors and of advisors hired by the Audit Committee and ordinary administrative expenses; |

|

|

|

|

|

| · | reviewing and discussing with management and the independent auditor the annual and quarterly financial statements prior to their release; |

|

|

|

|

|

| · | monitoring and evaluating the independent auditor’s qualifications, performance and independence on an ongoing basis; |

|

|

|

|

|

| · | reviewing reports to management prepared by the internal audit function, as well as management’s response; |

|

|

|

|

|

| · | reviewing and assessing the adequacy of the Audit Committee’s formal written charter on an annual basis; |

|

|

|

|

|

| · | reviewing and approving transactions with related persons for potential conflict of interest situations on an ongoing basis; and |

|

|

|

|

|

| · | overseeing such other matters as are specifically delegated to the Audit Committee by our board of directors from time to time. |

The board of directors has affirmatively determined that Mr. Innes is designated as an “Audit Committee financial expert.”

Compensation Committee

Our Compensation Committee currently consists of four members, Mss. Nguyen (Chair) and Henshall, Dr. Barnes and Mr. Brudnick, each of whom has been determined to be an independent director under the NYSE American Company Guide. Following the Annual Meeting, assuming the election of the director nominees set forth in Proposal 1 – Election of Directors of this Proxy Statement, our Compensation Committee shall consist of three members, Mss. Nguyen (Chair) and Henshall, and Dr. Barnes, each of whom has been determined to be an independent director under the NYSE American Company Guide.

The Compensation Committee is responsible for, among other things:

|

| · | developing, reviewing, and approving our overall compensation programs, and regularly reporting to the full board of directors regarding the adoption of such programs; |

|

|

|

|

|

| · | developing, reviewing and approving our cash and equity incentive plans, including approving individual grants or awards thereunder; |

|

|

|

|

|

| · | reviewing and approving individual and company performance goals and objectives that may be relevant to the compensation of executive officers and other key employees; |

|

|

|

|

|

| · | reviewing and discussing with management the tables and narrative discussion regarding executive officer and director compensation to be included in the annual proxy statement; |

|

|

|

|

|

| · | reviewing and assessing, on an annual basis, the adequacy of the Compensation Committee’s formal written charter; and |

|

|

|

|

|

| · | overseeing such other matters that are specifically delegated to the Compensation Committee by our board of directors from time to time. |

In fulfilling its responsibilities, the Compensation Committee has the authority to delegate any or all of its responsibilities to a subcommittee of the Compensation Committee.

| 14 |

| Table of Contents |

Nominations and Governance Committee

Our Nominations and Governance Committee currently consists of four members, Dr. Futcher (Chair), Mss. Nguyen and Henshall and Mr. Innes, each of whom has been determined to be an independent director under the NYSE American Company Guide.

The Nominations and Governance Committee is responsible for, among other things:

|

| · | identifying and screening candidates for our board of directors, and recommending nominees for election as directors; |

|

|

|

|

|

| · | assessing, on an annual basis, the performance of the board of directors and any committee thereof; |

|

|

|

|

|

| · | reviewing the structure of the board of directors’ committees and recommending to the board of directors, for its approval, directors to serve as members of each committee, including each committee’s respective chair, if applicable; |

|

|

|

|

|

| · | reviewing and assessing, on an annual basis, the adequacy of the Nominations and Governance Committee’s formal written charter; and |

|

|

|

|

|

| · | generally advising our board of directors on corporate governance and related matters including, without limitation, with respect to the Company’s Certificate of Incorporation, Bylaws and charters of other committees. |

The Nominations and Governance Committee considers candidates for the board of directors from any reasonable source, including stockholder recommendations. The Committee will not evaluate candidates differently based on who has made the proposal. The Committee has the authority under its charter to hire and pay a fee to consultants or search firms to assist in the process of identifying and evaluating candidates. The Nominations and Governance Committee, and our board of directors, believe that directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company’s stockholders. Each director must also be able to dedicate the time and resources sufficient to ensure the diligent performance of his or her duties. Further, our board of directors is intended to encompass a range of talents, experience, skills, backgrounds, and expertise sufficient to provide sound and prudent guidance with respect to the operations and interests of the Company and its stockholders. The Company values diversity and seeks to achieve a diversity of professional experiences, personal backgrounds, and personal characteristics, including race, gender and ethnicity, on our board of directors, but no specific policy regarding board diversity has been adopted. We intend to implement a policy requiring diversity of board candidates for future elections.

