PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on January 26, 2026

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

| VOLITIONRX LIMITED |

| (Name of Registrant as Specified In Its Charter) |

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

|

|

|

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

| ☐ | Fee paid previously with preliminary materials. |

VOLITIONRX LIMITED

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on March 31, 2026

To Our Stockholders:

Notice is hereby given that a Special Meeting of Stockholders, or the Special Meeting, of VolitionRx Limited, which we refer to as VolitionRx, the Company, we or us, will be held at 93-95 Gloucester Place, London, W1U 6JQ, United Kingdom, at 3:00 p.m. British Summer Time on March 31, 2026, for the following purposes:

| 1.

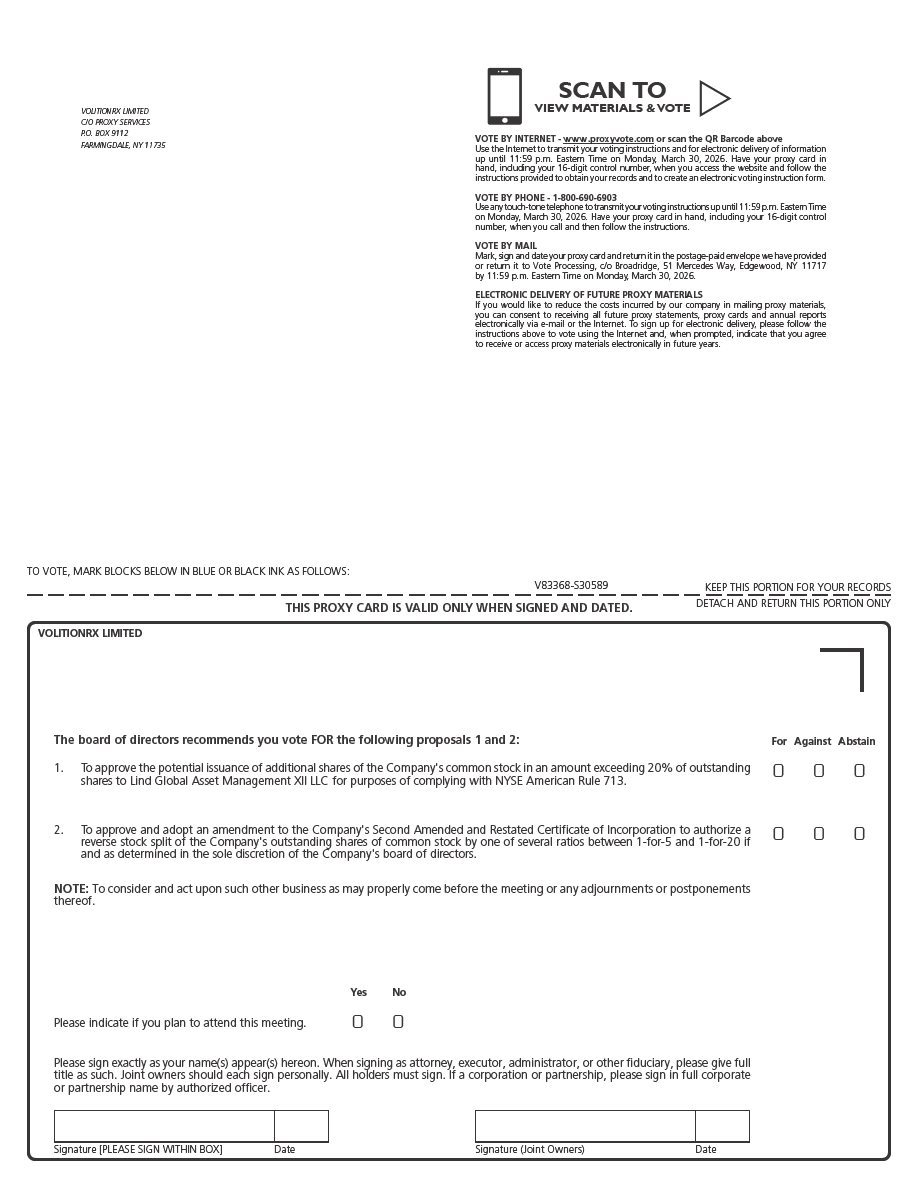

| Approval of issuing shares in excess of 20% of our outstanding shares. To approve the potential issuance of additional shares of our common stock in an amount exceeding 20% of outstanding shares to Lind Global Asset Management XII LLC for purposes of complying with NYSE American Rule 713.

|

| 2.

| Approval of an amendment to our Second Amended and Restated Certificate of Incorporation to authorize a reverse stock split. To approve and adopt an amendment to our Second Amended and Restated Articles of Incorporation to authorize a reverse stock split of our outstanding shares of common stock by one of several ratios between 1-for-5 and 1-for-20, if and as determined by our board of directors. |

|

|

|

| 3. | Other business. To consider and act upon such other business as may properly come before the Special Meeting and any adjournments or postponements thereof. |

The Company’s board of directors unanimously recommends that you vote “FOR” Proposals 1 and 2.

The Company’s board of directors has fixed the close of business on February 9, 2026 as the Record Date for the determination of stockholders that are entitled to notice of and to vote at the Special Meeting and any adjournment or postponement thereof. Only stockholders of record, and holders of shares in street name as represented by a bank or broker statement certifying the number of shares in their possession, as of the close of business on the Record Date are entitled to notice of and to vote at the Special Meeting and any adjournment or postponement thereof.

Your vote is very important. Whether or not you plan to attend the Special Meeting, we encourage you to read the Proxy Statement and submit your proxy and voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section entitled “How do I vote my shares?” in the Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

|

| By order of the Board of Directors |

|

|

|

|

|

|

| /s/ Cameron Reynolds |

|

|

| Cameron Reynolds President, Chief Executive Officer and Director |

|

Approximate Date of Mailing of Notice of

Internet Availability of Proxy Materials:

February [___], 2026

| 2 |

VOLITIONRX LIMITED

1489 West Warm Springs Road, Suite 110

Henderson, Nevada 89014

Telephone: +1 (512) 774-8930

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

To Be Held on March 31, 2026 at

93-95 Gloucester Place, London, W1U 6JQ, United Kingdom

GENERAL INFORMATION

VolitionRx Limited has made this Proxy Statement and Notice of Special Meeting of Stockholders, or collectively, the Proxy Materials, available to you on the Internet or, upon your request, in paper or e-mail form, in connection with the solicitation of proxies by the board of directors of VolitionRx Limited for the Special Meeting of Stockholders, or the Special Meeting, to be held on March 31, 2026, and any adjournment or postponement of the Special Meeting. In addition to the Proxy Materials, proxies may be solicited personally or by telephone, mail, facsimile or other electronic means. Directors, officers and employees will not be paid any additional compensation for soliciting proxies, but Broadridge Financial Solutions, Inc. will be paid a customary fee of approximately $9,000, exclusive of printing and mailing fees, for its services relating to the distribution of the Proxy Materials and the facilitation and tabulation of votes. We will, upon request, also reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares of common stock held of record by such persons. The cost of solicitation will be borne by the Company.

The Company is taking advantage of the rules of the Securities and Exchange Commission, or the SEC, that allow us to furnish our Proxy Materials over the Internet to our stockholders rather than in paper form. We believe this delivery process will expedite our stockholders’ receipt of our Proxy Materials, reduce the environmental impact of the Special Meeting and lower the costs of printing and distributing our Proxy Materials. Accordingly, you will receive a Notice of Internet Availability of Proxy Materials, or the Notice, which we expect to mail on or about February [___], 2026. The Notice provides instructions on how to access our Proxy Materials through the Internet and request receipt of our Proxy Materials in paper or e-mail form.

