10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 22, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2020

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to ______

Commission File Number: 001-36833

VOLITIONRX LIMITED

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization) |

13215 Bee Cave Parkway Suite 125, Galleria Oaks B Austin, Texas 78738 (Address of principal executive offices) +1 (646) 650–1351 (Registrant’s telephone number, including area code) |

91-1949078 (I.R.S. Employer Identification No.) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class: |

Trading Symbol(s) |

Name of Each Exchange on Which Registered: |

|

Common Stock, par value $0.001 per share |

VNRX |

NYSE American, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X].

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X].

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ].

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer [ ]Accelerated filer [ ]

Non-accelerated filer [X]Smaller reporting company[X]

Emerging growth company[ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X].

As of June 30, 2020, the last trading day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by non-affiliates of the registrant was $111,767,725 (based upon the $3.89 per share closing price for the registrant’s common stock as reported by the NYSE American on such date). This calculation does not reflect a determination that persons deemed to be affiliates for this purpose are affiliates for any other purpose.

As of March 10, 2021, there were 52,870,907 shares of the registrant’s $0.001 par value common stock issued and outstanding.

Documents incorporated by reference:

Portions of the registrant’s Proxy Statement for its 2021 Annual Meeting of Stockholders, to be filed on or before April 30, 2021 are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K.

|

PART I |

|

Page |

|

|

|

|

|

Item 1. |

BUSINESS……………………………………………………………………………………………… |

2 |

|

Item 1A. |

RISK FACTORS………………………………………………………………………………………... |

10 |

|

Item 1B. |

UNRESOLVED STAFF COMMENTS………………………………………………………………… |

21 |

|

Item 2. |

PROPERTIES…………………………………………………………………………………………… |

21 |

|

Item 3. |

LEGAL PROCEEDINGS………………………………………………………………………………. |

21 |

|

Item 4. |

MINE SAFETY DISCLOSURES………………………………………………………………………. |

21 |

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

Item 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS |

|

|

|

AND ISSUER PURCHASES OF EQUITY SECURITIES…………………………………….………. |

22 |

|

Item 6. |

SELECTED FINANCIAL DATA………………………………………………………………….…… |

22 |

|

Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND |

|

|

|

RESULTS OF OPERATIONS……………………………………………………………………….…. |

23 |

|

Item 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK………….……. |

28 |

|

Item 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA…………………………………….. |

F-29 |

|

Item 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND |

|

|

|

FINANCIAL DISCLOSURE…………………………………………………………..……………….. |

60 |

|

Item 9A. |

CONTROLS AND PROCEDURES………………………………………………………………….…. |

60 |

|

Item 9B. |

OTHER INFORMATION…………………………………………………………………………….…. |

61 |

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

Item 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE…………………..… |

62 |

|

Item 11. |

EXECUTIVE COMPENSATION………………………………………………………………….....… |

62 |

|

Item 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND |

|

|

|

RELATED STOCKHOLDER MATTERS……………………………………………..………………. |

62 |

|

Item 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR |

|

|

|

INDEPENDENCE……………………………………………………………………………….……… |

62 |

|

Item 14. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES………………………………………………... |

62 |

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

Item 15. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES……………………………………………..… |

63 |

|

Item 16. |

FORM 10-K SUMMARY…………………………………………………………………………….…. |

67 |

|

|

|

|

|

SIGNATURES |

…………………………………………………………………………………………………………… |

68 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which we refer to as this Report, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which statements are subject to considerable risks and uncertainties. These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this Report or incorporated by reference into this Report are forward-looking statements. Throughout this Report, we have attempted to identify forward-looking statements by using words such as “may,” “believe,” “will,” “could,” “project,” “anticipate,” “expect,” “estimate,” “should,” “continue,” “potential,” “plans,” “forecasts,” “goal,” “aim,” “seek,” “intend,” other forms of these words or similar words or expressions or the negative thereof (although not all forward-looking statements contain these words). In particular, forward-looking statements contained in this Report relate to, among other things, any predictions of earnings, revenues, expenses or other financial items; plans or expectations with respect to our development activities or business strategy, including commercialization and market acceptance; statements concerning industry trends and industry size; statements regarding anticipated demand for our products and market opportunity, or the products of our competitors; statements relating to manufacturing forecasts, and the potential impact of our relationship with contract manufacturers and original equipment manufacturers on our business; assumptions regarding the future cost and potential benefits of our research and development efforts; the effect of critical accounting policies; forecasts of our liquidity position or available cash resources; and statements relating to the assumptions underlying any of the foregoing.

We have based our forward-looking statements on our current expectations and projections about trends affecting our business and industry and other future events. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. Forward-looking statements are subject to substantial risks and uncertainties that could cause our future business, financial condition, results of operations or performance to differ materially from our historical results or those expressed or implied in any forward-looking statement contained in this Report. We discuss these risks and uncertainties in greater detail in the section entitled “Risk Factors” in Part I, Item 1A of this Report, and the other documents that we have filed with the U.S. Securities and Exchange Commission, or the SEC.

In addition, actual results may differ as a result of additional risks and uncertainties of which we are currently unaware or which we do not currently view as material to our business. For these reasons, readers are cautioned not to place undue reliance on any forward-looking statements.

You should read this Report in its entirety, including the documents that we file as exhibits to this Report and the documents that we incorporate by reference into this Report, with the understanding that our future results may be materially different from what we currently expect. The forward-looking statements we make speak only as of the date on which they are made. We expressly disclaim any intent or obligation to update any forward-looking statements after the date hereof to conform such statements to actual results or to changes in our opinions or expectations. If we do update or correct any forward-looking statements, readers should not conclude that we will make additional updates or corrections.

Except as otherwise indicated by the context, references in this Report to “Company,” “VolitionRx,” “Volition,” “we,” “us,” and “our” are references to VolitionRx Limited and its wholly-owned subsidiaries, Singapore Volition Pte. Limited, Belgian Volition SRL, Volition Diagnostics UK Limited, Volition Germany GmbH and Volition America, Inc., as well as majority-owned subsidiary Volition Veterinary Diagnostics Development LLC. Additionally, unless otherwise specified, all references to “$” refer to the legal currency of the United States of America.

NucleosomicsTM and Nu.Q®. and their respective logos are trademarks and/or service marks of VolitionRx and its subsidiaries. All other trademarks, service marks and trade names referred to in this Report are the property of their respective owners.

ITEM 1.BUSINESS

Overview

VolitionRx is a multi-national epigenetics company that applies its NucleosomicsTM platform through its subsidiaries to develop simple, easy to use, cost-effective blood tests to help diagnose a range of cancers and other diseases. We hope that through earlier diagnosis we can help save and improve the quality of human and animals’ lives throughout the world.

Volition’s Solution and the Science Behind It

Our assays are based on the science of NucleosomicsTM, which is the practice of identifying and measuring nucleosomes in the bloodstream or other bodily fluid, since changes in these parameters are an indication that disease is present.