Stockholders who wish to suggest qualified candidates should write to the Chair of the Nominations and Governance Committee c/o VolitionRx Limited, 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014, in accordance with the time periods and information requirements set forth in the Bylaws, specifying the name of the candidates and stating in detail the qualifications of such persons for consideration by the Committee. A written statement from the candidate consenting to be named as a candidate and, if nominated and elected, to serve as a director should accompany any such recommendation. See the section of this Proxy Statement entitled Deadline for Receipt of Stockholder Proposals for the Next Annual Meeting. No director nominations by stockholders have been received as of the filing of this Proxy Statement.

Board Leadership Structure and Role in Risk Oversight

Our board of directors does not have a formal policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board. Our board of directors believes that it is in the best interests of our organization to make that determination from time to time based on the position and the direction of our organization and the membership of our board of directors.

Dr. Martin Faulkes currently serves as the Executive Chairman of our board of directors. Guy Innes is the lead independent director on our board of directors. As the lead independent director, Mr. Innes regularly consults with the Executive Chairman of our board of directors and management on the key issues concerning the Company. Cameron Reynolds, our Chief Executive Officer and principal executive officer, also serves as a director of the Company. Due to Mr. Reynolds’ executive officer position, he is not an independent director. Our board of directors views this arrangement as providing an efficient connection between our management and board of directors, enabling our board to obtain information pertaining to operational matters expeditiously and enabling our Executive Chairman and our Chief Executive Officer to bring areas of concern before the board in a timely manner.

| 15 |

| Table of Contents |

One of our board of directors’ key functions is informed oversight of our risk management process. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through the board as a whole, as well as through various board standing committees that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for us. Each committee of our board of directors meets in executive session with key management personnel and representatives of outside advisors as necessary to oversee risks associated with their respective principal areas of focus. Our Audit Committee oversees management of financial risks. Our Compensation Committee oversees the management of risks related to our executive compensation plans and arrangements. Our Nominations and Governance Committee manages risks associated with the independence of our board and potential conflicts of interest. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through committee reports about such risks. While our board of directors, through its committees, oversees our risk management, our management team is responsible for day-to-day risk-management processes to ensure that such risks are being adequately managed.

Communications with the Board of Directors

Our board of directors encourages stockholders and other interested parties to send communications to the board of directors or to individual members of the board of directors. Such communications, whether by letter, e-mail or telephone, should be directed to the Executive Chairman of the board of directors who will forward them to the intended recipients. However, unsolicited advertisements or invitations to conferences or promotional material, in the discretion of the Executive Chairman or his designee, may not be forwarded to the directors.

If a stockholder or other interested party wishes to communicate to our board of directors regarding a concern relating to the Company’s financial statements, accounting practices or internal controls, the concern should be submitted in writing to the board of directors in care of the Executive Chairman at the Company’s headquarters. If the concern relates to the Company’s governance practices, business ethics or corporate conduct, the concern likewise should be submitted in writing to the Executive Chairman at the Company’s headquarters address. If the stockholder or other interested party is unsure as to which category his or her concern relates, he or she may communicate it to any one of the directors in care of the Company’s Corporate Secretary.

Stockholders or other interested parties who wish to contact members of our board of directors either individually or as a group may do so by writing to Corporate Secretary c/o VolitionRx Limited, 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014, by email to investorrelations@volition.com, or by telephone at +1 (646) 650-1351, specifying whether the communication is directed to the entire board of directors or to a particular director. Such communications are screened by Company personnel to filter out improper or irrelevant topics, such as solicitations, and to confirm that they relate to matters that are within the scope of responsibilities of the board of directors.