In this Proxy Statement, except as otherwise indicated by the context, references to “Company,” “VolitionRx,” “Volition,” “we,” “us,” and “our” are references to VolitionRx Limited and its wholly owned subsidiaries, Singapore Volition Pte. Limited, a Singapore-registered company, or Singapore Volition, Belgian Volition SRL, a Belgium-registered company, or Belgian Volition, Volition Diagnostics UK Limited, a company registered in the United Kingdom, or Volition Diagnostics, Volition Global Services SRL, a Belgium-registered company, or Volition Global Services, and Volition America, Inc., a Delaware corporation, or Volition America, as well as majority-owned subsidiary Volition Veterinary Diagnostics Development LLC, a Texas limited liability company, or Volition Vet.

ABOUT THE MEETING

We are holding our Special Meeting at 93-95 Gloucester Place, London, W1U 6JQ, United Kingdom, on March 31, 2026, at 3:00 p.m. British Summer Time. At our Special Meeting, our stockholders will act upon the matters outlined herein. In addition, our management will respond to questions from stockholders.

Attendance at the Special Meeting will be limited to stockholders of the Company. Stockholders will be required to furnish valid identification and proof of ownership of the Company’s common stock as of the close of business on February 9, 2026, or the Record Date, before being admitted to the Special Meeting. Stockholders holding shares in street name are requested to bring a statement from the bank, broker or other holder of record confirming their ownership of the Company’s common stock. For directions to the Special Meeting, you may contact the Company’s Corporate Secretary, Rodney Rootsaert, by writing to VolitionRx’s principal executive offices at 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014, by email to investorrelations@volition.com, or by telephone at +1 (512) 774-8930.

| 3 |

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I received these Proxy Materials?

We are providing this Proxy Statement in connection with the solicitation by the board of directors of proxies to be voted at the Special Meeting, or at any postponement or adjournment thereof. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Special Meeting.

You are invited to attend the Special Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Special Meeting to vote your shares. Instead, you may vote your shares using one of the other voting methods described in this Proxy Statement.

Whether or not you plan to attend the Special Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible.

Who can vote at the Special Meeting?

Only stockholders of record as the close of business on February 9, 2026, or the Record Date, will be entitled to vote at the Special Meeting. As of the Record Date, we had [_____] shares of common stock issued and outstanding held of record by approximately [_____] stockholders.

Stockholder of Record – Shares Registered in Your Name

If on the Record Date, your shares of our common stock were registered directly in your name with our transfer agent, VStock Transfer, LLC, or VStock, then you are a stockholder of record. As a stockholder of record, you may vote at the Special Meeting or vote by proxy using the voting methods described in this Proxy Statement. Whether or not you plan to attend the Special Meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner – Shares Registered in the Name of a Broker or Bank

If on the Record Date, your shares of our common stock were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these Proxy Materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Special Meeting unless you request and obtain a signed letter or other valid proxy from your broker or other agent.

A complete list of the stockholders entitled to vote at the Special Meeting will be open to examination by any stockholder for purposes germane to the Special Meeting, during normal business hours for ten days prior to the date of the Special Meeting at the Company’s offices at 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014. If you wish to inspect the stockholder list, please contact the Company’s Corporate Secretary, Rodney Rootsaert, by writing to Corporate Secretary c/o VolitionRx Limited, 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014, or by telephone at +1 (512) 774-8930.

What is the quorum requirement for the Special Meeting?

We will have a quorum and will be able to conduct the business of the Special Meeting if the holders of 33 1/3% of the voting power of the stock issued and outstanding and entitled to vote are present at the Special Meeting, either in person or by proxy. In determining whether we have a quorum, we count abstentions and broker non-votes as present and entitled to vote. If there is no quorum present, the chairman of the Special Meeting may adjourn the Special Meeting to a later date.

| 4 |

How many votes do I have?

Each share of common stock is entitled to one vote on each matter properly brought before the Special Meeting.

What proposals am I voting on at the Special Meeting?

The following two proposals will be voted on at the Special Meeting:

| Proposal 1:

| To approve the potential issuance of additional shares of our common stock in an amount exceeding 20% of outstanding shares to Lind Global Asset Management XII LLC for purposes of complying with NYSE American Rule 713. |

| Proposal 2:

| To approve and adopt an amendment to our Second Amended and Restated Certificate of Incorporation, or our Restated Certificate, to authorize a reverse stock split of our outstanding shares of common stock by one of several ratios between 1-for-5 and 1-for-20 if and as determined in the sole discretion of our board of directors. |

As of the date of this Proxy Statement, the board of directors is not aware of any matters, other than those described in the Proxy Statement, which may be presented for consideration at the Special Meeting. Should any other matters requiring a vote of the stockholders come before the Special Meeting, or any adjournment or postponement thereof, the persons named in the accompanying proxy card will have the discretionary authority to vote with respect to such matters with their best judgment.

Subject to any revocation, all shares represented by properly executed proxies received by the board of directors pursuant to this solicitation will be voted in accordance with the holder’s directions specified on the proxy. If no directions have been specified using the Internet voting site, toll-free number or by marking the appropriate places on a proxy card, the shares will be voted in accordance with the board of directors’ recommendations.

What are the voting requirements to approve each of the proposals?

You may vote “FOR” or “AGAINST” (or “ABSTAIN” from voting on) any of the proposals. Your vote on any one of these proposals will not affect your vote on any of the other proposals. If Proposal 2 is approved, we may file a third amendment to our Restated Certificate with the Secretary of State of the State of Delaware promptly after stockholder approval is obtained. However, our board of directors may delay or abandon the filing of the third amendment to our Restated Certificate before or after adoption and approval by our stockholders.

| Proposal | Voting Requirement | Effect of Votes “Against” and “Abstentions” | Effect of Broker Non-Votes |

| Proposal 1 Approval of the potential issuance of additional shares of our common stock in an amount exceeding 20% of outstanding shares to Lind Global Asset Management XII LLC for purposes of complying with NYSE American Rule 713

| The affirmative vote of a majority of the stock having voting power of the shares of capital stock present or represented by proxy and entitled to vote on this proposal is required to approve this proposal. | Abstentions will have the same effect as a vote “against” this proposal. | Broker non-votes will have no effect on the outcome of this proposal.

|

| Proposal 2 Approval and adoption of an amendment to our Restated Certificate to authorize a reverse stock split of our outstanding shares of common stock by one of several ratios between 1-for-5 and 1-for-20, if and as determined in the sole discretion of our board of directors. | The affirmative vote of a majority of the stock having voting power of the shares of capital stock present or represented by proxy and entitled to vote on this proposal is required to approve this proposal. | Abstentions will have the same effect as a vote “against” this proposal. | Because a bank, broker, dealer or other nominee may generally vote without instructions on this proposal, we do not expect any broker non-votes on this proposal. |

| 5 |

What are broker non-votes?

If you are a beneficial owner of shares held in “street name” and do not give the bank, broker, dealer or other nominee that holds the shares specific voting instructions, the nominee may vote in its discretion on “routine” matters (such as Proposal 2). However, if the nominee that holds your shares does not receive voting instructions from you on how to vote your shares on a “non-routine” matter (such as Proposal 1), it will be unable to vote your shares on that matter. When this occurs, it is referred to as a “broker non-vote.” Broker non-votes will be counted for purposes of determining whether a quorum is present at the Special Meeting.

How do I vote my shares?

Your Vote Is Important. We encourage you to vote promptly. You may vote in any of the following ways:

By Internet – www.proxyvote.com: Use the Internet to submit your proxy by going to www.proxyvote.com and following the instructions on how to complete an electronic proxy card up until 11:59 p.m. Eastern Time on March 30, 2026, the day before the Special Meeting. You will need the 16-digit control number or QR code included on your Notice or your proxy card in order to vote by Internet.