Background to Genetics, Epigenetics and Cancer

Human genetics, the sequence of our DNA, is essentially a “recipe book” containing details of how to make each of the thousands of different proteins in the human body; simply put, there is a different gene (or recipe) for each protein. However, just because a recipe is in the book, does not mean you have to make it, and nobody makes all the proteins in their DNA. For example, men have all the genes necessary to make ovarian and uterine proteins but do not do so. Similarly, muscle cells do not make liver proteins or kidney proteins. This is because the genes for liver and kidney proteins are inactive or “switched off” in muscle cells. The mechanisms for the control of which genes are active or inactive in a cell are collectively known as epigenetics.

There are many different types of cancers, but generally, the primary cause of a cancer is a mutation within a cell of the DNA encoding or regulating the expression of one or more specific genes called oncogenes. While many mutations cause no consequence, some can lead to the uncontrolled expansion of the mutated cells and their dissemination to other parts of the body from the tissue of origin in a process called metastasis. Another consequence of these mutations is an alteration in the epigenetic regulation of many other genes and this, in turn, can create a unique epigenetic signature in the cancer cells.

Epigenetic control is therefore a critical factor in biology and medicine. A number of epigenetic cancer drugs have been in routine clinical use for more than a decade and the altered epigenetic signature seen in cancer underpins Volition’s diagnostic approaches.

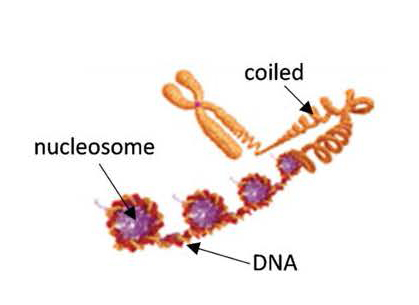

A major mechanism for epigenetic control is mediated through chromosome and nucleosome structure. Each chromosome contains a long, single molecule of DNA that is coated by a complex array of proteins, mostly in the form of nucleosomes, giving the stretched-out, unwound DNA/protein core, or chromatin, the appearance of “beads on a string.” Unwound chromatin is accessible for reading (or transcribing) and “unwound” genes may be active. However, genes whose nucleosomes are coiled or supercoiled are inaccessible and inactive.

Figure 1 – A chromosome

Each nucleosome consists of a disc of eight histone proteins wrapped by a short length of DNA. Nucleosome structure has a dual role: first, it allows the compact storage and protection of the genetic material (or DNA), and second, it modulates the epigenetic regulation (transcription) of that DNA. This regulation is achieved through reversible chemical changes to both the DNA and protein components as well as through the binding of specific regulatory proteins to the DNA.

2

Volition’s Epigenetic Approach

Volition’s approach is to investigate the epigenetic structure of chromatin and nucleosomes rather than investigating only the DNA sequence. We are continuously developing new technologies including:

·A suite of low cost Nu.Q® immunoassays that can accurately measure nucleosomes containing numerous epigenetic signals or structure, now being developed on a range of different enzyme-linked immunosorbent assay, or ELISA, platforms.

·Nu.Q® Capture technology to isolate or enrich nucleosomes containing particular epigenetic signals or structures for a wide range of potential scientific and medical applications. For example, the enrichment of nucleosomes of tumor origin in blood samples taken from cancer patients.

·The production of synthetic (recombinant) nucleosomes, containing exact defined epigenetic signals and structures, is now in-house. These nucleosomes are used to ensure maximal accuracy of Nu.Q® immunoassay tests but also have many other applications including Research Use Only, or RUO, kits and as tools in epigenetic drug development.

Improving Outcomes for Cancer Patients

The prospects for cancer patients vary greatly depending on whether the disease is detected at an early localized stage when effective treatment options are available, or at an advanced stage when the disease may have spread, and treatment is much more difficult. Unfortunately, most cancers are symptomless at early stage and most patients are not diagnosed until the disease has spread to other organs in the body and the likely outcome is poor. Simple low-cost immunoassay blood tests to detect cancer at an early stage leading to earlier treatment would greatly improve patient outcomes.

The Limitations of DNA Sequencing in Cancer

The advent of next generation sequencing has revolutionized medical research and led to a host of medical and other innovations. For example, sequencing the DNA of tumor tissue removed by surgery or biopsy uncovers cancer DNA mutations present in the tumor and is used to direct patient treatment selection, but tissue biopsy cannot be used routinely for cancer detection.

However, small fragments of cancer DNA from dead tumor cells are also found in the blood of cancer patients so it is possible to sequence circulating tumor DNA, or ctDNA, in a blood sample taken from a patient to test for any cancer DNA mutations (e.g., mutated P53, KRAS, EGFR). Unfortunately, these ctDNA blood tests, often called liquid biopsy tests, have thus far also proved ineffectual for early stage cancer detection.

The main reasons why ctDNA tests alone have not proved useful for early cancer detection include:

·The level of DNA fragments circulating in the blood is very low.

·Only a small proportion of the circulating DNA fragments are of tumor origin and the proportion is especially low in early stage cancer (usually less than 1%). The remaining “healthy” DNA fragments originate mainly from dead white blood cells.

·A DNA sequence mutation will occur on only one in several million (up to 20 million) of the circulating DNA fragments that do originate from cancer cells. This means that cancer mutations are found in one in millions of a small percentage of a very low level of circulating DNA fragments, with the result that ctDNA is undetectable in most early-stage cancer patients.

·Many cancer-like mutations have recently been found to be present in the blood of healthy elderly people through a process known as clonal hematopoiesis. Any DNA released from these cells could lead to false positive readings.

Volition’s Epigenetic Approach to Cancer, COVID-19 and Sepsis

Cancer is in essence a disease of genetic and epigenetic mis-regulation of oncogenes and tumor suppressor genes in the chromosomes of affected cells, leading to uncontrolled cell division and eventually to uncontrolled tumor growth and spread. Thus, the epigenetic signaling structures of chromosomes and nucleosomes are different in cancer cells and healthy cells of the same tissue.

When a cancer cell dies, its chromosomes are digested into nucleosomes as shown in the figure below. Most nucleosomes are metabolized, but some are released into the blood stream as circulating nucleosomes. The DNA attached to these nucleosomes is ctDNA. However, liquid biopsy companies extract only the DNA and discard the remainder of the nucleosome.

Volition analyzes whole circulating nucleosomes containing particular epigenetic signals and structures using our low cost, but highly accurate Nu.Q® nucleosome immunoassay tests.

3

Figure 2 – Digestion of a chromosome into nucleosomes.

The epigenetic structure of nucleosomes of cancer origin are known to differ from that of nucleosomes from healthy cells. These epigenetic changes occur early and drive the development of cancer, for example by inappropriately activating oncogenes that promote cell division or inactivating tumor suppressor genes that repress cell division. However, the structural epigenetic changes that occur are not restricted to “1 in 20 million” nucleosomes or even to oncogenes and tumor suppressor genes, but are widely distributed, providing a larger cancer signal and enabling earlier detection of cancer. We use our Nu.Q® immunoassay tests to detect a variety of early stage cancers.