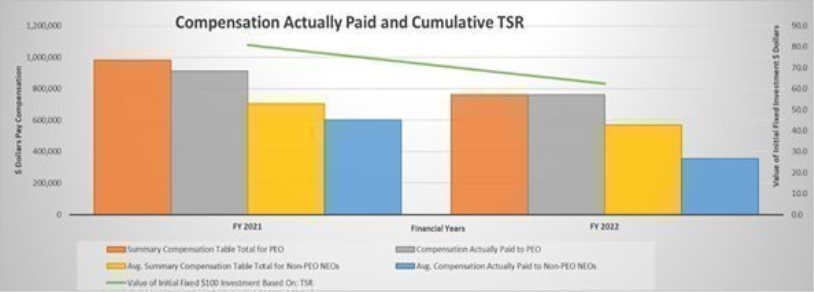

We undertook an engagement program with our significant stockholders in the first quarter of 2023. Ms. Nguyen (Chair of the Compensation Committee) and Mr. Hughes (Chief Financial Officer) participated in these meetings. Topics discussed in these meetings and covered in related materials focused on the steps we have taken to: increase Board diversity and abide by the Rooney Rule for future appointments; strengthen corporate governance with reviews and updates to Committee charters, policies and the board of directors skills matrix; further align executive compensation with the inclusion of performance-based metrics related to corporate goals, including goals specifically linked to share price performance; bolster the business in key corporate areas of finance, human resources, information technology and legal, as well as expand production and regulatory capabilities to meet future anticipated needs.

In our outreach efforts, we reached out to institutional holders representing approximately 30% of our outstanding shares at the time, as well as Institutional Shareholder Services and Glass Lewis. We held meetings with our two largest stockholders representing approximately 26.5% of shares outstanding at the time. We also received written feedback from two institutions representing approximately 1.4% of our outstanding shares at the time. All the stockholders we engaged with expressed an appreciation for hearing from our leadership. They encouraged us to continue to engage with stockholders. As with our 2021/22 efforts we found our 2023 engagement program to be extremely beneficial and plan to continue to conduct an annual engagement program. Given our previous engagement, the resulting enhanced disclosures made in our 2022 proxy statement and the updated corporate materials reporting our progress in 2022 and 2023, the overall feedback from our engagement efforts in 2023 was positive. In particular, our reported progress regarding our compensation practices for our executive officers was acknowledged and appreciated. Key actions that are responsive to the feedback from our 2023 engagement efforts, are summarized below:

Remediation of material weaknesses. Material weaknesses in our internal control over financial reporting and our ability to continue as a going concern have historically impacted the level of stockholder support received by our directors, particularly the chair of our Audit Committee. In our efforts to remediate these weaknesses we appointed Mr. Hughes as our Chief Financial Officer in February 2021 who, together with his team, are working to remedy such materials weaknesses as previously identified in our filings with the SEC.

| 16 |

| Table of Contents |

During the year ended December 31, 2022, as disclosed in our Annual Report on Form 10-K for such period, our management, with oversight from our Audit Committee, continued to implement the following remediation steps to address and mitigate the underlying deficiencies which gave rise to the previously disclosed material weaknesses and to improve our internal control over financial reporting:

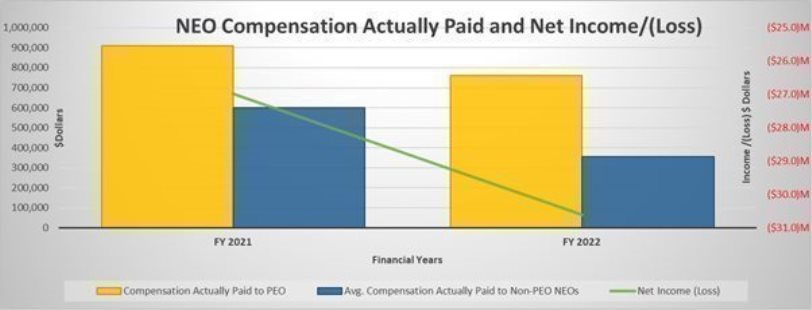

|