By Telephone – 1-800-690-6903: Use any touch-tone telephone to submit your proxy by dialing 1-800-690-6903 up until 11:59 p.m. Eastern Time on March 30, 2026, the day before the Special Meeting. You will need the 16-digit control number included on your Notice or your proxy card in order to vote by telephone.

By Mail: You may request a paper copy of the Proxy Materials from us by following the instructions on your Notice. When you receive the proxy card, mark your selections on the proxy card, date and sign your name exactly as it appears on your proxy card and mail it in the postage-paid envelope that will be provided to you. Return your proxy card by 11:59 p.m. Eastern Time on March 30, 2026, the day before the Special Meeting.

At the Special Meeting: If you plan to vote in person at the Special Meeting, please bring valid identification. Even if you currently plan to attend the Special Meeting, we recommend that you also submit your proxy so that your vote will be counted if you later decide not to attend the Special Meeting. If you vote your shares now it will not limit your right to change your vote at the Special Meeting if you attend in person. If you hold your shares in street name, you must obtain a proxy, executed in your favor, from your bank, broker or other holder of record, if you wish to vote your shares at the Special Meeting.

When using Internet or telephone voting, the voting systems will verify that you are a stockholder through the use of a company number for VolitionRx and a 16-digit control number or QR code unique to you, which is printed on the Notice you receive in the mail. If you vote by Internet or telephone, please do not also mail a proxy card.

All shares that have been properly voted and not revoked will be voted at the meeting. If you vote using the Internet voting site or the toll-free number, or by signing and returning a proxy card in each case without any voting instructions, your shares will be voted as the board of directors recommends.

| 6 |

Can I change my vote?

You can revoke your proxy (or voting instructions if you hold your shares in street name) at any time before your shares are voted at the Special Meeting if you: (1) send a written notice by mail to our Corporate Secretary indicating that you want to revoke your proxy by writing to VolitionRx Limited, 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014, Attention: Rodney Rootsaert, Corporate Secretary, which notice is received prior to the Special Meeting; (2) vote after delivery of your proxy and before the Special Meeting by using the Internet voting site or toll-free number or deliver to our Corporate Secretary a duly executed proxy card bearing a later date, which revokes all previous proxies; or (3) attend the Special Meeting in person and, at the meeting, give written notice of revocation of your proxy to the Corporate Secretary of the Special Meeting prior to the voting of your proxy and vote your shares in person, although your attendance at the meeting will not by itself revoke your proxy.

Do I have dissenters’ rights?

Under Delaware law, stockholders are not entitled to dissenters’ rights of appraisal on any Proposal referred to herein.

May I cumulate my votes?

Stockholders are not entitled to cumulate votes with respect to voting on any proposal referred to herein.

When will voting results be announced?

Preliminary voting results will be announced at the Special Meeting. Final voting results will be published in a Current Report on Form 8-K that we plan to file with the SEC within four business days after the Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Special Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

| 7 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of January 20, 2026, by: (i) each of our directors and director nominees; (ii) each of our named executive officers; (iii) all of our directors and director nominees, and executive officers as a group; and (iv) each person or group known by us to beneficially own more than 5% of our outstanding shares of common stock.

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under the rules of the SEC, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which the person has a right to acquire beneficial ownership within 60 days. Under these rules more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

Unless otherwise indicated below, to the best of our knowledge each beneficial owner named in the table (i) has the sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable, and (ii) has the following address: 1489 West Warm Springs Road, Suite 110, Henderson, Nevada 89014.

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Ownership (#) |

|

| Percent of Class(1) (%) |

| ||

| Directors and Named Executive Officers: |

|

|

|

|

|

| ||

| Dr. Phillip Barnes(2) |

|

| 86,503 | * | % | |||

| Dr. Salvatore Thomas Butera(3) |

|

| 507,828 | * | % | |||

| Dr. Alan Colman(4) |

|

| 390,817 | * | % | |||

| Mickie Henshall(5) |

|

| 39,706 | * | % | |||

| Guy Innes(6) |

|

| 3,635,936 | 2.8 | % | |||

| Dr. Gaetan Michel(7) |

|

| 207,381 | * | % | |||

| Kim Nguyen(8) |

|

| 162,507 | * | % | |||

| Cameron Reynolds(9) |

|

| 3,881,277 | 2.9 | % | |||

| Dr. Ethel Rubin(10) |

|

| 64,948 | * | % | |||

| Timothy Still(11) |

|

| 406,868 | * | % | |||

| All Directors and Executive Officers as a Group (17 Persons)(12) |

|

| 12,894,290 | 9.6 | % | |||

|

|

|

|

| |||||

| More Than 5% Stockholders: |

|

|

| |||||

| Armistice Capital Master Fund Ltd(13) |

|

| 9,380,425 | 7.2 | % | |||

| 510 Madison Avenue, 7th Floor New York, New York 10022 United States of America |

|

|

| |||||

| Eight Corporation Limited(14) |

|

| 12,005,332 | 9.2 | % | |||

| c/o Crowe Morgan 8 St. George’s Street Douglas, Isle of Man IM1 1AH |

|

|

| |||||

| Lagoda Investment Management, L.P.(15) |

|

| 11,705,000 | 8.9 | % | |||

| 3 Columbus Circle New York, New York |

|

|

| |||||

| Lind Global Asset Management XII LLC(16) |

|

| 34,795,889 |

|

|

| 4.99 | %(16) |

| 444 Madison Avenue, 41st Floor, New York, NY 10022 United States of America |

|

|

|

|

|

|

|

|

| 8 |

| * | Represents ownership of less than 1.0% |

|

|

|

| (1) | For purposes of this table, the percent of class is based upon 130,993,590 shares of our common stock issued and outstanding as of January 20, 2026. Shares of common stock subject to stock options or warrants currently exercisable, or exercisable within 60 days of January 20, 2026, and restricted stock units which may be settled within 60 days of January 20, 2026, are deemed beneficially owned and outstanding for computing the percentage ownership of the person or entity holding such securities, but are not considered outstanding for computing the percentage ownership of any other person or entity. |

| (2) | Dr. Barnes’ beneficial ownership includes direct ownership of (i) 50,868 shares of common stock, (ii) options to purchase 23,635 shares of common stock that are exercisable within 60 days of January 20, 2026 and (iii) restricted stock units for 12,000 shares of common stock that may be settled within 60 days of January 20, 2026. |

|

|

|

| (3) | Dr. Butera’s beneficial ownership includes direct ownership of (i) 365,733 shares of common stock, (ii) options to purchase 52,400 shares of common stock that are exercisable within 60 days of January 20, 2026 and (iii) restricted stock units for 89,695 shares of common stock that may be settled within 60 days of January 20, 2026. |

| (4) | Dr. Colman’s beneficial ownership includes direct ownership of (i) 226,024 shares of common stock, (ii) options to purchase 137,953 shares of common stock that are exercisable within 60 days of January 20, 2026 and (iii) restricted stock units for 26,840 shares of common stock that may be settled within 60 days of January 20, 2026. |

|

|

|

| (5) | Ms. Henshall’s beneficial ownership consists of direct ownership of (i) 27,706 shares of common stock and (ii) restricted stock units for 12,000 shares of common stock that may be settled within 60 days of January 20, 2026. |

|

|

|

| (6) | Mr. Innes’ beneficial ownership includes direct ownership of (i) 1,005,348 shares of common stock, (ii) options to purchase 128,635 shares of common stock that are exercisable within 60 days of January 20, 2026, (iii) restricted stock units for 31,786 shares of common stock that may be settled within 60 days of January 20, 2026 and (iv) warrants to purchase 96,153 shares of common stock that are exercisable within 60 days of January 20, 2026. Mr. Innes’ beneficial ownership also includes indirect ownership of (x) 618,014 shares of common stock held directly by Mr. Innes’ children, (y) 1,400,000 shares of common stock held directly by The Innes Family Bare Trust 2023, of which the Mr. Innes is the trustee, for the benefit of his children and (z) 356,000 shares of common stock held directly by The Dill Faulkes Educational Trust Limited, or DFET. Mr. Innes serves as a director and a trustee of DFET and shares voting and dispositive control over such shares. |