Circulating cancer nucleosomes also differ from nucleosomes of healthy origin in other ways. For example, the DNA fragments in cancer nucleosomes are approximately 20 base pairs (or about 14%) shorter than the DNA fragments in nucleosomes originating in healthy cells. This structural difference is used as the basis of one of Volition’s Nu.Q® Capture technologies to separate or enrich cancer nucleosomes by removing nucleosomes of healthy origin. Volition expects that Nu.Q® Capture technology will further increase the accuracy of its Nu.Q® immunoassay tests to detect early-stage cancers and will also be useful to ctDNA companies to decrease the cost and increase the accuracy of liquid biopsy tests.

In terms of background science, white blood cells help protect the body against infection. White cells engulf invading viruses and bacteria and produce antibodies against them. In addition, white cells also eject chromatin material out of the cell to form Neutrophil Extracellular Traps, or NETs, which catch and trap invading viruses. NETs are a complicating factor in a wide variety of diseases including respiratory infections, SARS, and pneumonia as well as metabolic diseases, autoimmune conditions, inflammatory conditions, cancer, thrombosis, stroke and sepsis.

While cancer remains our core disease focus, given the prominence of infectious diseases as a result of the pandemic we are also researching the use of our proprietary technology in infectious diseases with particular regard to NETosis and the activation and release of NETs in disease.

In a respiratory infection, white cells migrate to the lungs to protect them from the virus. Elevated levels of NETs are a clinical complication of the novel coronavirus SARS-CoV-2, or COVID-19, associated with poor patient outcomes.

The ejected NETs material is made up of nucleosomes that can be detected in minute quantities using Volition’s Nu.Q® nucleosome assays. Indeed, we believe that we have the only available analytically validated quantitative nucleosome assay.

We believe the versatility of the Nu.Q® platform and the range of applications for which these assays can be leveraged may help increase diagnostic power and monitor disease progression and potentially treatment response across a range of infectious diseases that involve the over production of NETs, such as COVID-19, pneumonia, influenza and sepsis.

While NETosis is still a relatively new field for Volition, given positive early results, we have formed a Nu.Q® NETs team to provide increased focus and drive to the product development program.

Our COVID-19 studies in 2020 showed nucleosome levels correlated positively with strong significance:

·with disease severity in the first wave COVID-19 patients,

· with differentiation of patients with mild disease from those admitted to hospitals, and

·between those whom survived or died.

We are now conducting studies of serial testing in second wave COVID-19 patients to determine how predictive our test is and hope to announce additional studies and data throughout 2021. We continue to research the use of our Nu.Q® technology for diagnostic and disease monitoring, and as a companion diagnostic to monitor treatment response in a variety of disease conditions.

4

Research and Development

Volition is developing NucleosomicsTM technologies in a number of areas including:

·Adaptation and optimization of Nu.Q® immunoassay tests across multiple clinical platforms worldwide for the rapid quantification of epigenetic changes in blood and other biofluids. Volition’s Nu.Q® assays for use in clinical studies operate on a random-access immunoassay autoanalyzer approved by the Food and Drug Administration, or FDA, using a chemiluminescent magnetic particle-based assay format, a format which has enhanced analytical performance. Volition is pursuing both autoanalyzer and manual kit Nu.Q® platforms for use in its products, services and clinical studies.

·Nu.Q® assays (both the established plate format and the particle-based format mentioned above) are used for the development of Nu.Q® blood tests for the most prevalent cancers focusing initially on lung cancer, colorectal cancer and hematological cancers using our NucleosomicsTM biomarker discovery platform. Our development platform includes assays to be used for asymptomatic (screening) subjects, high-risk populations, symptomatic patients and to monitor disease progression and/or treatment response. We are developing blood based Nu.Q® assays to detect specific biomarkers that can be used individually or in combination to generate a profile which forms the basis of a product for a particular cancer or disease.

·Nu.Q® assays are used for the development of Nu.Q® blood tests for NETosis. We are developing blood based Nu.Q® assays to detect specific biomarkers that can be used individually or in combination to generate a profile which forms the basis of a product for a particular disease. Our development platform includes assays that may be used for diagnostic purposes and/or to monitor disease progression and/or treatment response.

·Nu.Q® Capture technology to isolate or enrich nucleosomes containing particular epigenetic signals or structures for complete analysis by mass spectrometry, DNA sequencing, immunoassays or other methods for a wide range of potential scientific and medical applications. For example, these applications include the enrichment of nucleosomes of tumor origin in blood samples taken from cancer patients for biomarker discovery, and widespread analysis of circulating chromatin fragments that include epigenetically active chromatin proteins.

The Company has also developed the use of the Nu.Q® technology in veterinary applications and launched its first product, the Nu.Q® Vet Cancer Screening Test, in the fourth quarter of 2020. We are in the process of developing additional veterinary products, including a treatment monitoring test, a disease recurrence test and a point-of-care platform. Our extensive intellectual property portfolio includes the coverage of veterinary applications.

Product Strategy Summary (Human and Canine)

|

|

|

|

|

|

|

|

|

|

|

Potential Use |

Frontline Human and Canine Screening Tests |

Triage Tests to improve sensitivity and/or specificity of existing tests

|

Aid to Diagnosis |

Disease Monitoring |

Treatment Response |

|

|

|

Subjects |

Asymptomatic Human and Canine Subjects |

High Risk Subjects (For example, FIT positive, LDCT positive)

|

Symptomatic human and canine Patients |

Diagnosed human and canine Patients |

Treated human and canine Patients |

|

|

|

Potential Disease(s) |

Most prevalent cancers (Ca) (Lung, Prostate, Colorectal, Breast, Non-Hodgkins Lymphoma, Canine Lymphoma, Canine hemangiosarcoma)

|

Lung Ca, Prostate Ca, Colorectal Ca |

Blood Ca, Colorectal Ca Canine Blood Cancers |

COVID-19, Sepsis, Cancers |

COVID-19, Sepsis, Cancers |

|

|

|

|

|

|

|

|

|

|

5

Commercialization Strategy

Volition believes that given the global prevalence of cancer and diseases associated with NETosis, and the low-cost, accessible and routine nature of our tests, Nu.Q® could potentially be used throughout the world. Our launch sequence is largely determined by the regulatory hurdles we face; consequently, we aim to initially launch in Europe and Asia, and subsequently in the United States. We plan to work with partners to commercialize Nu.Q® worldwide. Additionally, we are working on complete nucleosome analysis in our Nu.Q® Capture technology. The goal of this project is to investigate ways to specifically target ctDNA. The ability to enrich ctDNA will allow us to use mass spectrometry to analyze histone and DNA modifications, and moreover to sequence the DNA present around the nucleosomes. This information might enable cancer diagnosis to identify the tissue of origin of that given cancer.