|

|

|

| (7) | Dr. Michel’s beneficial ownership includes direct ownership of (i) 134,021 shares of common stock and (ii) options to purchase 73,360 shares of common stock that are exercisable within 60 days of January 20, 2026. |

|

|

|

| (8) | Ms. Nguyen’s beneficial ownership includes direct ownership of (i) 92,711 shares of common stock, (ii) options to purchase 8,635 shares of common stock that are exercisable within 60 days of January 20, 2026 and (iii) restricted stock units for 30,605 shares of common stock that may be settled within 60 days of January 20, 2026. Ms. Nguyen’s beneficial ownership also includes indirect ownership of 30,556 shares of common stock held directly by Ms. Nguyen’s spouse. |

|

|

|

| (9) | Mr. Reynolds’ beneficial ownership includes direct ownership of (i) 2,128,297 shares of common stock, (ii) options to purchase 526,486 shares of common stock that are exercisable within 60 days of January 20, 2026, (iii) restricted stock units for 74,700 shares of common stock that may be settled within 60 days of January 20, 2026 and (iv) warrants to purchase 110,000 shares of common stock that are exercisable within 60 days of January 20, 2026. Mr. Reynolds’ beneficial ownership also includes indirect ownership of (x) 34,076 shares of common stock held directly by Mr. Reynolds’ spouse and (y) 1,007,718 shares of common stock held directly by Concord International, Inc., of which Mr. Reynolds is the majority stockholder. Mr. Reynolds shares voting and dispositive control over such shares. |

|

|

|

| (10) | Dr. Rubin’s beneficial ownership consists of direct ownership of (i) 34,343 shares of common stock and (ii) restricted stock units for 30,605 shares of common stock that may be settled within 60 days of January 20, 2026. |

| 9 |

| (11) | Mr. Still’s beneficial ownership includes direct ownership of (i) 268,792 shares of common stock, (ii) restricted stock units for 90,000 shares of common stock that may be settled within 60 days of January 20, 2026 and (iii) warrants to purchase 48,076 shares of common stock that are exercisable within 60 days of January 20, 2026. |

|

|

|

| (12) | The number of directors and executive officers as a group includes two executive officers of the Company’s subsidiaries. The amount beneficially owned by the directors and executive officers as a group consists of an aggregate of (i) 9,189,983 shares of common stock, (ii) options to purchase 2,342,010 shares of common stock that are exercisable within 60 days of January 20, 2026, (iii) restricted stock units for 798,068 shares of common stock that may be settled within 60 days of January 20, 2026 and (iv) warrants to purchase 564,229 shares of common stock that are exercisable within 60 days of January 20, 2026. |

|

|

|

| (13) | Based on the information contained in Amendment No. 4 to the Schedule 13G filed with the SEC on November 14, 2025, Armistice Capital, LLC, or Armistice Capital, is the investment manager of Armistice Capital Master Fund Ltd., or the Master Fund, the direct holder of the 9,380,425 shares of common stock, and pursuant to an Investment Management Agreement, Armistice Capital exercises voting and investment power over these shares of common stock held by the Master Fund and thus may be deemed to beneficially own these shares. Steven Boyd, as the managing member of Armistice Capital, may be deemed to beneficially own the shares of common stock held by the Master Fund. Armistice Capital’s beneficial ownership reflected in the table excludes warrants to purchase 25,454,546 shares of common stock that are exercisable within 60 days of January 20, 2026; provided, however, that Armistice Capital does not have the right to exercise any portion of such warrants to the extent that its beneficial ownership (together with its affiliates and any members of a group, if applicable) would exceed 9.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of the shares of common stock upon exercise of such warrants. |

|

|

|

| (14) | Based on the information contained in the Form 4 filed with the SEC on January 3, 2024, Eight Corporation Limited, or Eight, which is a director of Cotterford Company Limited, or Cotterford, and Hever Investments Limited, or Hever, beneficially owns 12,005,332 shares of common stock, including those held by Cotterford and Hever. Amy Slee is a director of Eight and Hever and holds dispositive and voting control over the shares of common stock beneficially owned by Cotterford and Hever. |

|

|

|

| (15) | Based on the information contained in Amendment No. 3 to the Schedule 13G filed with the SEC on August 14, 2025, Lagoda Investment Management, L.P. serves as the investment manager to certain managed accounts, and Fatima Dickey, as the sole member of Lagoda Investment Management, LLC, the General Partner of Lagoda Investment Management, L.P., possesses sole voting and dispositive power over such shares. |

|

|

|

| (16) | Beneficial ownership consists of (i) 8,680,559 shares of common stock which are issuable upon conversion at the conversion price of the senior secured convertible promissory note, dated May 20, 2025, or the 2025 Note, (ii) 13,020,834 shares of common stock, which are issuable upon exercise of the common stock purchase warrant, dated May 20, 2025, or the 2025 Warrant, (iii) 4,200,210 shares of common stock, which are issuable upon conversion at the conversion price of the senior secured convertible promissory note, dated January 15, 2026, (iv) 7,000,350 shares of common stock, which are issuable upon exercise of the common stock purchase warrant, dated January 15, 2026, and (v) 1,893,936 shares of common stock issued in connection with an installment payment under the 2025 Note. The 2025 Note, the 2026 Note, the 2025 Warrant, and the 2026 Warrant contain provisions preventing the conversion or exercise thereof to the extent such conversion or exercise would cause the holder, together with its affiliates, to beneficially own a number of shares of common stock which would exceed 4.99% of the Company’s then outstanding shares of common stock (or 9.99% of the Company’s then outstanding shares of common stock to the extent that the holder, together with its affiliates, beneficially owns in excess of 4.99% of shares of the Company’s then outstanding shares of common stock at the time of such exercise or conversion), or the Contractual Limitation. In addition, the 2025 Note, the 2026 Note, the 2025 Warrant, and the 2026 Warrant contain provisions preventing the number of shares of common stock issuable upon conversion or exercise thereof, if such conversion or exercise would result in the holder obtaining greater than 19.99% of the Company’s voting securities, or the 19.99% Limitation. The number of shares of common stock set forth in the second column in the table above does not give effect to the Contractual Limitation or the 19.99% Limitation, and (ii) the third column in the table above gives effect to the Contractual Limitation. The 2025 Note, 2026 Note, 2025 Warrant, and 2026 Warrant are directly owned by Lind Global Asset Management XII LLC, or Lind. Jeff Easton is the Managing Member of The Lind Partners, LLC, which is the Investment Manager of Lind, and in such capacity has the right to vote and dispose of the securities held by Lind. Mr. Easton disclaims beneficial ownership over the securities listed except to the extent of his pecuniary interest therein. The address for Lind is 444 Madison Avenue, 41st Floor, New York, NY 10022. |

| 10 |

PROPOSAL 1 - APPROVAL OF THE POTENTIAL ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK IN AN AMOUNT EXCEEDING 20% OF OUTSTANDING SHARES TO LIND GLOBAL ASSET MANAGEMENT XII LLC FOR PURPOSES OF COMPLYING WITH NYSE AMERICAN RULE 713

Overview

Our common stock is listed on NYSE American, and we are subject to Section 713(a) of the NYSE American Company Guide, which requires us to obtain stockholder approval when shares will be issued in connection with a transaction involving the sale, issuance or potential issuance by the issuer of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding shares for less than the greater of book or market value of the shares. Section 713(b) of the NYSE American Company Guide requires stockholder approval of a transaction, other than a public offering, involving the sale, issuance or potential issuance by an issuer of common stock (or securities convertible into or exercisable for common stock) when the issuance or potential issuance of additional shares may result in a change of control of the issuer.

In connection with the Original Purchase Agreement and the Amended Purchase Agreement (each as defined below) with Lind, the aggregate number of shares of common stock issuable to Lind could be in excess of 20% of our outstanding common stock prior to the issuance under each agreement, upon the terms and conditions more fully described below. Further, pursuant to each of the Original Purchase Agreement and the Amended Purchase Agreement, we are required to seek stockholder approval, which if not obtained, we are obligated to hold additional special meetings of stockholders. Therefore, we are asking our stockholders to authorize the potential issuance of shares of our common stock in connection with the Original Purchase Agreement and the Amended Purchase Agreement in order to satisfy the stockholder approval requirements of Sections 713(a) and 713(b) of the NYSE American Company Guide.

Senior Secured Convertible Notes and Warrants with Lind Global Asset Management XII LLC

On May 15, 2025, we entered into a securities purchase agreement, as amended June 26, 2025, as further amended September 10, 2025, or the Original Purchase Agreement, with Lind, pursuant to which, on May 20, 2025, in exchange for a purchase price of $6,250,000 we issued to Lind (a) the 2025 Note in an outstanding principal amount of $7,500,000, that is initially convertible into 10,416,667 shares of our common stock at a conversion price of $0.72 per share, subject to adjustment, and (b) the 2025 Warrant to purchase up to 13,020,834 shares of our common stock at an exercise price of $0.672 per share, subject to adjustment and exercisable for 5 years. We received net proceeds of $5,802,799 in exchange for the issuance of the 2025 Note and the 2025 Warrant (excluding the proceeds upon exercise of the warrant, if any).

On January 7, 2026, we entered into an amendment and restatement of the Original Purchase Agreement, or the Amended Purchase Agreement, with Lind, pursuant to which, on January 15, 2026, in exchange for a purchase price of $2,000,000 we issued to Lind (a) the 2026 Note in an outstanding principal amount of $2,400,000, that is initially convertible into 4,200,210 shares of our common stock at a conversion price of $0.5714 per share, subject to adjustment, and (b) the 2026 Warrant to purchase up to 7,000,350 shares of our common stock at an exercise price of $0.5714 per share, subject to adjustment and exercisable for 5 years. We received net proceeds of $1,905,000 in exchange for the issuance of the 2026 Note and the 2026 Warrant (excluding the proceeds upon exercise of the warrant, if any).

The 2025 Note bears a $1,250,000 original issue discount and matures on May 20, 2027 and the 2026 Note bears a $400,000 original issue discount and matures on January 15, 2028. Neither note carries any interest. Beginning on the date that is 180 days from the issuance date of the respective note and on each one (1) month anniversary thereafter for 18 months, we shall pay Lind an amount equal to $416,666 with respect to the 2025 Note and $133,333 with respect to the 2026 Note, until the outstanding principal amount of such note has been paid in full prior to or on its maturity date or, if earlier, upon acceleration, conversion or redemption of such note in accordance with its terms. At our discretion, the monthly payments shall be made in (i) cash, (ii) shares of our common stock, or (iii) a combination of cash and shares; if made in shares, the number of shares shall be determined by dividing (x) the principal amount being paid in shares by (y) 90% of the average of the five lowest daily volume-weighted average prices during the 20 trading days prior to the applicable payment date. The notes set forth certain conditions that must be satisfied before we may make any monthly payments in shares of common stock. If we make a monthly payment in cash, we must also pay Lind a cash premium of 5% of such monthly payment. Lind may elect with respect to no more than two (2) monthly payments for each note to increase the amount of such monthly payment up to $1,000,000.

| 11 |

The notes may be converted from time to time at Lind’s option at an initial conversion price of $0.72 per share for the 2025 Note and $0.5714 per share for the 2026 Note, in each case subject to adjustment. The dollar amount of any such conversion will be applied toward upcoming note payments for such note in reverse chronological order. Each note may be prepaid by the Company in whole upon written notice on any business day following thirty (30) days after the earlier to occur of (i) the resale registration statement for the shares underlying such note and related warrant being declared effective by the SEC or (ii) the date that the shares issued pursuant to conversion of such note may be immediately resold under Rule 144 without restriction on the number of shares to be sold or the manner of sale; but in the event of a prepayment notice, Lind may convert up to one-third (1/3) of principal amount due under such note at the lesser of (x) 90% of the average of the five lowest daily volume-weighted average prices during the 20 trading days prior to the prepayment date or (y) the then-applicable conversion price.

Issuance of note shares and warrant shares upon repayment or conversion of the notes and upon exercise of the warrants is subject to an ownership limitation equal to 4.99% of our outstanding shares of common stock; provided, that if Lind and its affiliates beneficially own in excess of 4.99% of our outstanding shares of common stock, then such limitation shall automatically increase to 9.99% so long as Lind and its affiliates own in excess of 4.99% of such common stock (and shall, for the avoidance of doubt, automatically decrease to 4.99% upon Lind and its affiliates ceasing to own in excess of 4.99% of such common stock).

Upon the occurrence of any event of default under a note, such note will become immediately due and payable and we must pay Lind an amount equal to 120% of the then outstanding principal amount of such note, subject to a reduction to 110% in certain limited circumstances, in addition to any other remedies under such note or the other transaction documents. Events of default include, among others, our failure to make any note payment when due, a default in any indebtedness or adverse final judgements in excess of threshold amounts, our failure to instruct our transfer agent to issue unlegended certificates in certain circumstances, our shares of common stock no longer being publicly traded or listed on a national securities exchange, any stop order or trading suspension restricting the trading in our common stock that remains uncured for a specified period, an announcement of a change of control (as defined in the Original Purchase Agreement and the Amended Purchase Agreement), the failure to file reports or filings required by the Securities and Exchange Commission, and our market capitalization falling below a threshold amount for a specified period, each as defined in the notes.

Each note contains certain negative covenants, including restricting us from making certain distributions, stock repurchases, borrowing, sale of assets, loans and exchange offers. Additionally, unless waived by Lind, we shall be required to utilize a portion of the proceeds from certain specified debt or equity transactions and asset sales to repay the outstanding principal amount due under the notes.

Following the occurrence of a change of control, Lind may require us to prepay, effective immediately prior to the consummation of such change of control, an amount equal to 105% of the outstanding principal amount of each note as of such date.

Our obligations under the notes are secured by a first-priority security interest in all of our assets pursuant to the terms of a security agreement in favor of Lind. We have also entered into a pledge agreement in favor of Lind with respect to the equity that we hold in our subsidiaries. In addition, in connection with the offering, our subsidiaries have guaranteed all of our obligations in connection with the offerings pursuant to the terms of a guaranty in favor of Lind and certain of our subsidiaries have entered into a guarantor security agreement and a pledge agreement in favor of Lind.

The warrants may be exercised via cashless exercise in the event there is no effective registration statement covering the shares of common stock underlying a warrant exercise.

The sales of the notes and warrants and the terms of the offerings, including the guaranty, are set forth in the Original Purchase Agreement, the Amended Purchase Agreement, the 2025 Note, the 2026 Note, the 2025 Warrant, the 2026 Warrant, a security agreement, a guaranty, pledge agreements and a guarantor security agreement (the security agreement, guaranty, pledge agreements and guarantor security agreement referred to collectively as the “Security Agreements”).

| 12 |

Pursuant to our obligations under the Original Purchase Agreement, we registered for resale on Form S-3 (Registration No. 333-288508) up to 10,416,667 shares of common stock issuable upon conversion of the 2025 Note and up to 13,020,834 shares of common stock issuable upon exercise of the 2025 Warrant.