Commercialization will take multiple forms in various markets and opportunities including, but not limited to:

·Direct sales of the Nu.Q® Vet Cancer Screening Test via the Gastrointestinal Laboratory at Texas A&M University, or TAMU.

·Sales of veterinary clinical products utilizing Nu.Q® Vet assays and/or Nu.Q® Capture reagents through distributor networks.

·Licensing of intellectual property, or IP, for clinical products utilizing Nu.Q® assays and/or Nu.Q® Capture reagents.

·Sales of clinical products utilizing Nu.Q® assays and/or Nu.Q® Capture reagents through distributor networks.

·Licensing of IP for RUO kit sales of Nu.Q® assays and/or Nu.Q® Capture reagents.

·Licensing of IP for laboratory developed patient testing services utilizing Nu.Q® assays and/or Nu.Q® Capture reagents.

·Provision of direct research services in the processing of samples using Nu.Q® RUO assays and/or Nu.Q® Capture.

If we do not have enough funds to fully implement our business plan, we will be forced to scale back our plan of operations and our business activities, increase our anticipated timeframes to complete each milestone or seek additional funding. In the event that additional financing is delayed, we will prioritize the maintenance of our research and development personnel and facilities, primarily in Belgium.

Our Market Opportunity

Cancer is one of the leading causes of death worldwide, accounting for around 9.5 million annual deaths globally. There are over 18 million new cases of cancer diagnosed each year and given the aging population this is expected to grow rapidly to over 29.5 million new cases annually by 2040. Currently, in the United States there are more than three new cases of cancer diagnosed and one person dies from a cancer-related cause every minute. Statistically, the chances of surviving cancer are greatly improved by early detection and treatment. However, there are currently very few blood tests for diagnosis of cancer in common clinical use.

Volition believes that early, non-invasive, accurate cancer diagnosis remains a significant unmet medical need and a significant commercial opportunity. For these reasons, cancer diagnostics is an active field of research and development both academically and commercially.

The global in vitro diagnostic medical device, or IVD, market was $64.5 billion in 2017 and is forecasted to reach $93.6 billion by 2025, registering a compound annual growth rate, or CAGR, of 4.8% from 2018 to 2025. The forecasted growth is due primarily to the increasing health care demands of an aging population.

The veterinary market for early stage cancer diagnostics is also large and growing, with approximately 77 million pet dogs in the United States alone. Cancer in dogs is widespread. It is the leading cause of death for dogs over the age of 10 years and there are over 6 million new dog cancer diagnoses each year. As cancer screening is not as commonplace in animal health as it is in human health, we believe blood tests like our Nu.Q® Vet Cancer Screening Test could transform how veterinarians manage cancer in companion animals.

We believe that our low-cost and easy-to-use ELISA based screening blood test for the early diagnosis of cancer will help streamline the screening process, and improve the treatment and quality of life for up to a third of dogs with malignancies, including common malignancies such as lymphoma and hemangiosarcoma. These two malignancies comprise approximately 2 million cases out of a total of 6 million annual dog cancer diagnoses in the United States.

The United States is currently the largest veterinary market in the world and requires fewer and smaller clinical studies than the FDA process for human diagnostics. This generally allows for a much faster route to revenue for veterinary products as compared to human products.

We anticipate that because of their ease of use and cost efficiency, our tests have the potential to become the first method of choice for cancer diagnostics, allowing detection of a range of cancers at an earlier stage than typically occurs currently, and testing of animals who, for reasons such as time, cost or aversion to current methods, are not currently being tested. The initial veterinary focus is the United States and canines but in time we plan to launch products for other cancers, other species, in other countries and other indications such as disease monitoring and even a point of care test.

6

Our Competition

Volition anticipates facing competition primarily from other healthcare, pharmaceutical and diagnostic companies such as Exact Sciences Corporation, Guardant Health, GRAIL Inc., Freenome Holdings Inc, CellMax Life, Archer DX Inc., Foundation Medicine Inc., Oncocyte Corporation, OpKo Health Inc., MDNA Life Sciences Inc., Oncimmune Holdings Plc, Abbott Laboratories Inc., Cepheid Inc., Koninklijke Philips N.V., GE Healthcare, Siemens, Gen-Probe Incorporated, MDxHealth SA, Roche Diagnostics, EpiGenomics AG, and Thrive Earlier Detection Corp, and from companies such as Mars Incorporated, and IDEXX Laboratories, Inc. focused on the veterinary space. There may also be other companies developing products competitive with ours of which we are unaware.

We predict that our future products will have a competitive edge compared to those offered by competitors on the basis that our tests are developed to be accurate, cost-effective, attractive from a government reimbursement perspective, easy to use, non-invasive, technologically advanced, and compatible with immunoassay systems, based on strong intellectual property and to be used for mass screenings.

Many of our competitors have substantially greater financial, technical, and other resources and larger, more established marketing, sales and distribution systems than we have. Many of our competitors also offer broad product lines outside of the diagnostic testing market and have brand recognition. Moreover, our competitors may make rapid technological developments that may result in our intended technologies and products becoming obsolete before we are able to enter the market, recover the expenses incurred to develop them or generate significant revenue. Our success will depend, in part, on our ability to develop our intended products in a timely manner, keep our future products current with advancing technologies, achieve market acceptance of our future products, gain name recognition and a positive reputation in the healthcare industry, and establish successful marketing, sales and distribution efforts.

Government Regulations

The healthcare industry, and thus our business, is subject to extensive federal, state, local and foreign regulation. Some of the laws pertinent to our business have not been definitively interpreted by regulatory authorities or the courts, and their provisions are open to a variety of subjective interpretations. In addition, these laws and their interpretations are subject to change.

Both United States federal and state governmental agencies continue to subject the healthcare industry to intense regulatory scrutiny, including heightened civil and criminal enforcement efforts. As indicated by work plans and reports issued by these agencies, the federal government will continue to scrutinize, among other things, the marketing, labeling, promotion, manufacturing and export of diagnostic health care products. Our diagnostic products fall within the IVD medical device category and are subject to FDA clearance or approval in the United States.

The federal government also has increased funding in recent years to fight healthcare fraud, and various agencies, such as the United States Department of Justice, the Office of Inspector General of the Department of Health and Human Services and state Medicaid fraud-control units, are coordinating their enforcement efforts.