Pursuant to our obligations under the Amended Purchase Agreement, we are required to file a registration statement by February 14, 2026 to register for resale all of the shares of common stock issuable upon conversion of the 2026 Note (up to 4,200,210 shares of common stock based upon the initial conversion price) and up to 7,000,350 shares of common stock issuable upon exercise of the 2026 Warrant.

Why Approval is Needed

As described above, at the time of the execution of each of (i) the Original Purchase Agreement, assuming full conversion of the 2025 Note and full exercise of the 2025 Warrant, and (ii) the Amended Purchase Agreement, assuming full conversion of the 2026 Note and full exercise of the 2026 Warrant, and in each case including shares issued in connection with the repayment of the notes and/or as a result of anti-dilution adjustments in accordance with the terms of the notes and warrants, the number of shares of common stock which may be issuable could be more than 20% of our common stock outstanding at the time of execution of each agreement and may also result in such shares being issued at less than the greater of market price or book value per share.

We generally have no control over whether Lind will convert the notes or exercise the warrants. For these reasons, we are unable to accurately forecast or predict with any certainty the total amount of shares of common stock that may be issued under the notes or the warrants. Under certain circumstances, however, it is possible, that we may have to issue more than 20% of our outstanding shares of common stock to Lind under the terms of the Original Purchase Agreement and/or more than 20% of our outstanding shares of common stock to Lind under the terms of the Amended Purchase Agreement. Therefore, we are seeking stockholder approval under this proposal to issue more than 20% of our outstanding shares of Common Stock, if necessary, to Lind under the terms of each of the Original Purchase Agreement and under the Amended Purchase Agreement, as applicable.

NYSE American Rule 713 requires that we obtain stockholder approval of the issuances of common stock and/or securities convertible into, or exercisable for, common stock in excess of 20% of our issued and outstanding shares of common stock at the time of the offering. Accordingly, we seek your approval of Proposal 1 to issue the maximum number of shares of common stock that could be issued upon full conversion and exercise thereof, in order to satisfy the requirements of NYSE American Rule 713.

Effect of Issuance of Securities

The potential issuance of shares of our common stock pursuant to the notes and warrants, plus any additional shares of common stock issued in connection with the repayment of the notes and/or as a result of anti-dilution adjustments in accordance with the terms of the notes and warrants, would result in an increase in the number of shares of common stock outstanding, and our stockholders would incur dilution of their percentage ownership to the extent that Lind converts the notes or exercises the warrants, or to the extent that additional shares of common stock are issued in connection with the repayment of the notes and/or as a result of anti-dilution adjustments in accordance with the terms of the notes and warrants. Because of potential adjustments to the number of shares of common stock issuable upon conversion of the notes and warrants, the exact magnitude of the dilutive effect of the 2025 Note, 2026 Note, 2025 Warrant and 2026 Warrant cannot be conclusively determined. However, the dilutive effect may be material to our current stockholders.

Further, the issuance or resale of common stock issued to Lind could cause the market price of our common stock to decline. In addition to the foregoing, the increase in the number of issued shares of common stock in connection with the offerings may have an incidental anti-takeover effect in that additional shares could be used to dilute the stock ownership of parties seeking to obtain control of us. The increased number of issued shares could discourage the possibility of, or render more difficult, certain mergers, tender offers, proxy contests or other change of control or ownership transactions.

| 13 |

Effect of Failure to Obtain Stockholder Approval

If the stockholders do not approve this Proposal 1 at the Special Meeting, we would be required to continue to seek such stockholder approval, again, every 4 months thereafter until such stockholder approval is obtained. Any such adjournments or calling of a special meetings of stockholders could result in our having to incur substantial additional expenses. Additionally, if we are unable to obtain shareholder approval to issue common stock to Lind in excess of the limitations impose by NYSE American Rule 713, without limiting any rights of Lind under the notes, any remaining outstanding balance under the notes may be repaid in cash at the request of Lind in accordance with the terms of the notes. If we do not have sufficient cash resources to make these payments, we may need to delay, reduce or eliminate certain research and development programs or other operations or take other measures deemed necessary by the Company.

Further Information

The terms of the transaction documents are only briefly summarized above. For a further description of the Original Purchase Agreement, the 2025 Note, the 2025 Warrant, and the Security Agreements see Exhibits 10.2 to 10.8 and 10.11 filed as exhibits to the Company’s Quarterly Report Form 10-Q, filed with the SEC on May 15, 2025 and incorporated herein by reference. For a further description of the Amended Purchase Agreement, the 2026 Note, and the 2026 Warrant, see Exhibits 4.1, 10.1 and 10.2 filed as exhibits to the Company’s Current Report Form 8-K, filed with the SEC on January 8, 2026 and incorporated herein by reference. The discussion herein is qualified in its entirety by reference to the filed documents.

Required Vote

The affirmative vote of a majority of the stock having voting power of the shares of capital stock present or represented by proxy and entitled to vote on this proposal is required to approve this proposal. Stockholders may vote “for” or “against” the proposal, or they may abstain from voting on the proposal. Abstentions will have the same effect as a vote “against” this proposal. Broker non-votes will have no effect on the outcome of this proposal.

Board of Directors’ Recommendation

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE POTENTIAL ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK IN AN AMOUNT EXCEEDING 20% OF OUTSTANDING SHARES TO LIND GLOBAL ASSET MANAGEMENT XII LLC FOR PURPOSES OF COMPLYING WITH NYSE AMERICAN RULE 713.

| 14 |

PROPOSAL 2 - APPROVAL AND ADOPTION OF AN AMENDMENT TO OUR SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO AUTHORIZE A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK BY ONE OF SEVERAL RATIOS BETWEEN 1-FOR-5 AND 1-FOR-20, IF AND AS DETERMINED IN THE SOLE DISCRETION OF OUR BOARD OF DIRECTORS

General

Our board of directors has unanimously approved and declared advisable and is recommending that our stockholders approve and adopt a proposed certificate of amendment to our Restated Certificate, in substantially the form attached hereto as Appendix A, to authorize a reverse stock split of all of our outstanding shares of common stock, par value $0.001 per share, by one of several ratios between 1-for-5 and 1-for-20, or the Reverse Stock Split, if and as determined in the sole discretion of our board of directors, with the timing of the Reverse Stock Split and the exact ratio of the Reverse Stock Split to be determined by our board of directors without further action by our stockholders; provided, our board of directors will not select a reverse split ratio that will result in us having fewer than 200,000 publicly held shares under the NYSE American Company Guide.

By approving this Proposal 2, stockholders would be authorizing the Reverse Stock Split at a specific ratio within the range described above, if our board of directors determines in the future that implementing the Reverse Stock Split is in the best interests of the Company and its stockholders. Our board of directors believes that stockholder approval of the range of reverse stock split ratios (as opposed to approval of a single reverse stock split ratio) provides our board of directors with maximum flexibility to react to then-current market conditions and achieve the purpose of a reverse stock split, as discussed below, and therefore is in the best interests of the Company and our stockholders. Although stockholders are being asked to vote on each of the proposed reverse stock split ratios within the range described above, only one such proposal will be effected. By approving this Proposal 2, stockholders will be authorizing our board of directors to file only one amendment to our Restated Certificate, as determined by our board of directors in the manner described herein. Our board of directors at its discretion may also elect not to implement any reverse stock split.

However, stockholder approval of this Proposal 2 does not obligate our board of directors to implement a reverse stock split. Approval of this Proposal 2 would only authorize our board of directors to implement the Reverse Stock Split in the future, if and as our board of directors determines in its sole discretion that such action is in the best interests of the Company and its stockholders. Our board of directors may determine not to implement the Reverse Stock Split at all.