In Europe, medical devices are regulated by self-certification through the Conformité Européenne, or CE, mark system. Under the system, developers and manufacturers must operate a quality system and validate medical devices in a limited clinical trial to demonstrate the manufacturer has met analytical and clinical performance criteria. We have implemented an International Organization for Standardization standard, or ISO 13485, Medical Devices – Quality management systems – Requirements for regulatory purposes, or ISO 13485. The standard addresses managerial awareness of regulatory requirements, control systems, inspection and traceability, device design, risk and performance criteria, as well as verification for corrective and preventative measures for device failure. Medical device companies such as ours are subject to pre-market compliance assessments from notified bodies, a European Union certification organization which the national authority, or the competent authority, of a European Union member state designates to carry out one or more of the conformity assessment procedures. ISO 13485 certification establishes conformity to specific European Union directives related to medical devices and allows CE marking and sale of the device.

7

The European Commission’s In Vitro Diagnostic Regulation 2017/746, or the EU IVDR, became effective in May 2017, marking the start of a transition period for manufacturers selling IVD devices into Europe. The EU IVDR, which replaces IVD Directive 98/79/EC, has a transition period of five years, after which the EU IVDR will apply in full, and no new applications pursuant to the former directive will be accepted. Manufacturers have the duration of the five-year transition period to update their technical documentation and processes to meet the new, more stringent European Union regulatory requirements. We believe the most challenging changes under the EU IVDR will be those regarding the classification of products, which will bring almost all IVDs under the direct review and control of notified bodies, and the performance evaluation of IVDs, which will require extensive clinical and analytical performance studies but also demonstration of scientific validity. Additional requirements will apply to reinforce the safety of the products, such as extended responsibilities of the economic actors of the supply chain, increased post-marketing surveillance activities, unannounced audits from notified bodies, implementation of an improved traceability and transparency of the devices with, in particular, the introduction of the Unique Device Identification, or UDI, system and an expanded European Database on Medical Devices.

Notified bodies can begin auditing to the EU IVDR once they have been designated as a notified body under the EU IVDR by their competent authority. TÜV SÜD will be one such notified body. In practice, it will not be possible to CE mark a product according to the EU IVDR beforehand. We expect our devices will be deemed to be Class C devices under the EU IVDR, and the conformity assessment procedure for such devices will be a combination of quality management system audits and technical documentation assessments. The assessment time needed for a technical documentation assessment of a Class C device is expected to be between 2 to 6 months. We have commenced discussions with the TÜV SÜD to ensure compliance with the EU IVDR as soon as possible.

Regulatory Approach

Commercialization of our future products in the clinical IVD market (e.g., for patient diagnosis in hospitals, clinics, etc.) requires government approval (CE marking in Europe, FDA approval in the United States, and Chinese Food and Drug Administration, or CFDA, approval in China).

In the United States, Volition anticipates that its tests will have to be cleared through the FDA’s premarket notification, or 510(k) process, or the FDA’s premarket approval, or PMA, process. The determination of whether a 510(k) or a PMA is necessary will depend in part on the proposed indications for use and the FDA’s assessment of the risk associated with the use of the IVD for a particular indication. A similar system operates in China through the CFDA. In the European Union, our tests can be marketed after a declaration and marking that the test conforms to the essential requirements of the relevant European health, safety and environmental protection legislation, or CE marking. The CE mark is also recognized in certain Asian territories, including India, for the private payer market.

Volition is developing clinical products based on the enrichment and analysis of epigenetically modified circulating nucleosomes using immunoassay, mass spectrometry, DNA sequencing and other methods. We have used this position to build a growing, broad, strong and exclusive patent portfolio around the ability to profile the epigenetic environment surrounding circulating chromosome fragments from diseased cells including the epigenetic signaling status of nucleosomes, DNA, and other epigenetic chromatin proteins.

Our patent portfolio includes 27 patent families and a total 64 patents granted related to our diagnostic tests (including veterinary applications), with 10 patents granted in the United States, 14 patents granted in Europe and a further 40 patents granted worldwide. Additionally, we have a total of 90 patent applications currently pending, with 11 patent applications in the United States, 8 in Europe and a further 71 patent applications worldwide.

We intend to continue our development of the Nucleosomics™ technologies and will continue to apply for patents for future product developments. Our IP strategy is to protect the technologies and gain market exclusivity with patents in Europe and the United States and in other strategic countries. The patents on the technologies underlying our products should provide broad coverage for each product, including protection through at least 2031.

Employees

As of December 31, 2020, we had 65 full-time equivalents compared to 50 as of December 31, 2019. We continually assess employee turnover, recruitment initiatives, compensation and benefits programs, safety in performing critical laboratory work, diversity and other matters relevant to human capital management, and we review results with our board of directors on a periodic basis. We aim to offer competitive compensation (including salary, incentive bonus, and equity) and benefits packages in each of our locations and in each of our employee groups at each level around the globe as assessed with internal and external benchmarking data. We aim to build a pipeline for talent to create more opportunities for workplace diversity and to support greater representation within the Company.

8

Corporate History

The Company was incorporated on September 24, 1998 in the State of Delaware under the name “Standard Capital Corporation.” On September 22, 2011, the Company filed a Certificate for Renewal and Revival of Charter with the Secretary of State of Delaware. Pursuant to Section 312 of Delaware General Corporation Law, the Company was revived under the new name of “VolitionRX Limited” (which name was subsequently amended to reflect “VolitionRx Limited”). The Company acquired its wholly owned operating subsidiary, Singapore Volition Pte. Limited, a Singapore registered company, or Singapore Volition, on October 6, 2011. Singapore Volition has one subsidiary, Belgian Volition SRL, a Belgium private limited liability company, or Belgian Volition, which it acquired on September 22, 2010. Belgian Volition has four subsidiaries, Volition Diagnostics UK Limited, which was formed on November 13, 2015, Volition America, Inc., which was formed on February 3, 2017, Volition Veterinary Diagnostics Development LLC, which was formed on June 3, 2019, and Volition Germany GmbH (formerly Octamer GmbH, or “Octamer”), a Munich, Germany-based epigenetic reagent company that it acquired on January 10, 2020.

Our principal executive office is located at 13215 Bee Cave Parkway, Suite 125, Galleria Oaks B, Austin, Texas 78738. Our telephone number is +1 (646) 650-1351. Our website is located at www.volition.com. The information that can be accessed through our website is not incorporated by reference into this Report and should not be considered to be a part hereof.

Financial Information

See our consolidated financial statements and accompanying notes to the consolidated financial statements included in this Report.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Exchange Act electronically with the SEC. You can access these reports and other filings electronically on the SEC’s website, www.sec.gov.

9

ITEM 1A.RISK FACTORS

Our short and long-term success is subject to numerous risks and uncertainties, many of which involve factors that are difficult to predict or beyond our control. As a result, investing in our common stock involves substantial risk. Before deciding to purchase, hold or sell our common stock, stockholders, and potential stockholders should carefully consider the risks and uncertainties described below, in addition to the other information contained in or incorporated by reference into this Report, as well as the other information we file with the SEC. If any of these risks are realized, our business, financial condition, results of operations, and prospects could be materially and adversely affected. In that case, the value of our common stock could decline, and stockholders may lose all or part of their investment. Furthermore, additional risks and uncertainties of which we are currently unaware, or which we currently consider to be immaterial, could have a material adverse effect on our business.