If our stockholders approve the Reverse Stock Split, and our board of directors decides to implement it, the Reverse Stock Split will become effective as of a date and time to be determined by our board of directors that will be specified in the certificate of amendment. Only one such amendment will be filed, if at all, and stockholders authorize our board of directors to abandon the other amendments in accordance with Section 242(c) of the Delaware General Corporation Law.

The full text of the form of proposed amendment of our Restated Certificate is attached to this proxy statement as Appendix A.

Background and Reasons for the Reverse Stock Split

We are seeking stockholder approval of this Proposal 2 primarily to satisfy a covenant contained in the Amended Purchase Agreement requiring us, no later than March 31, 2026, to call a meeting of our stockholders for purposes of approving a reverse stock split of our common stock. Under the terms of the agreement, subject to receipt of stockholder approval, our board of directors has the sole discretion whether to implement a reverse stock split, and we are not required to effect a reverse stock split solely as a result of obtaining such approval. Notwithstanding the foregoing, if stockholder approval is obtained and our board of directors elects not to implement a reverse stock split at that time, then only if the trading price of our common stock subsequently falls below $0.20 per share and Lind delivers a written request would we be required, subject to compliance with applicable laws, rules, and regulations, to use commercially reasonable efforts to effect a reverse stock split.

| 15 |

Although we are seeking stockholder approval of this Proposal 2 to comply with the foregoing contractual requirement and to preserve flexibility, our board of directors has not determined that a reverse stock split will be implemented at this time and may elect not to implement a reverse stock split at all, even if stockholder approval is obtained, subject to the limited circumstances described above.

In addition to our contractual obligations to seek stockholder approval of the Reverse Stock Split, we believe that the low per share market price of our common stock impairs its marketability to and acceptance by institutional investors and other members of the investing public and creates a negative impression of the Company. Theoretically, decreasing the number of shares of common stock outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be interested in acquiring them, or our reputation in the financial community. In practice, however, many investors, brokerage firms and market makers consider low-priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. The presence of these factors may be adversely affecting, and may continue to adversely affect, not only the pricing of our common stock but also its trading liquidity. In addition, these factors may affect our ability to raise additional capital through the sale of stock.

We further believe that a higher stock price could help us attract and retain employees and other service providers. We believe that some potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the company's market capitalization. If the Reverse Stock Split successfully increases the per share price of our common stock, we believe this increase will enhance our ability to attract and retain employees and service providers.

We hope that the decrease in the number of shares of our outstanding common stock as a consequence of the Reverse Stock Split, and the anticipated increase in the price per share, will encourage greater interest in our common stock by the financial community and the investing public, help us attract and retain employees and other service providers, help us raise additional capital through the sale of stock in the future if needed, and possibly promote greater liquidity for our stockholders with respect to those shares presently held by them. However, the possibility also exists that liquidity may be adversely affected by the reduced number of shares which would be outstanding if the reverse stock split is effected, particularly if the price per share of our common stock begins a declining trend after the Reverse Stock Split is effected.

There can be no assurance that the Reverse Stock Split will achieve any of the desired results. There also can be no assurance that the price per share of our common stock immediately after the Reverse Stock Split will increase proportionately with the Reverse Stock Split, or that any increase will be sustained for any period of time.

If our common stock were delisted from the NYSE American, trading of our common stock would thereafter be conducted on the OTC Bulletin Board or the “pink sheets.” As a result, an investor may find it more difficult to dispose of, or to obtain accurate quotations as to the price of, our common stock. To relist shares of our common stock on the NYSE American or another national trading market, we would be required to meet the initial listing requirements, which are more stringent than the maintenance requirements.

In addition, if our common stock were delisted from the NYSE American and the price of our common stock were below $5.00 at such time, such stock would come within the definition of “penny stock” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and would be covered by Rule 15g-9 of the Exchange Act. That rule imposes additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5.0 million or individuals with net worth in excess of $1.0 million or annual income exceeding $200,000 or $300,000 jointly with their spouse). For transactions covered by Rule 15g-9, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser's written agreement to the transaction prior to the sale. These additional sales practice restrictions will make trading in our Common Stock more difficult and the market less efficient.

We are not aware of any present efforts by anyone to accumulate our common stock, and the proposed Reverse Stock Split is not intended to be an anti-takeover device.

| 16 |

The Reverse Stock Split May Not Result in an Increase in the Per Share Price of Our Common Stock; There Are Other Risks Associated with the Reverse Stock Split

We cannot predict whether the Reverse Stock Split will increase the market price for our common stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

|

| · | the market price per share will either exceed or remain in excess of the trade price requirements set forth in the Original Purchase Agreement and the Amended Purchase Agreement; |

|

|

|

|

|

| · | we will otherwise continue to meet the requirements of the NYSE American for continued listing; |

|

|

|

|

|

| · | the market price per share after the Reverse Stock Split will rise in proportion to the reduction in the number of shares outstanding before the Reverse Stock Split; |

|

|

|

|

|

| · | the Reverse Stock Split will result in a per share price that will attract brokers and investors who do not trade in lower-priced stocks; or |

|

|

|

|

|

| · | the Reverse Stock Split will result in a per share price that will increase our ability to attract and retain employees and other service providers. |

If the Reverse Stock Split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Reverse Stock Split. In some cases, the total market value of a company following a reverse stock split is lower, and may be substantially lower, than the total market value before the reverse stock split. In addition, the fewer number of shares that will be available to trade could possibly cause the trading market of our common stock to become less liquid, which could have an adverse effect on the price of our common stock. The market price of our common stock is based on our performance and other factors, including trading dynamics and substantial volatility, which are likely unrelated to the number of our shares outstanding.

Principal Effects of Reverse Stock Split on Common Stock; No Fractional Shares

If stockholders approve amending our Restated Certificate to authorize a Reverse Stock Split, and if our board of directors decides to effectuate such amendment and Reverse Stock Split, the principal effect of the Reverse Stock Split will be to reduce the number of issued and outstanding shares of our common stock, in accordance with an exchange ratio approved by the stockholders and determined by our board of directors as set forth in this Proposal 2 from approximately 130,993,590 shares of Common Stock to between and including approximately 26,198,718 and 6,549,680 shares, depending on which Reverse Stock Split ratio is effectuated by our board of directors and based upon the number of shares outstanding at the time such Reverse Stock Split is effectuated. The total number of shares of our common stock each stockholder holds will be reclassified automatically into the number of shares of our common stock equal to the number of shares of our common stock each stockholder held immediately before the Reverse Stock Split divided by the exchange ratio approved by the stockholders and determined by our board of directors as set forth in this proposal. If the number of shares of common stock a stockholder holds is not evenly divisible by such exchange ratio, that stockholder will not receive a fractional share but instead will receive one whole share of common stock in lieu of such fractional share.

The Reverse Stock Split will affect all of our holders of common stock uniformly and will not affect any stockholder’s percentage ownership interests, except to the extent that the Reverse Stock Split results in any stockholders owning a fractional share. As described above, stockholders holding a fractional share will be entitled to one whole share in lieu of such fractional share. Common stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. The par value of our common stock and preferred stock would remain unchanged at $0.001 per share. We will continue to be subject to the periodic reporting requirements of the Exchange Act.

| 17 |

Principal Effects of Reverse Stock Split on Outstanding Options, Restricted Stock Units, and Warrants

As of September 30, 2025, there were outstanding (i) warrants to purchase 47,963,112 shares of common stock at a weighted average exercise price of $0.659 per share; (ii) stock options under our 2015 Stock Incentive Plan, or our 2015 Plan, exercisable for 4,056,535 at a weighted average exercise price of $3.87 per share; and (iii) restricted stock units, or RSUs, under our 2015 Plan, and our 2024 Stock Incentive Plan, or our 2024 Plan, for 6,291,669 shares of common stock.

Subsequent to September 30, 2025, an aggregate of 522,693 RSUs previously granted vested and resulted in the issuance of an aggregate of 437,167 shares of common stock.