Certain statements made in this section constitute “forward-looking statements,” which are subject to numerous risks and uncertainties including those described in this section. Refer to the section entitled “Cautionary Note Regarding Forward-Looking Statements” within this Report for additional information.

Risks Associated with Our Company

We have incurred significant losses, and we may never achieve profitability.

We are a clinical stage company and have incurred losses since our formation. As of December 31, 2020, we have an accumulated total deficit of approximately $110.2 million. As we continue the discovery and development of our future diagnostic products, we expect our expenses to increase significantly. Even as we begin to market and sell our intended products, we expect our losses to continue as a result of ongoing research and development expenses, as well as increased manufacturing, sales and marketing expenses. These losses, among other things, have had and will continue to have an adverse effect on our working capital, total assets and stockholders’ equity. Because of the numerous risks and uncertainties associated with our product development and commercialization efforts, we are unable to predict when or if we will become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. If we are unable to achieve and then maintain profitability, our business, financial condition and results of operations will be negatively affected, and the market value of our common stock will decline.

We may need to raise additional capital in the future. If we are unable to secure adequate funds on terms acceptable to us, we may be unable to execute our plan of operations.

We will require additional capital to fully fund our current strategic plan, which includes successfully commercializing our Nu.Q® cancer pipeline and developing future products. If we incur delays in commencing commercialization of our Nu.Q® cancer pipeline or other future products or in achieving significant product revenue, or if we encounter other unforeseen adverse business developments, we may exhaust our capital resources prior to the commencement of commercialization.

We cannot be certain that additional capital will be available when needed or that our actual cash requirements will not be greater than anticipated. Financing opportunities may not be available to us, or if available, may not be available on favorable terms. The availability of financing opportunities will depend on various factors, such as market conditions and our financial condition and outlook. In addition, if we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders could be significantly diluted, and these newly issued securities may have rights, preferences or privileges senior to those of existing stockholders. If we obtain debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we are unable to obtain financing on terms favorable to us, we may be unable to execute our plan of operations and we may be required to cease or reduce development or commercialization of any future products, sell some or all of our technology or assets or merge with another entity.

It is difficult to forecast our future performance, which may cause our financial results to fluctuate unpredictably.

Our limited operating history and the rapid evolution of the market for diagnostic products make it difficult for us to predict our future performance. A number of factors, many of which are outside of our control, may contribute to fluctuations in our financial results, such as:

·our ability to develop or procure antibodies for clinical use in our future products;

·our ability to translate preliminary clinical results to larger prospective symptomatic and screening populations;

·the demand for our intended products;

·our ability to obtain any necessary financing;

·our ability to market and sell our future products;

10

·market acceptance of our future products and technology;

·performance of any future strategic business partners;

·our ability to obtain regulatory clearances or approvals;

·our success in collecting payments from third-party payors and customers;

·changes in technology that may render our future products uncompetitive or obsolete;

·competition with other cancer diagnostics companies; and

·adverse changes in the healthcare industry (human and canine).

Our future success depends on our ability to retain our officers and directors, scientists, and other key employees and to attract, retain and motivate qualified personnel.

Our success depends on our ability to attract, retain and motivate highly qualified management and scientific personnel. In particular, we are highly dependent on Cameron Reynolds, our President and Chief Executive Officer, our other officers and directors, scientists and key employees. The loss of any of these persons or their expertise would be difficult to replace and could have a material adverse effect on our ability to achieve our business goals. In addition, the loss of the services of any one of these persons may impede the achievement of our research, development and commercialization objectives by diverting management’s attention to the identification of suitable replacements, if any. There can be no assurance that we will be successful in hiring or retaining qualified personnel and our failure to do so could have a material adverse effect on our business, financial condition and results of operations.

Recruiting and retaining qualified scientific personnel and, in the future, sales and marketing personnel will also be critical to our success. We may not be able to attract and retain these personnel on acceptable terms given the competition among pharmaceutical, biotechnology and diagnostic companies for similar personnel. We also experience competition for the hiring of scientific personnel from universities and research institutions. We do not maintain “key person” insurance on any of our employees. In addition, we rely on consultants and advisors, including scientific and clinical advisors, to assist us in formulating our research, development and commercialization strategies. Our consultants and advisors, however, may have other commitments or employment that may limit their availability to us.

We expect to expand our product development, research and sales and marketing capabilities, and as a result, we may encounter difficulties in managing our growth, which could disrupt our operations.

We are focused on developing our pipeline for future products. It is likely that our efforts will result in significant growth in the number of our consultants, advisors, and employees, in addition to the scope of our operations. In order to manage our anticipated future growth, we must continue to implement and improve our managerial, operational and financial systems, expand our facilities, and continue to recruit and train additional qualified personnel. Due to our limited resources, we may not be able to effectively manage the expansion of our operations or recruit and train additional qualified personnel. The expansion of our operations may lead to significant costs and may divert our management and business development resources. Any inability to manage growth could delay the execution of our business plan or disrupt our operations.

We have limited experience with direct sales and marketing and any failure to build and manage a direct sales and marketing team effectively, or to successfully engage third party providers for such services, could have a material adverse effect on our business.

Our products will require several dynamic and evolving sales models tailored to different worldwide markets, users and products. Our sales strategy is initially focused on the clinical IVD market with the CE marking of our first product in Europe. Following CE marking of our first product in Europe we intend to enter the European markets and, following the completion of any necessary regulatory clearances, certain Asian markets. Even if we receive a CE mark, we must still seek regulatory clearance in other jurisdictions. A failure to obtain these regulatory clearances in other jurisdictions could negatively affect our business. Pending completion of our review of the regulatory environment in the United States, including the effect of recent pronouncements regarding Laboratory Developed Tests, or LDTs, by the FDA, we may decide to enter the United States market through a Clinical Laboratory Improvement Amendments, or CLIA, certified laboratory located in the United States. We remain firmly committed to pursuing FDA approval as our primary objective. FDA approval can consist of PMA or 510(k) clearance depending on the test complexity and risk posed to patients. We intend to pursue the most appropriate approval pathway for each individual product developed. We intend to progressively grow to large volumes of tests sold to centralized laboratories and eventually reach the mass diagnostics testing market. The exact nature of the ideal sales strategy will evolve as we continue to develop our intended products and seek entry into the IVD markets. We also have limited experience with direct sales and marketing and we intend to engage a network of distributors to help commercialize our products worldwide. Any failure to build and manage a direct sales and marketing team effectively, or to successfully engage third-party providers for such services, could have a material adverse effect on our business.