When the Reverse Stock Split becomes effective, the number of shares of common stock covered by each of the foregoing securities will be reduced to between and including one-fifth and one-twentieth the number currently covered and the exercise price per share will be increased by between and including five and 20 times the current exercise price, resulting in the same aggregate price being required to be paid therefor upon exercise thereof as was required immediately preceding the Reverse Stock Split.

Principal Effects of Reverse Stock Split on Equity Incentive Plans

As of September 30, 2025, we had no shares of common stock available for issuance under our 2015 Plan, and 3,251,722 shares of common stock available for issuance under our 2024 Plan. Pursuant to the terms of our 2024 Plan, the number of shares of common stock reserved under such plan will be adjusted to between and including one-fifth and one-twentieth of the number of shares currently included in the plan.

Principal Effects of Reverse Stock Split on Legal Ability to Pay Dividends

Our board of directors has not in the past declared, nor does it have any plans to declare in the foreseeable future, any distributions of cash, dividends or other property, and we are not in arrears on any dividends. Therefore, we do not believe that the Reverse Stock Split will have any effect with respect to future distributions, if any, to our holders of common stock.

Accounting Matters

The Reverse Stock Split will not affect the par value of our common stock, which will remain unchanged at $0.001 per share, or the number of authorized shares of common stock. As a result, on the effective date of the Reverse Stock Split, the stated capital on our balance sheet attributable to our common stock, which consists of the par value per share of our common stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will be reduced by a factor of between and including five and twenty. In other words, stated capital will be reduced to between and including one-fifth and one-twentieth of its present amount, and the additional paid-in capital account, which consists of the difference between the stated capital and the aggregate amount paid upon issuance of all currently outstanding shares of common stock, will be credited with the amount by which the stated capital is reduced. The stockholders’ equity, in the aggregate, will remain unchanged. In addition, the per share net loss and net book value of our common stock will be increased because there will be fewer shares of common stock outstanding in both the basic and fully diluted calculations.

Potential Anti-Takeover Effect

The increased proportion of unissued authorized shares to issued shares could, under certain circumstances, be construed as having an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of our board of directors or contemplating a tender offer or other transaction for the combination of the Company with another company). Although not designed or intended for such purposes, the effect of the proposed Reverse Stock Split might be to render more difficult or to discourage a merger, tender offer, proxy contest or change in control of the Company and the removal of management, which stockholders might otherwise deem favorable. For example, the authority of our board of directors to issue common stock might be used to create voting impediments or to frustrate an attempt by another person or entity to effect a takeover or otherwise gain control of us because the issuance of additional common stock would dilute the voting power of our common stock and preferred stock then outstanding. Our common stock could also be issued to purchasers who would support our board of directors in opposing a takeover bid, which our board of directors determines not to be in the best interests of the Company and our stockholders. Our board of directors is not presently aware of any attempt, or contemplated attempt, to acquire control of the Company and the Reverse Stock Split is not part of any plan by our board of directors to recommend or implement a series of anti-takeover measures.

| 18 |

Procedure for Effecting Reverse Stock Split; Exchange of Stock Certificates; Treatment of Fractional Shares

If stockholders approve the Reverse Stock Split and if our board of directors determines to effectuate the Reverse Stock Split, we will file the proposed amendment to the Restated Certificate with the Secretary of State of the State of Delaware. The Reverse Stock Split will become effective at the time specified in the amendment, which will most likely be the date of the filing of the amendment and which we refer to as the “effective time.” Beginning at the effective time, each certificate representing outstanding pre-reverse stock split shares of common stock will be deemed for all corporate purposes to evidence ownership of post-reverse stock split shares of common stock.

We will appoint VStock, 18 Lafayette Place, Woodmere, New York 11598, (212) 828-8436, to act as exchange agent for holders of common stock in connection with the Reverse Stock Split. Neither the Company nor VStock will distribute fractional shares of common stock. As described above, stockholders holding a fractional share will be entitled to one whole share in lieu of such fractional share. Our stockholder list shows that some of our outstanding common stock is registered in the names of clearing agencies and broker nominees. Because we do not know the numbers of shares held by each beneficial owner for whom the clearing agencies and broker nominees are record holders, we cannot predict with certainty the number of fractional shares that will result from the Reverse Stock Split or the total amount of shares we will be required to issue in lieu of fractional shares. However, we do not expect that amount will be material.

As of the Record Date, we had approximately [____] holders of record of common stock (although we had significantly more beneficial holders). We do not expect the Reverse Stock Split to result in a significant reduction in the number of record holders. We presently do not intend to seek any change in our status as a reporting company for federal securities law purposes, either before or after the Reverse Stock Split.

Effect on Beneficial Holders of Common Stock (i.e., stockholders who hold in “street name”): Upon the effectiveness of the Reverse Stock Split, we intend to treat shares of common stock held by stockholders in “street name,” through a bank, broker or other nominee, in the same manner as registered stockholders whose shares of common stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our common stock in “street name.” However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. If a stockholder holds shares of common stock with a bank, broker or other nominee and has any questions in this regard, stockholders are encouraged to contact their bank, broker or other nominee.

Effect on Registered Holders of Common Stock (i.e., stockholders that are registered on the transfer agent’s books and records): If a stockholder holds registered shares in book-entry form with the transfer agent, no action needs to be taken to receive post-reverse stock split shares. If a stockholder is entitled to post-reverse stock split shares, a transaction statement will automatically be sent to the stockholder’s address of record indicating the number of shares of common stock held following the Reverse Stock Split. If a stockholder holds registered shares in certificated form, such stockholder will be asked to surrender to the transfer agent certificates representing pre-reverse stock split shares in exchange for certificates representing post-reverse stock split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by us or our transfer agent. No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the transfer agent. Any pre-reverse stock split shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-reverse stock split shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Stockholders will not have to pay any service charges in connection with the exchange of their certificates.

Even if stockholders approve the Reverse Stock Split, our Board reserves the right to not effect the reverse stock split if in our Board's opinion it would not be in the best interests of the Company or our stockholders to effect such Reverse Stock Split.

| 19 |

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the Reverse Stock Split, our board of directors does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

No Dissenters’ or Appraisal Rights

Under the Delaware General Corporation Law, stockholders are not entitled to any dissenter’s or appraisal rights with respect to the Reverse Stock Split, and we will not independently provide stockholders with any such right.

Interest of Certain Persons in Matters to Be Acted Upon

No director or executive officer has any substantial interest, direct or indirect, by security holdings or otherwise, in the Reverse Stock Split that is not shared by all of our other stockholders.

Material U.S. Federal Income Tax Consequences

The following is a general discussion of the material U.S. federal income tax consequences of the Reverse Stock Split. This discussion does not provide a complete analysis of all potential U.S. federal income tax considerations relating thereto. This description is based on the Internal Revenue Code of 1986, as amended, or the Code, and existing and proposed U.S. Treasury regulations promulgated thereunder, administrative pronouncements, judicial decisions, and interpretations of the foregoing, all as of the date hereof and all of which are subject to change, possibly with retroactive effect.

This discussion addresses only common stock held as capital assets within the meaning of Section 1221 of the Code (generally for investment) by U.S. holders (defined below).

Moreover, this discussion is for general information only and does not address all of the tax consequences that may be relevant to you in light of your particular circumstances, including the alternative minimum tax, the Medicare tax on certain investment income or any state, local or foreign tax laws or any U.S. federal tax laws other than U.S. federal income tax laws, nor does it discuss special tax provisions, which may apply to you if you are subject to special treatment under U.S. federal income tax laws, such as for:

|

| · | certain financial institutions or financial services entities; |

|

|

|

|

|

| · | insurance companies; |

|

|

|

|

|

| · | tax-exempt entities; |

|

|

|

|