11

There are significant risks involved in building and managing our sales and marketing organization, as well as identifying and negotiating deals with the right sales and distribution partners, including risks related to our ability to:

·identify appropriate partners;

·negotiate beneficial partnership and distribution agreements;

·hire qualified individuals as needed;

·generate sufficient leads within our targeted market for our sales force;

·provide adequate training for effective sales and marketing;

·protect intellectual property rights;

·retain and motivate our direct sales and marketing professionals; and

·effectively oversee geographically dispersed sales and marketing teams.

Our failure to adequately address these risks could have a material adverse effect on our ability to increase sales and use of our future products, which would cause our revenues to be lower than expected and harm our results of operations. Further, we are required to comply with numerous other federal, state, and local laws relating to matters such as safe working conditions, industrial safety, and labor laws. We may incur significant costs to comply with such laws and regulations in the future, and lack of compliance could have material adverse effects on our operations. We believe that we have structured our business operations to comply with applicable legal requirements. However, it is possible that governmental entities or other third parties could interpret these laws differently and assert otherwise, which could have a material adverse impact on our business.

We have identified material weaknesses in our internal control over financial reporting that have not yet been remediated, and the failure to address these material weaknesses, or the identification of any others, could impact the reliability of our financial reporting and harm investors’ views of us, which could adversely impact our stock price.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

·pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and dispositions of assets;

·provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and/or directors; and

·provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

We have determined that we have material weaknesses in our internal control over financial reporting as of December 31, 2020. See Part II, Item 9A of this Report for a complete discussion of these material weaknesses in our internal control over financial reporting and remediation efforts. Although we are undertaking steps to address these material weaknesses, the existence of a material weakness is an indication that there is more than a remote likelihood that a material misstatement of our financial statements will not be prevented or detected in the current or any future period. There can be no assurance that we will be able to fully implement our plans and controls, as further described in Item 9A, to address these material weaknesses, or that the plans and controls, if implemented, will be successful in fully remediating these material weaknesses. In addition, we may in the future identify further material weaknesses in our internal control over financial reporting that we have not discovered to date. If we fail to successfully remediate the identified material weaknesses, or we identify further material weaknesses in our internal controls, the market’s confidence in our financial statements could decline and the market price of our common stock could be adversely impacted. Additionally, for so long as we remain as a smaller reporting company, under current rules our accounting firm will not be required to provide an opinion regarding our internal controls over financial reporting.

We have a “going concern” opinion from our auditors, indicating the possibility that we may not be able to continue to operate.

Our independent registered public accountants have expressed substantial doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, we will not be able to complete our proposed business plan. As a result, we may have to liquidate our business and investors may lose their investments. Our ability to continue as a going concern is dependent upon our ability to successfully accomplish our plan of operations described herein, obtain financing and eventually attain profitable operations. Investors should consider our independent registered public accountant’s comments when deciding whether to invest in the Company.

12

Our management has broad discretion over the use of our available cash and might not spend available cash in ways that increase the value of your investment.

As of December 31, 2020, we had approximately $19.4 million in combined cash and cash equivalents compared to approximately $17.0 million as of December 31, 2019. Our management expects to deploy these resources primarily to expand our commercialization activities, to fund our product development efforts and for general corporate and working capital purposes. However, our management has broad discretion to pursue other objectives. Our management might not apply our cash in ways that increase or permit any return of your investment.

Risks Associated with Our Business

Failure to successfully develop, manufacture, market, and sell our future products will have a material adverse effect on our business, financial condition, and results of operations.

We are in the process of developing a suite of diagnostic tests as well as additional products. The successful development and commercialization of our intended products is critical to our future success. Our ability to successfully develop, manufacture, market, and sell our future products is subject to a number of risks, many of which are outside our control. There can be no assurance that we will be able to develop and manufacture products in commercial quantities at acceptable costs, successfully market any products, or generate revenues from the sale of any products. Failure to achieve any of the foregoing would have a material adverse effect on our business, financial condition, and results of operations.

Our business is dependent on our ability to successfully develop and commercialize diagnostic products. If we fail to develop and commercialize diagnostic products, we may be unable to execute our plan of operations.

Our current business strategy focuses on discovering, developing and commercializing diagnostic products. The success of our business will depend on our ability to fully develop and commercialize the diagnostic products in our current development pipeline as well as continue the discovery and development of other diagnostics products.

Prior to commercializing the Nu.Q® tests and other diagnostic products, we will be required to undertake time-consuming and costly development activities with uncertain outcomes, including conducting clinical studies and obtaining regulatory clearance or approval in the United States, Asia and in Europe. Delays in obtaining approvals and clearances could have material adverse effects on us and our ability to fully carry out our plan of operations. We have limited experience in taking products through these processes and there are considerable risks involved in these activities. The science and methods that we are employing are innovative and complex, and it is possible that our development programs will ultimately not yield products suitable for commercialization or government approval. Products that appear promising in early development may fail to be validated in subsequent studies, and even if we achieve positive results, we may still fail to obtain the necessary regulatory clearances or approvals. Few research and development projects result in commercial products, and perceived viability in early clinical studies often is not replicated in later studies. At any point, we may abandon development of a product, or we may be required to expend considerable resources obtaining additional clinical and nonclinical data, which would adversely impact the timing for generating potential revenue from those products. Further, our ability to develop and launch diagnostic tests is dependent on our receipt of substantial additional funding. If our discovery and development programs yield fewer commercial products than we expect, we may be unable to execute our business plan, and our business, financial condition and results of operations may be adversely affected.

The results of pre-clinical studies and completed clinical trials are not necessarily predictive of future results, and our current product candidates may not have favorable results in later studies or trials which, in turn, could have a material adverse effect on our business.

As described above, we must conduct extensive testing of our product candidates and new indications of our marketed products before we can obtain regulatory approval to market and sell them. Success in pre-clinical studies or completed clinical trials does not ensure that later studies or trials, including continuing pre-clinical studies and large-scale clinical trials, will be successful nor does it necessarily predict future results. Favorable results in early studies or trials may not be repeated in later studies or trials, and product candidates in later stage trials may fail to show acceptable safety and efficacy despite having progressed through earlier trials. We may be required to demonstrate through large, long-term outcome trials that our product candidates are safe and effective for use in a broad population prior to obtaining regulatory approval. The failure of clinical trials to demonstrate the safety and effectiveness of our clinical candidates for the desired indication(s) would preclude the successful development of those candidates for such indication(s), in which event our business, prospects, results of operations and financial condition may be adversely affected.

13

Our failure to obtain necessary regulatory clearances or approvals on a timely basis would significantly impair our ability to distribute and market our future products on the clinical IVD market.

We are subject to regulation by the FDA in the United States, the CE in Europe, the CFDA in China, and other regulatory bodies in other countries where we intend to sell our future products. Before we are able to place our intended products in the clinical IVD markets in the United States, China and Europe, we will be required to obtain clearance or approval of our future products from the FDA and the CFDA with respect to the United States and China, respectively, and receive a CE mark with respect to Europe.

The European Union has recently adopted regulations that may impose additional requirements to obtain a CE mark, which could result in delays and further expense, in terms of staff costs to us as compared to the current CE mark process. The new regulations will require each product submission to be thoroughly audited by notified bodies, instead of the current self-certification process. The European Medical Device Regulations, or EU MDR, will be fully applicable in 2020 and the EU IVDR will be fully applicable in 2022.

Additionally, even if we receive the required government clearance or approval of our intended products, we are still subject to continuing regulation and oversight. Under the FDA, diagnostics are considered medical devices and are subject to ongoing controls and regulations, including inspections, compliance with established manufacturing practices, device-tracking, record-keeping, advertising, labeling, packaging, and compliance with other standards. The process of complying with such regulations with respect to current and new products can be costly and time-consuming. Failure to comply with these regulations could jeopardize our ability to sell our products and result in enforcement actions such as fines, civil penalties, injunctions, warning letters, recalls of products, delays in the introduction of products into the market, refusal of the FDA or other regulators to grant future clearances or approvals, delays by the FDA or other regulators in granting clearances or approvals, and the suspension or withdrawal of existing approvals by the FDA or other regulators, any of which could have a material adverse effect on our business, financial condition, and results of operations. Furthermore, any FDA regulations governing our future products are subject to change at any time, which may cause delays and have material adverse effects on our operations. In Europe, IVD companies are currently able to self-certify that they meet the appropriate regulatory requirements (which are subject to change with the EU MDR and the EU IVDR noted above) but are subject to inspection for enforcement. European national agencies, such as customs authorities and/or the Departments of Health, Industry and Labor, conduct market surveillance to ensure the applicable requirements have been met for products marketed within the European Union.

The cancer diagnostics market is highly competitive and subject to rapid technological change; accordingly, we will face fierce competition and our intended products may become obsolete.

The cancer diagnostics market is extremely competitive and characterized by evolving industry standards and new product enhancements. Cancer diagnostic tests are technologically innovative and require significant planning, design, development, and testing at the technological, product, and manufacturing process levels. These activities require significant capital commitments and investment. There can be no assurance that our intended products or proprietary technologies will remain competitive following the introduction of new products and technologies by competing companies within the industry. Furthermore, there can be no assurance that our competitors will not develop products that render our future products obsolete or that are more effective, accurate or can be produced at lower costs. There can be no assurance that we will be successful in the face of increasing competition from new technologies or products introduced by existing companies in the industry or by new companies entering the market.

Reductions or changes in reimbursement policies could limit our ability to sell our products.

Market acceptance and sales of our products will depend, in part, on reimbursement policies and may be affected by healthcare reform measures. Government authorities and third-party payers, such as private health insurers and health maintenance organizations, decide which products they will pay for and establish reimbursement levels for those products. To manage healthcare costs, many governments and third-party payers in the United States increasingly scrutinize the pricing of new products and require greater levels of evidence of favorable clinical outcomes and cost-effectiveness before extending coverage. We cannot be sure that reimbursement will be available for our products and, if reimbursement is available, the level of such reimbursement. Reimbursement may impact the demand for, or the price of, our products. If reimbursement is not available or is available only at limited levels, we may not be able to successfully commercialize our future products.

14

If the marketplace does not accept the products in our development pipeline or any other diagnostic products we might develop, we may be unable to generate sufficient revenue to sustain and grow our business.

Our intended products may never gain significant acceptance in the research or clinical marketplace and therefore may never generate substantial revenue or profits. Physicians, hospitals, clinical laboratories, researchers or others in the healthcare industry may not use our future products unless they determine that they are an effective and cost-efficient means of detecting and diagnosing cancer. If our research and studies do not satisfy providers, payors and others as to the reliability and effectiveness, we may experience reluctance or refusal on the part of the physician to use our future products. In addition, we will need to expend a significant amount of resources on marketing and educational efforts to create awareness of our future products and to encourage their acceptance and adoption. If the market for our future products does not develop sufficiently or the products are not accepted, our revenue potential will be harmed.

We expect to face intense competition from companies with greater resources and experience than us, which may increase the difficulty for us to achieve significant market penetration.

The market for cancer diagnostics is intensely competitive, subject to rapid change, and significantly affected by new product introductions and other market activities of industry participants. Our competitors include large multinational corporations and their operating units, including Exact Sciences Corporation, Guardant Health, GRAIL Inc., Freenome Holdings Inc., CellMax Life, Archer DX Inc., Thrive Earlier Detection Corp., Foundation Medicine Inc., Oncocyte Corporation, OpKo Health Inc, MDNA Life Sciences Inc., Oncimmune Holdings Plc, Abbott Laboratories Inc., Cepheid Inc., Koninklijke Philips N.V., GE Healthcare, Siemens, Gen-Probe Incorporated, EpiGenomics AG, MDxHealth SA, Roche Diagnostics, Mars Incorporated, and IDEXX Laboratories, Inc. There may also be other companies developing products competitive with ours of which we are not aware. Many of our competitors have greater resources and experience than us and may enjoy several competitive advantages, including:

·significantly greater name recognition;

·established relationships with healthcare professionals, companies and consumers;

·additional lines of products, and the ability to offer rebates or bundle products to offer higher discounts or incentives to gain a competitive advantage;

·established supply and distribution networks; and

·greater resources for product development, sales and marketing, and intellectual property protection.

Many of these other companies have developed and will continue to develop new products that will compete directly with our future products. In addition, many of our competitors spend significantly greater funds for the research, development, promotion, and sale of new and existing products. These resources may allow them to respond more quickly to new or emerging technologies and changes in consumer requirements. We also face competition in our search for third parties to assist us with sales and marketing of our product candidates, which may negatively impact our ability to enter into favorable sales and marketing arrangements. For all the foregoing reasons, we may not be able to compete successfully against our competitors.

Declining global economic or business conditions may have a negative impact on our business.

Concerns over United States healthcare reform legislation and energy costs, geopolitical issues, the availability and cost of credit and government stimulus programs in the United States and other countries may contribute to increased volatility and diminished expectations for the global economy. If the economic climate deteriorates, our business, including our access to the RUO or clinical IVD markets for diagnostic tests, could be adversely affected, resulting in a negative impact on our business, financial condition and results of operations.

The United Kingdom’s withdrawal from the European Union became effective on January 1, 2021. Although it is known what the terms of this withdrawal are, it is still possible that greater restrictions on imports and exports between the European Union countries and the United Kingdom and increased regulatory complexities are forthcoming. These changes may adversely affect our ability to market our future products in the United Kingdom which could have an adverse effect on our business, financial condition, and results of operations. We will rely on third parties to manufacture and supply our intended products. Any problems experienced by these third parties could result in a delay or interruption in the supply of our intended products to our customers, which could have a material negative effect on our business.

15

We will rely on third parties to manufacture and supply our intended products. Any problems experienced by these third parties could result in a delay or interruption in the supply of our intended products to our customers, which could have a material negative effect on our business.